- Japan

- /

- Electrical

- /

- TSE:6905

January 2025's Insider Picks For Leading Growth Companies

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic signals, major indices such as the Nasdaq Composite have shown resilience with moderate gains. In this environment, growth companies with high insider ownership can be particularly intriguing, as they often reflect strong internal confidence and alignment between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

Ocumension Therapeutics (SEHK:1477)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ocumension Therapeutics is an ophthalmic pharmaceutical platform company operating in the People's Republic of China, with a market cap of approximately HK$3.65 billion.

Operations: The company's revenue segment focuses on the discovery, development, and commercialization of ophthalmic therapies, generating CN¥310.29 million.

Insider Ownership: 20.1%

Earnings Growth Forecast: 101.9% p.a.

Ocumension Therapeutics is trading at 68% below its estimated fair value, with analysts predicting a potential stock price rise of 120.6%. Despite past shareholder dilution, the company shows strong growth prospects, with earnings projected to grow by 101.88% annually and revenue expected to increase by 33.8% per year, outpacing the Hong Kong market's growth rate. Recent developments include progress in clinical trials for OT-301 (NCX 470), enhancing its long-term growth potential in ophthalmic treatments across Asia.

- Take a closer look at Ocumension Therapeutics' potential here in our earnings growth report.

- The analysis detailed in our Ocumension Therapeutics valuation report hints at an deflated share price compared to its estimated value.

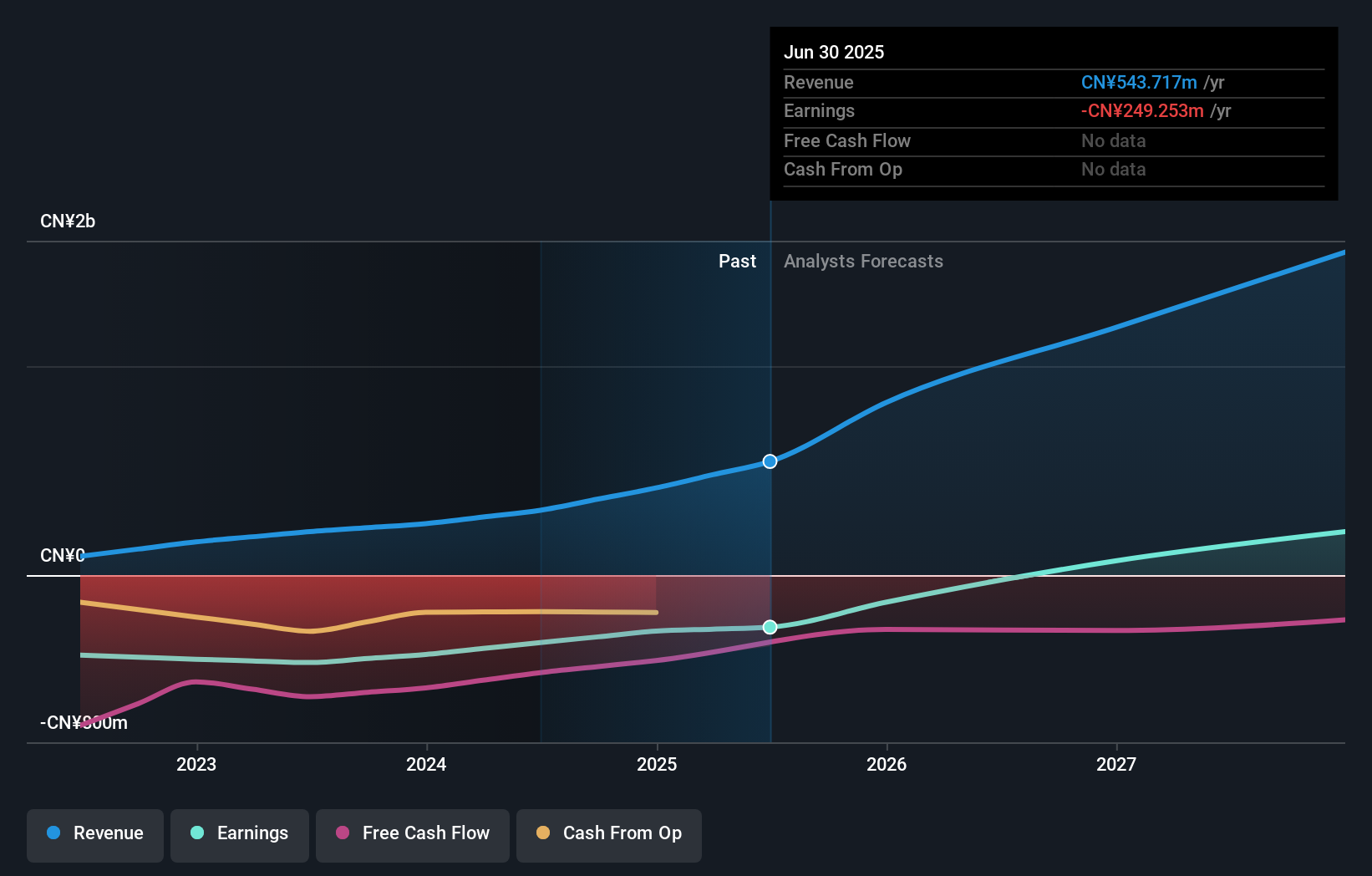

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. operates in the biopharmaceutical industry, focusing on the research, development, and commercialization of innovative drugs, with a market cap of CN¥16.49 billion.

Operations: The company's revenue primarily comes from its Pharmaceuticals segment, which generated CN¥488.45 million.

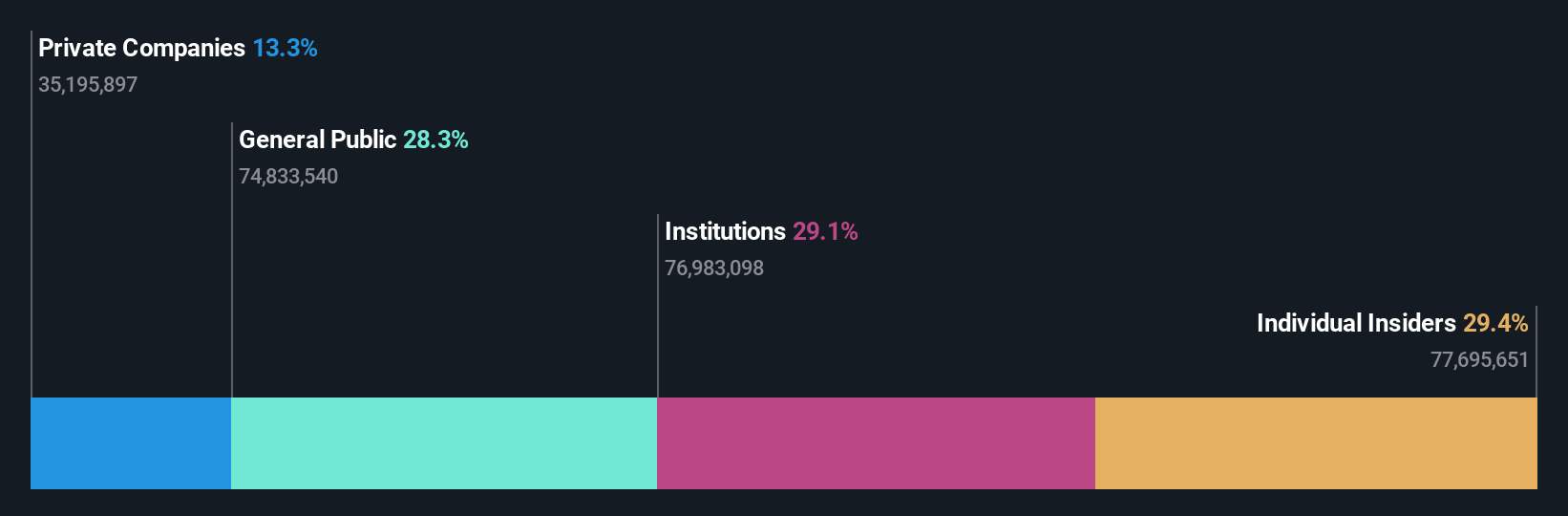

Insider Ownership: 29.4%

Earnings Growth Forecast: 127.3% p.a.

Suzhou Zelgen Biopharmaceuticals is trading at 59.5% below its estimated fair value, with revenue projected to grow 59.6% annually, surpassing the Chinese market's growth rate. Despite a net loss of CNY 97.9 million for the first nine months of 2024, earnings are expected to increase by 127.33% per year as profitability is anticipated within three years. The company has shown significant improvement in reducing losses compared to last year.

- Click here to discover the nuances of Suzhou Zelgen BiopharmaceuticalsLtd with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Suzhou Zelgen BiopharmaceuticalsLtd's share price might be too pessimistic.

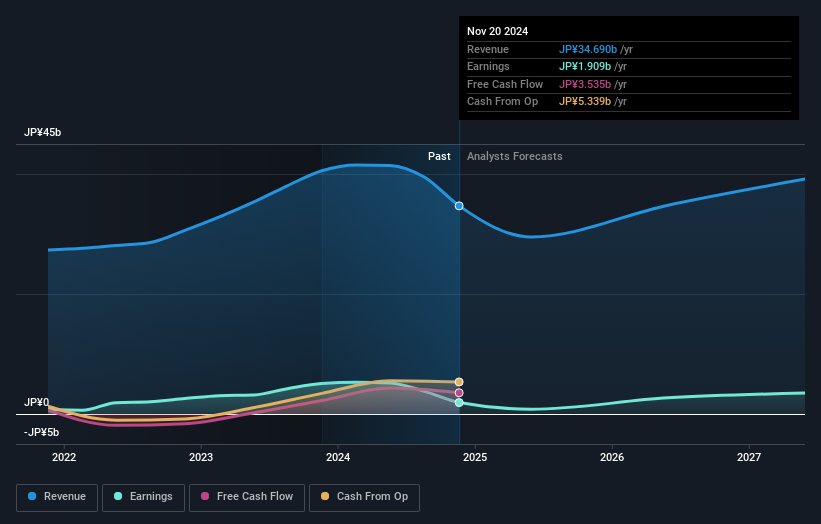

Cosel (TSE:6905)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cosel Co., Ltd. manufactures and sells electrical components and EMI filters both in Japan and internationally, with a market cap of ¥43.89 billion.

Operations: The company generates revenue from various segments, including the Japan Production and Sales Business (¥26.73 billion), Europe Production and Sales Business (¥6.73 billion), Asian Sales Business (¥2.89 billion), North American Sales Business (¥2.53 billion), and China Production Business (¥2.51 billion).

Insider Ownership: 23.4%

Earnings Growth Forecast: 34.1% p.a.

Cosel is trading significantly below its estimated fair value, with earnings forecast to grow substantially at 34.1% annually, outpacing the Japanese market. Despite a lower profit margin this year and revised downward earnings guidance due to geopolitical uncertainties and weak demand in key sectors, insider ownership remains high. The company aims to maintain stable dividends, recently increasing its annual dividend projection to ¥55 per share while managing financial reserves for future expansion.

- Click here and access our complete growth analysis report to understand the dynamics of Cosel.

- The analysis detailed in our Cosel valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Dive into all 1501 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6905

Cosel

Manufactures and sells electrical components and EMI filters in Japan and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives