- Japan

- /

- Construction

- /

- TSE:3431

Undiscovered Gems Three Promising Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with U.S. consumer confidence dipping and durable goods orders declining, investors remain cautious yet optimistic about potential opportunities. In this context, identifying promising small-cap stocks can be particularly rewarding as they often offer unique growth prospects not always reflected in larger indices.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Philippine Savings Bank | NA | 5.49% | 20.73% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sarkuysan Elektrolitik Bakir Sanayi ve Ticaret (IBSE:SARKY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sarkuysan Elektrolitik Bakir Sanayi ve Ticaret A.S. is a Turkish company that, along with its subsidiaries, specializes in the production and trade of electrolytic copper wires, copper pipes, coppering, and copper alloys, with a market capitalization of TRY11.33 billion.

Operations: Sarkuysan generates significant revenue from its copper segment, amounting to TRY46.42 billion, while enameled magnet wire contributes TRY2.45 billion. The company's net profit margin is an essential metric to consider when evaluating its financial performance.

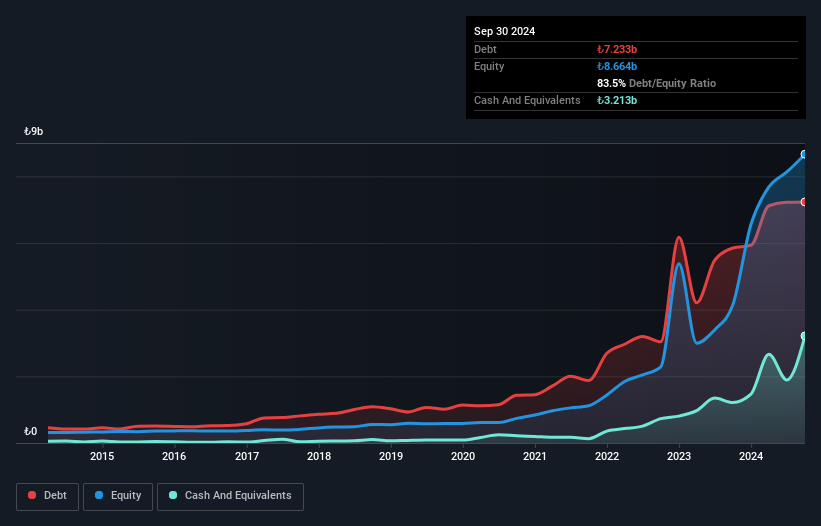

Sarkuysan, a notable player in the electrical industry, recently reported a net loss of TRY 144.82 million for Q3 2024, contrasting sharply with a net income of TRY 128.71 million from the previous year. Over five years, its debt to equity ratio has impressively decreased from 173.4% to 83.5%, yet interest payments remain inadequately covered at just 2.2 times EBIT. Despite trading at nearly 79% below estimated fair value and boasting high-quality earnings, challenges such as negative earnings growth (-38.8%) persist alongside high net debt levels (46%).

BioGaia (OM:BIOG B)

Simply Wall St Value Rating: ★★★★★★

Overview: BioGaia AB (publ) is a healthcare company that develops and sells probiotic products globally, with a market capitalization of SEK11.32 billion.

Operations: BioGaia generates revenue primarily from its Pediatrics segment, contributing SEK1.04 billion, followed by the Adult Health segment at SEK306.08 million.

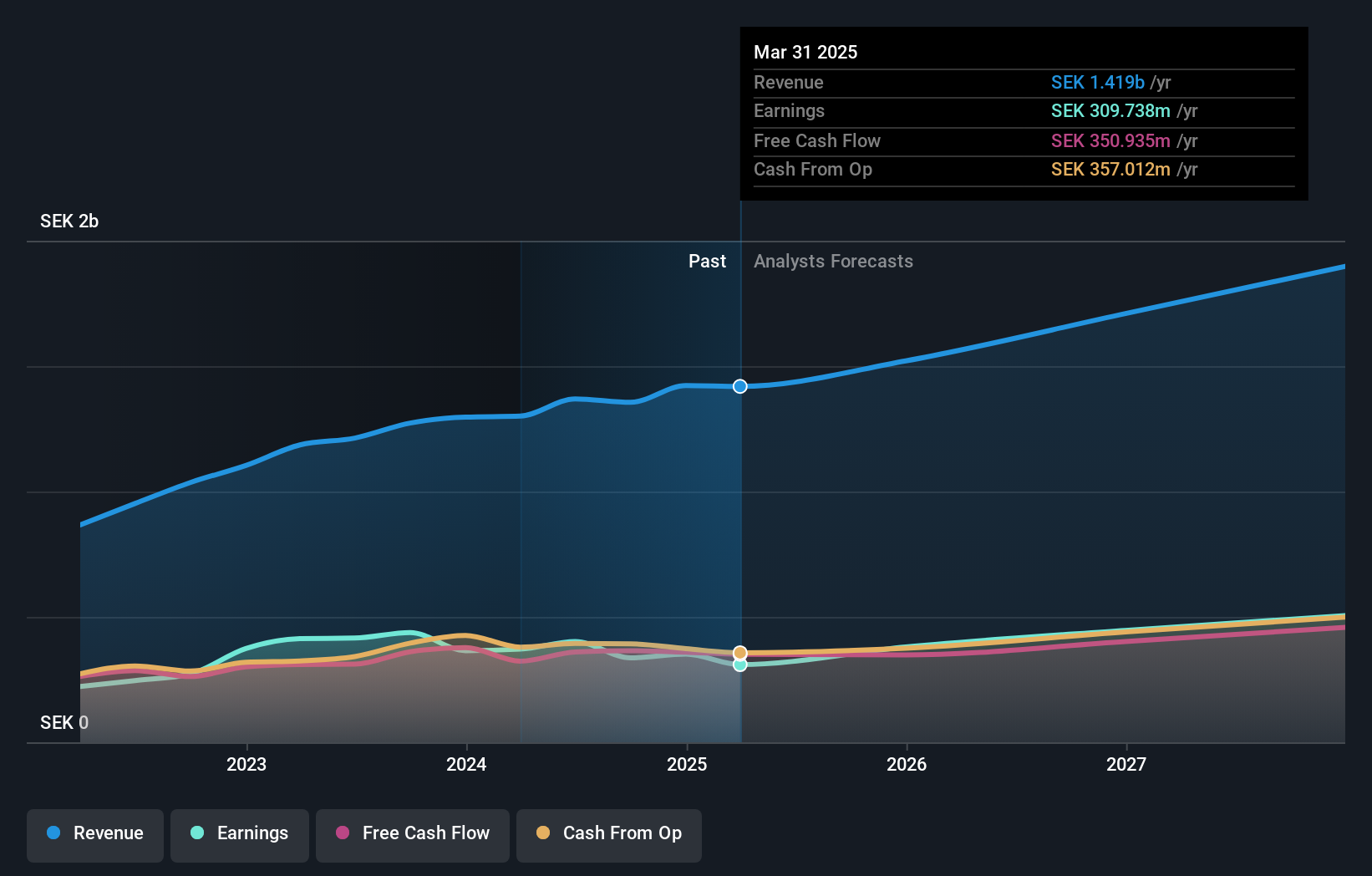

BioGaia, a nimble player in the biotech space, has been making strides with its innovative probiotic offerings. Despite facing a 23% dip in earnings growth over the past year, it remains debt-free for five years and boasts high-quality earnings. The recent launch of BioGaia® Gastrus® PURE ACTION highlights its commitment to addressing digestive health issues with scientifically-backed solutions. In Q3 2024, sales reached SEK 303.97 million while net income stood at SEK 36.6 million compared to SEK 101.5 million last year, reflecting challenges but also potential for future growth given forecasted earnings increase of over 16% annually.

- Take a closer look at BioGaia's potential here in our health report.

Gain insights into BioGaia's historical performance by reviewing our past performance report.

Miyaji Engineering GroupInc (TSE:3431)

Simply Wall St Value Rating: ★★★★★☆

Overview: Miyaji Engineering Group Inc. operates in the construction and civil engineering sectors in Japan through its subsidiaries, with a market capitalization of approximately ¥53.17 billion.

Operations: Miyaji Engineering Group Inc. generates revenue primarily from its MEC and MMB segments, contributing ¥42.46 billion and ¥32.21 billion respectively.

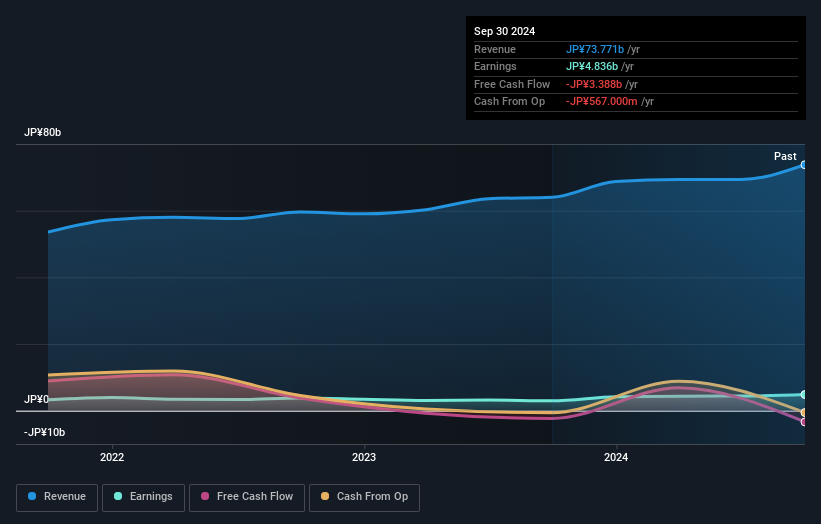

Miyaji Engineering's earnings surged 64% over the past year, outpacing the construction industry's 21% growth. The company's debt-to-equity ratio improved significantly from 17.2% to 6.5% over five years, indicating better financial health. Despite a lower free cash flow, Miyaji holds more cash than total debt, ensuring stability. Its price-to-earnings ratio of 11x is attractive compared to Japan's market average of 13.6x, suggesting good value potential. Recent guidance forecasts net sales of ¥73 billion and operating profit of ¥8.5 billion for fiscal year-end March 2025, with dividends reduced to ¥85 per share from last year's ¥150 per share due to strategic considerations.

Make It Happen

- Reveal the 4638 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3431

Miyaji Engineering GroupInc

Through its subsidiaries, engages in the construction and civil engineering activities in Japan.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives