- Sweden

- /

- Specialty Stores

- /

- OM:BHG

BHG Group (STO:BHG shareholders incur further losses as stock declines 10% this week, taking three-year losses to 80%

BHG Group AB (publ) (STO:BHG) shareholders should be happy to see the share price up 23% in the last quarter. But the last three years have seen a terrible decline. The share price has sunk like a leaky ship, down 80% in that time. So it's about time shareholders saw some gains. But the more important question is whether the underlying business can justify a higher price still. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Since BHG Group has shed kr344m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for BHG Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

BHG Group has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

Arguably the revenue decline of 6.8% per year has people thinking BHG Group is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

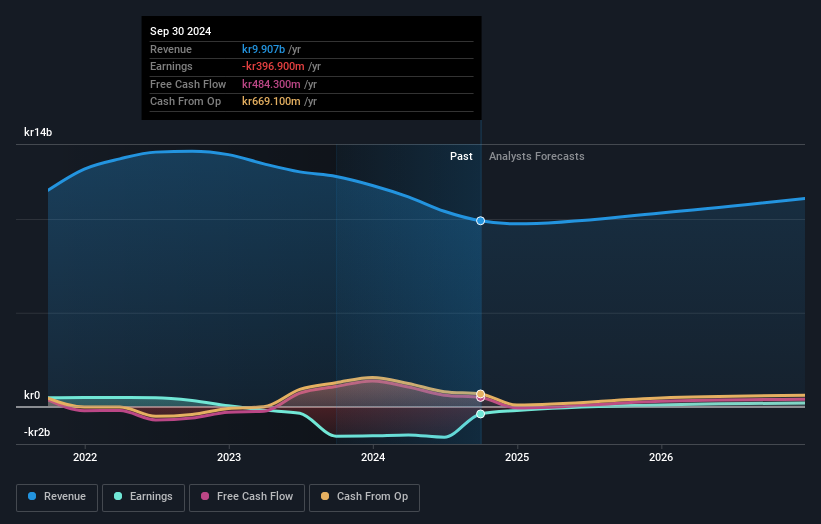

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on BHG Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that BHG Group shareholders have received a total shareholder return of 18% over one year. Notably the five-year annualised TSR loss of 12% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - BHG Group has 1 warning sign we think you should be aware of.

But note: BHG Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

If you're looking to trade BHG Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BHG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BHG

BHG Group

Operates as a consumer e-commerce company in Sweden, Finland, Denmark, Norway, Europe, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives