As 2024 draws to a close, global markets have experienced mixed signals with U.S. consumer confidence dipping and major indices like the Nasdaq Composite showing gains despite some volatility. In this environment, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer resilience and potential growth amid fluctuating economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.8% |

| Wasion Holdings (SEHK:3393) | HK$7.13 | HK$14.19 | 49.7% |

| First Solar (NasdaqGS:FSLR) | US$176.24 | US$350.71 | 49.7% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7309.53 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.70 | 50% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7652.96 | 49.9% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.71 | 49.8% |

| ASMPT (SEHK:522) | HK$74.90 | HK$149.66 | 50% |

Here we highlight a subset of our preferred stocks from the screener.

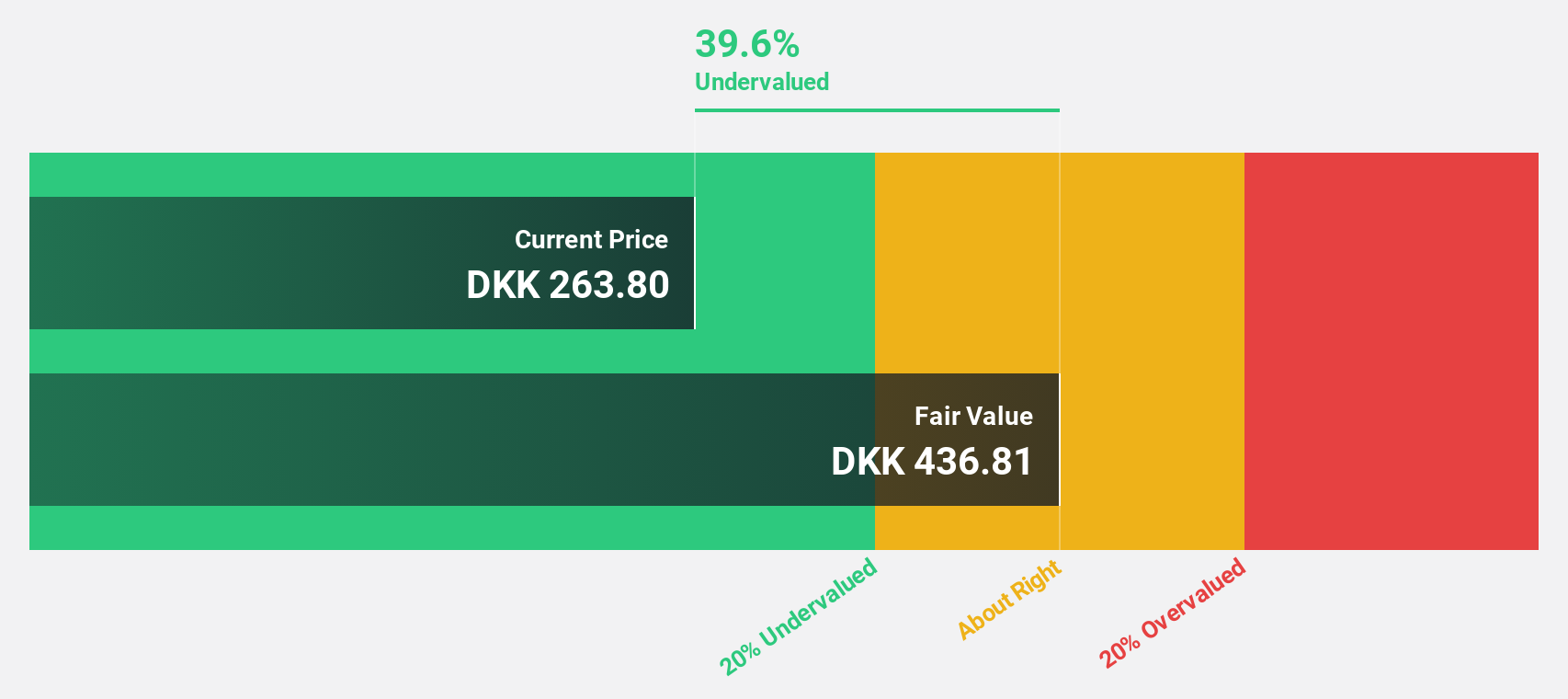

Netcompany Group (CPSE:NETC)

Overview: Netcompany Group A/S is an IT services company that provides business critical IT solutions to public and private sector clients across Denmark, Norway, the United Kingdom, the Netherlands, Belgium, Luxembourg, Greece and internationally with a market cap of DKK16.09 billion.

Operations: The company's revenue is derived from DKK4.41 billion in the public sector and DKK2.04 billion in the private sector.

Estimated Discount To Fair Value: 29.4%

Netcompany Group is trading at DKK339, significantly below its estimated fair value of DKK479.93, suggesting undervaluation based on discounted cash flow analysis. Despite a high debt level, the company's earnings are forecast to grow 29.5% annually, outpacing the Danish market's 11.3%. Recent earnings reports show strong performance with third-quarter net income rising to DKK139.5 million from DKK79.8 million last year, underscoring potential for robust cash flow growth amidst slower revenue expansion compared to market averages.

- Our growth report here indicates Netcompany Group may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Netcompany Group stock in this financial health report.

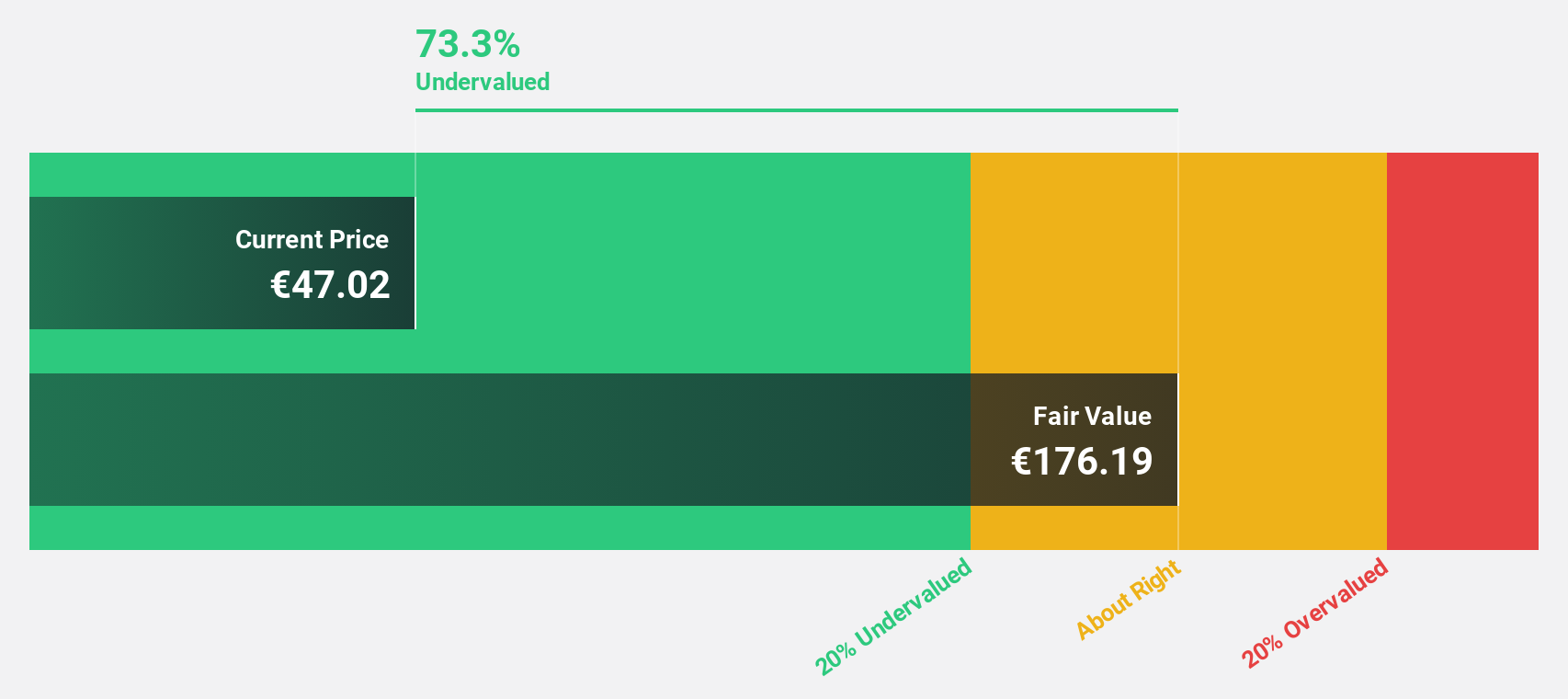

ERAMET (ENXTPA:ERA)

Overview: ERAMET S.A. is a mining and metallurgical company with operations in France, Asia, Europe, North America, and internationally, and has a market cap of €1.54 billion.

Operations: The company's revenue segments include €0.79 billion from Mining and Metals - Nickel and €280 million from Mining and Metals - Mineral Sands.

Estimated Discount To Fair Value: 11.4%

Eramet is trading at €54.15, below its estimated fair value of €61.11, indicating potential undervaluation based on cash flows. The company forecasts a 65.44% annual earnings growth over the next three years, surpassing average market expectations and highlighting robust future profitability prospects. Recent developments include full ownership of its lithium business and the first production at its Centenario plant using advanced Direct Lithium Extraction technology, enhancing long-term growth potential in the lithium sector.

- Insights from our recent growth report point to a promising forecast for ERAMET's business outlook.

- Click to explore a detailed breakdown of our findings in ERAMET's balance sheet health report.

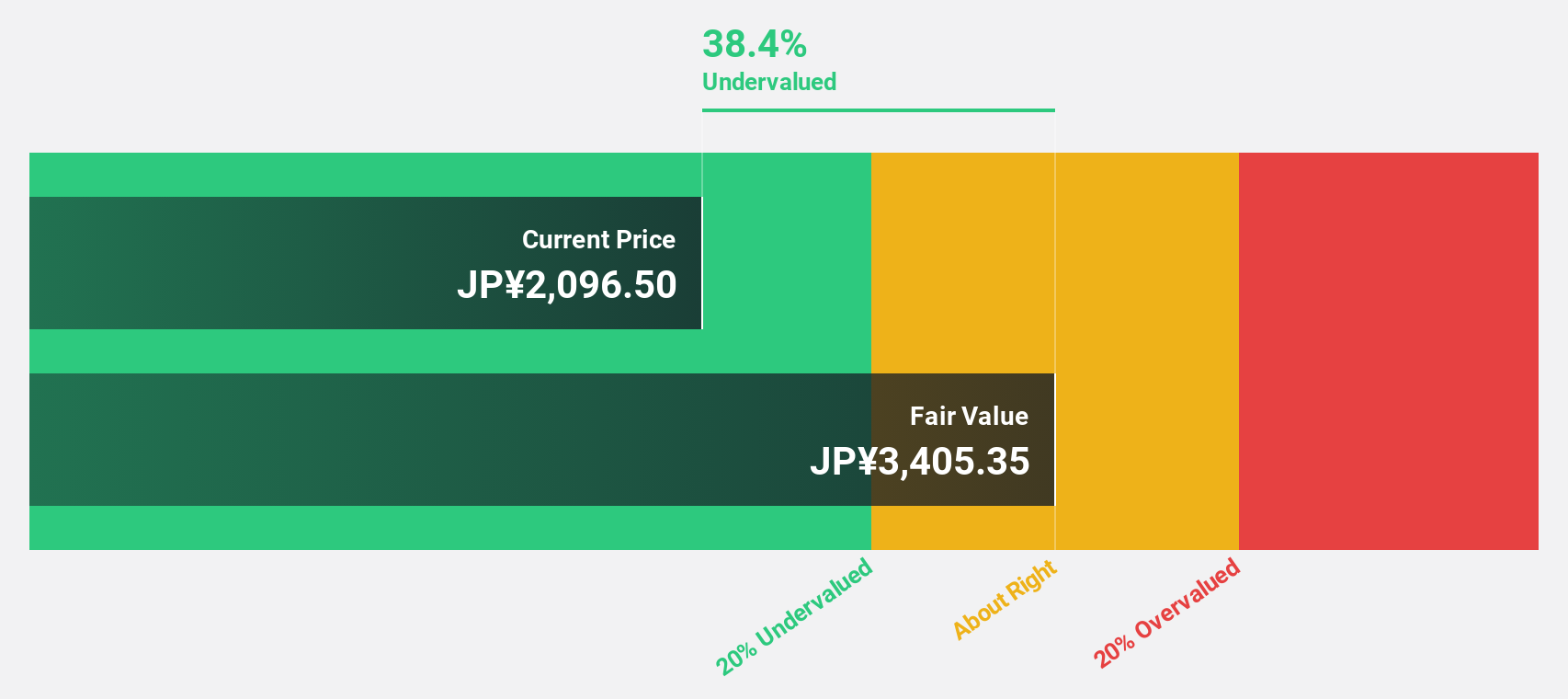

Aozora Bank (TSE:8304)

Overview: Aozora Bank, Ltd., along with its subsidiaries, offers a range of banking products and services both in Japan and internationally, with a market cap of ¥343.74 billion.

Operations: The company's revenue is primarily derived from its Customer Relations Group with ¥8.51 billion, Structured Finance Group with ¥35.68 billion, and International Business Group with ¥18.24 billion.

Estimated Discount To Fair Value: 25.3%

Aozora Bank is trading at ¥2,484, significantly below its estimated fair value of ¥3,326.31, suggesting undervaluation based on cash flows. The bank's earnings are forecast to grow by 72.48% annually over the next three years, outpacing market averages and indicating strong future profitability prospects. However, concerns include a low allowance for bad loans and recent shareholder dilution. A recent dividend affirmation underscores management's confidence in financial stability despite these challenges.

- The analysis detailed in our Aozora Bank growth report hints at robust future financial performance.

- Get an in-depth perspective on Aozora Bank's balance sheet by reading our health report here.

Taking Advantage

- Click here to access our complete index of 872 Undervalued Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8304

Aozora Bank

Provides various banking products and services in Japan and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives