- Sweden

- /

- Real Estate

- /

- OM:SBB B

Insider Favorites For Growth In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of monetary policy adjustments and mixed economic signals, the technology-heavy Nasdaq Composite continues to break records, highlighting investor interest in growth stocks. In this environment, companies with high insider ownership can be particularly attractive as they often signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Samhällsbyggnadsbolaget i Norden (OM:SBB B)

Simply Wall St Growth Rating: ★★★★☆☆

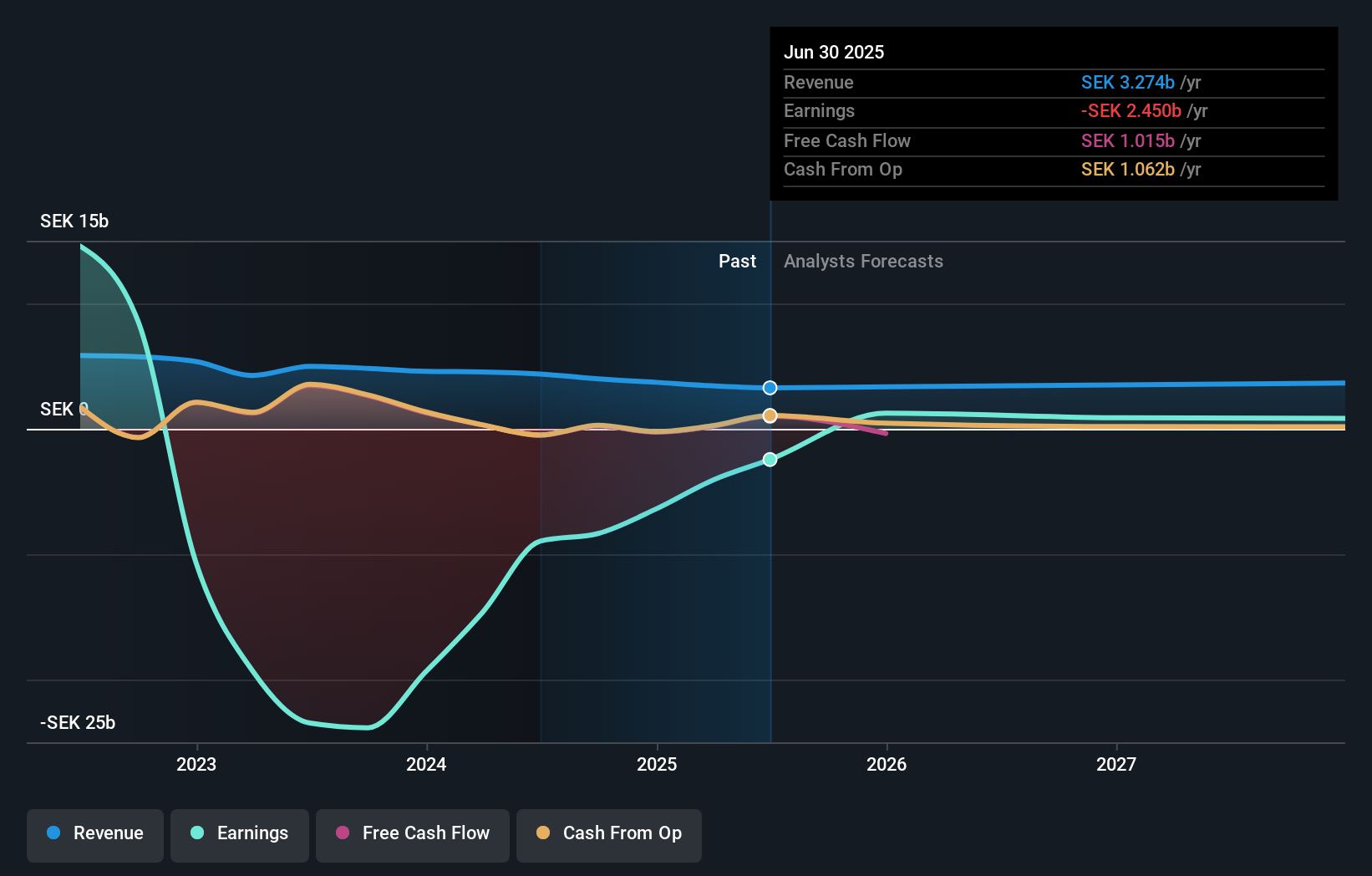

Overview: Samhällsbyggnadsbolaget i Norden AB (publ) owns, develops, and manages residential and social infrastructure properties across Sweden, Norway, Finland, and Denmark with a market cap of approximately SEK6.08 billion.

Operations: The company's revenue segments include SEK2.20 billion from community properties, SEK5.58 billion from residential properties, and a negative contribution of SEK863 million from education properties.

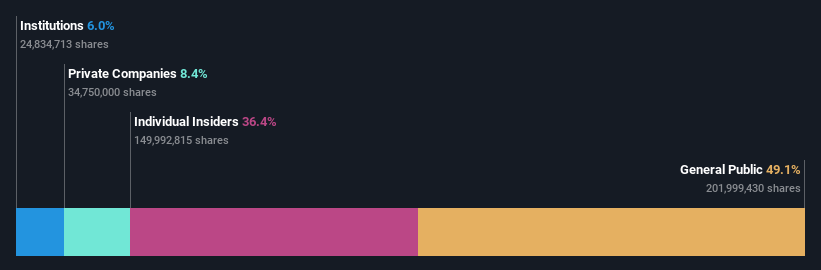

Insider Ownership: 10%

Samhällsbyggnadsbolaget i Norden is navigating financial challenges with a net loss reduction from SEK 18.99 billion to SEK 5.24 billion over nine months, despite declining sales. The company plans to list its subsidiary Sveafastigheter, aiming to become Sweden's largest listed residential real estate entity with assets worth SEK 27.5 billion and anticipated rental income of SEK 1.5 billion annually, reflecting strategic growth amid insider ownership stability and volatile share prices.

- Dive into the specifics of Samhällsbyggnadsbolaget i Norden here with our thorough growth forecast report.

- The analysis detailed in our Samhällsbyggnadsbolaget i Norden valuation report hints at an deflated share price compared to its estimated value.

BeijingABT NetworksLtd (SHSE:688168)

Simply Wall St Growth Rating: ★★★★★☆

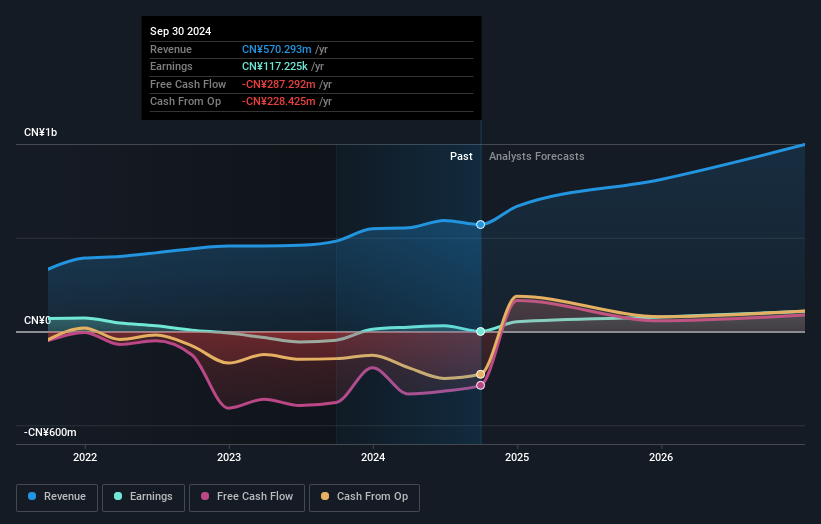

Overview: BeijingABT Networks Co., Ltd. develops and provides visualized network security technology solutions in China, with a market cap of CN¥3.16 billion.

Operations: The company's revenue is primarily derived from its network security segment, which generated CN¥570.29 million.

Insider Ownership: 25.2%

BeijingABT Networks Ltd.'s recent earnings report shows a net loss increase to CNY 81.53 million, despite revenue growth to CNY 297.41 million over nine months. The company is forecasted for significant earnings growth of over 20% annually, outpacing the Chinese market's average. However, its share price has been highly volatile recently and Return on Equity is expected to remain low at 7.1%. There has been no substantial insider trading activity in the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of BeijingABT NetworksLtd.

- The valuation report we've compiled suggests that BeijingABT NetworksLtd's current price could be inflated.

Zhejiang Double Arrow Rubber (SZSE:002381)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Double Arrow Rubber Co., Ltd. manufactures and sells rubber conveyor belt products both in China and internationally, with a market cap of CN¥2.94 billion.

Operations: The company's revenue primarily comes from the manufacturing and sale of rubber conveyor belt products in both domestic and international markets.

Insider Ownership: 36.5%

Zhejiang Double Arrow Rubber is experiencing revenue growth, with sales reaching CNY 1.93 billion for the first nine months of 2024, up from CNY 1.85 billion a year ago. Despite this, net income decreased to CNY 139.62 million from CNY 161.91 million in the same period last year. The company's earnings are projected to grow significantly at over 20% annually, though its dividend yield of 3.18% is not well covered by free cash flows and Return on Equity remains modest at a forecasted 14.3%.

- Take a closer look at Zhejiang Double Arrow Rubber's potential here in our earnings growth report.

- According our valuation report, there's an indication that Zhejiang Double Arrow Rubber's share price might be on the cheaper side.

Key Takeaways

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1516 more companies for you to explore.Click here to unveil our expertly curated list of 1519 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SBB B

Samhällsbyggnadsbolaget i Norden

Owns, develops, and manages residential and social infrastructure properties in Sweden, Norway, Finland, and Denmark.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives