High Insider Ownership Growth Stocks To Watch In January 2025

Reviewed by Simply Wall St

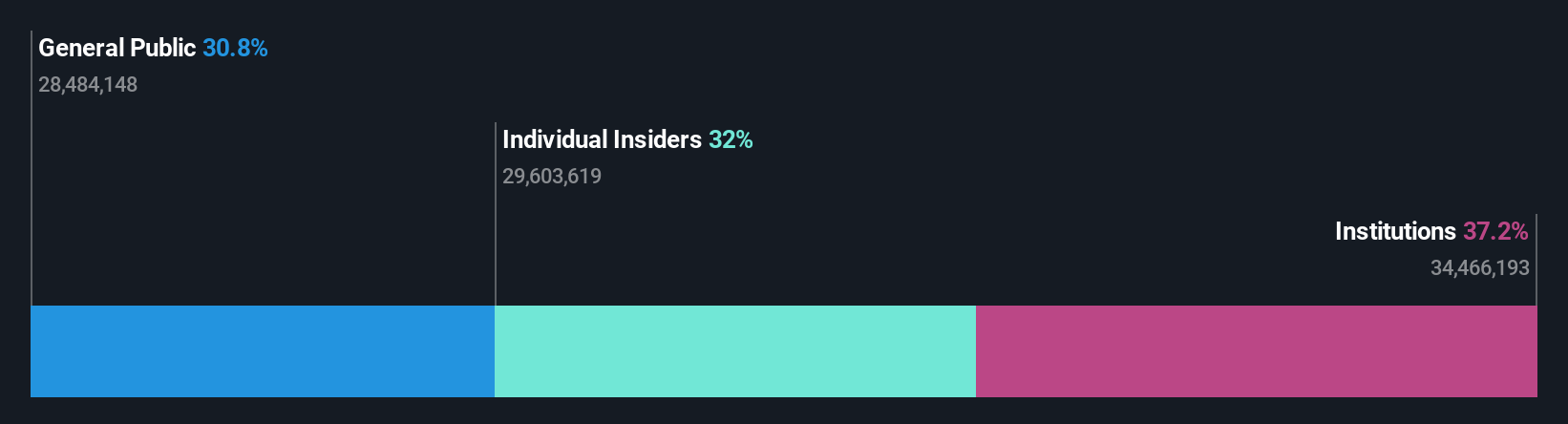

As global markets navigate a period of mixed economic signals, with U.S. consumer confidence waning and European growth estimates revised downward, investors are keeping a keen eye on the performance of major indices like the Nasdaq Composite and S&P 500, which have shown resilience despite recent volatility. In this climate, growth companies with high insider ownership can be particularly appealing as they often signal strong internal confidence in future prospects and align management interests closely with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

Bilia (OM:BILI A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bilia AB (publ) is a full-service supplier for car ownership, operating in Sweden, Norway, Luxembourg, and Belgium with a market cap of SEK11.17 billion.

Operations: The company's revenue segments include Car - Sweden (SEK19.85 billion), Car - Norway (SEK7.39 billion), Service - Sweden (SEK6.50 billion), Car - Western Europe (SEK3.53 billion), Service - Norway (SEK2.29 billion), Fuel (SEK964 million), and Service - Western Europe (SEK678 million).

Insider Ownership: 17%

Earnings Growth Forecast: 24.6% p.a.

Bilia's earnings are projected to grow significantly at 24.6% annually, outpacing the Swedish market. Despite a high debt level and lower profit margins compared to last year, Bilia is trading at a substantial discount to its estimated fair value. Recent insider activity shows more buying than selling, indicating confidence in future prospects. The new partnership with Polestar Sweden could enhance revenue growth, forecasted at 5.6% annually, outperforming the local market rate.

- Click here to discover the nuances of Bilia with our detailed analytical future growth report.

- Our expertly prepared valuation report Bilia implies its share price may be lower than expected.

Xi'an Actionpower Electric (SHSE:688719)

Simply Wall St Growth Rating: ★★★★★☆

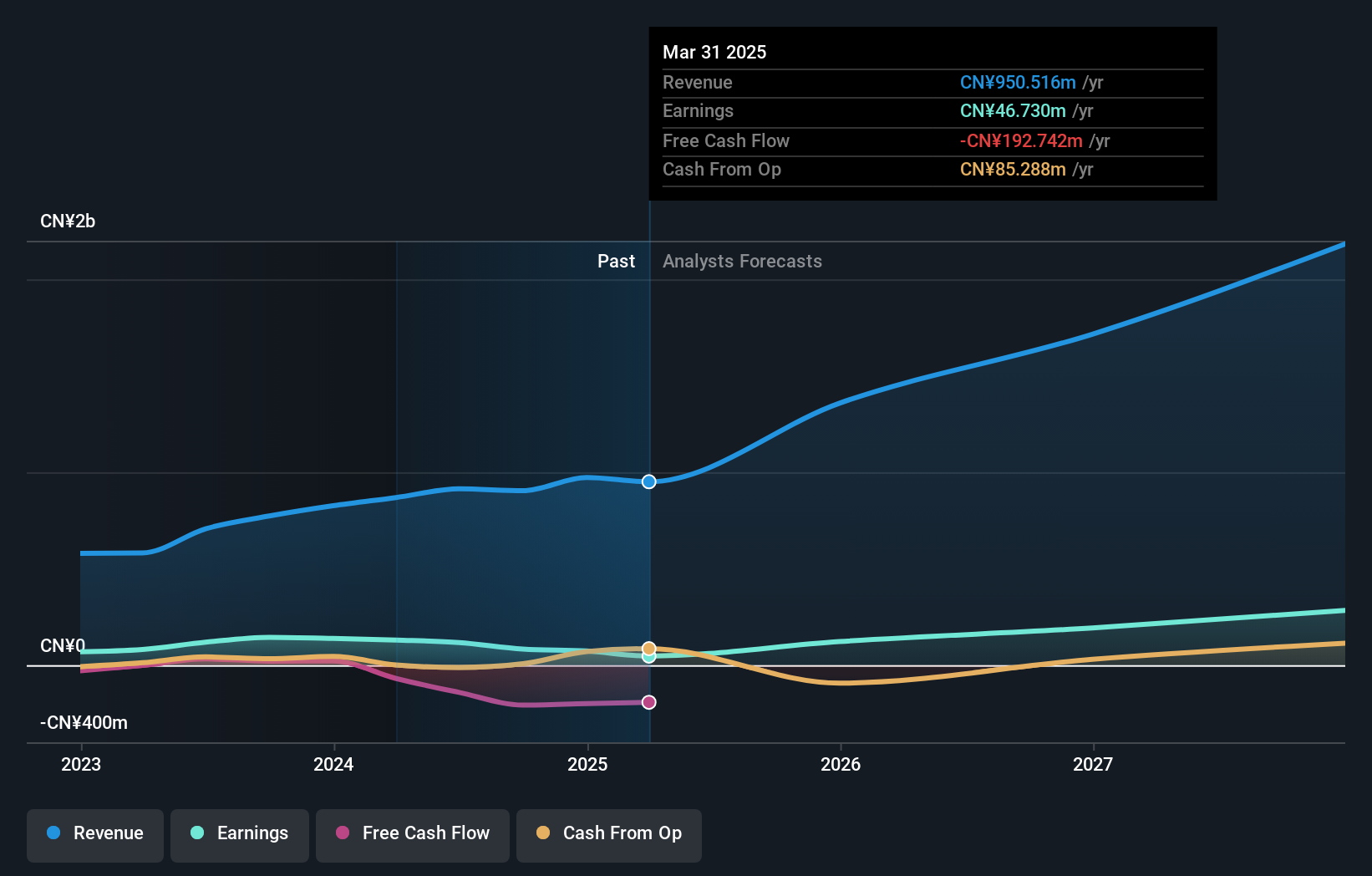

Overview: Xi'an Actionpower Electric Co., Ltd. focuses on the research, development, production, and sale of power supply and quality control equipment in China with a market cap of CN¥3.21 billion.

Operations: Xi'an Actionpower Electric Co., Ltd. generates revenue through its core activities involving the development, production, and distribution of power supply and quality control equipment in China.

Insider Ownership: 30.3%

Earnings Growth Forecast: 52.3% p.a.

Xi'an Actionpower Electric is expected to see significant earnings growth of 52.3% annually, well above the Chinese market average. Despite a decline in profit margins from 18.6% to 9.2%, the company trades at a favorable price-to-earnings ratio of 38.5x, below the semiconductor industry average. A recent share buyback program for CNY 166.68 million reflects management's confidence and aims to support equity incentives, potentially aligning insider interests with shareholders'.

- Click to explore a detailed breakdown of our findings in Xi'an Actionpower Electric's earnings growth report.

- Upon reviewing our latest valuation report, Xi'an Actionpower Electric's share price might be too pessimistic.

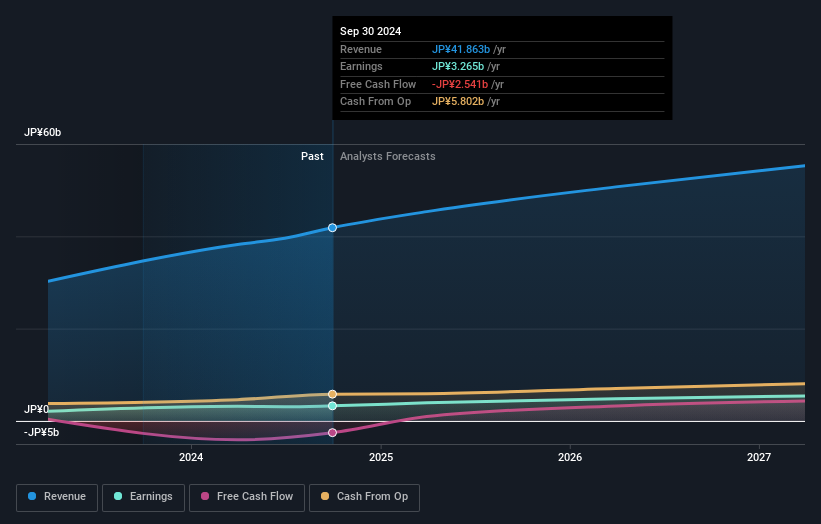

Lifedrink Company (TSE:2585)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lifedrink Company, Inc. manufactures and sells beverages in Japan with a market cap of ¥118.84 billion.

Operations: The company generates revenue from its Beverage and Leaf Business segment, totaling ¥41.86 billion.

Insider Ownership: 14.6%

Earnings Growth Forecast: 15.9% p.a.

Lifedrink Company is forecast to see earnings grow by 15.9% annually, outpacing the JP market average. Despite a highly volatile share price recently, it trades at 14.1% below estimated fair value, suggesting potential undervaluation. The company has high non-cash earnings but carries significant debt levels. Revenue growth is expected at 9% per year, faster than the market's 4.2%, yet slower than high-growth benchmarks of over 20%.

- Take a closer look at Lifedrink Company's potential here in our earnings growth report.

- Our valuation report unveils the possibility Lifedrink Company's shares may be trading at a premium.

Summing It All Up

- Get an in-depth perspective on all 1501 Fast Growing Companies With High Insider Ownership by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2585

Reasonable growth potential with adequate balance sheet.