High Growth Tech Stocks In Europe Featuring 3 Promising Companies

Reviewed by Simply Wall St

The European market has been experiencing a mixed performance with the pan-European STOXX Europe 600 Index ending roughly flat, as investors remain cautious amid ongoing U.S. and European trade discussions. In this environment, high growth tech stocks in Europe are attracting attention for their potential to capitalize on technological advancements and innovation-driven growth, making them appealing options for those interested in dynamic sectors despite broader market uncertainties.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Archos | 24.72% | 39.34% | ★★★★★★ |

| Pharma Mar | 26.67% | 43.29% | ★★★★★★ |

| innoscripta | 24.76% | 26.32% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Rubean | 45.56% | 108.82% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Global Dominion Access (BME:DOM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Global Dominion Access, S.A. offers comprehensive services aimed at enhancing business process efficiency and sustainability on a global scale, with a market capitalization of €519.67 million.

Operations: The company focuses on delivering integral services that improve business process efficiency and sustainability globally. It operates with a market capitalization of €519.67 million, emphasizing sustainable solutions across its service offerings.

Despite a challenging half-year with net income dropping to €5.05 million from €16.28 million, Global Dominion Access (DOM) shows resilience with a modest annual revenue growth of 5.1%. This growth, albeit slower than the broader Spanish market's 20%, is supported by DOM's strategic focus on diversifying its services within the tech sector. The company's commitment to innovation is evident in its R&D strategy, crucial for staying competitive in the rapidly evolving technology landscape. Moreover, DOM’s earnings are projected to surge by an impressive 25.6% annually, outpacing the general market's growth rate of 5.3%. This forecasted growth underscores potential for recovery and expansion as DOM continues adapting to industry demands and optimizing its operational efficiencies.

- Unlock comprehensive insights into our analysis of Global Dominion Access stock in this health report.

Explore historical data to track Global Dominion Access' performance over time in our Past section.

Devyser Diagnostics (OM:DVYSR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Devyser Diagnostics AB (publ) develops, manufactures, and sells diagnostic kits and solutions for DNA testing in areas such as hereditary diseases, oncology, and post-transplantation monitoring across various regions including Sweden, Europe, the Middle East, Africa, the Americas, and Asia with a market cap of SEK2.52 billion.

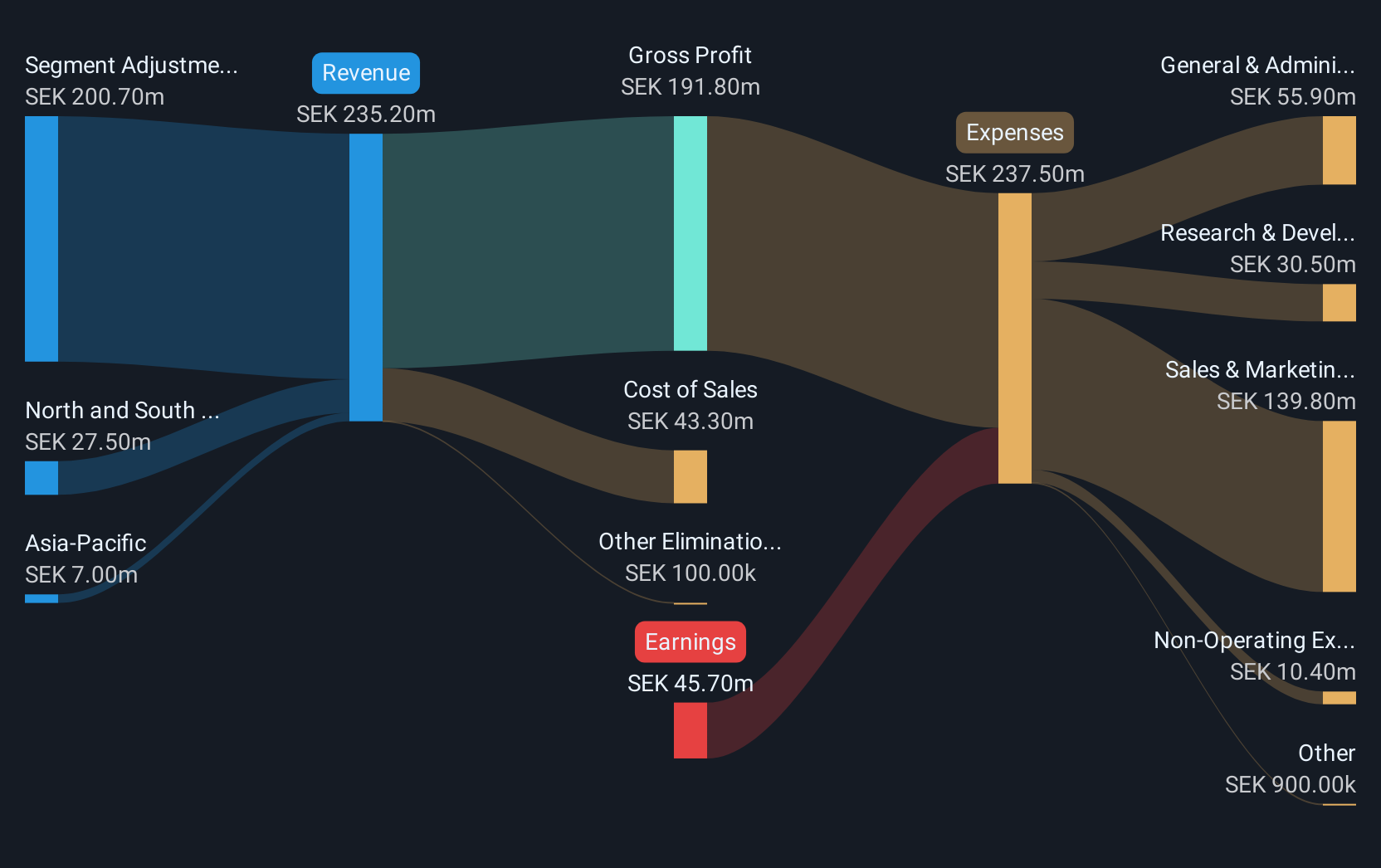

Operations: The company generates revenue primarily from the sale of diagnostic kits and equipment, totaling SEK235.10 million.

Devyser Diagnostics, amidst a transformative phase, reported a significant turnaround with Q2 sales surging to SEK 67.4 million from SEK 53.2 million year-over-year and flipping a net loss into a gain. This rebound is underscored by its innovative Devyser Genomic Blood Typing solution, enhancing molecular blood group research's precision and simplicity—a leap in transfusion and transplantation diagnostics. With an expected revenue growth of 27.7% annually, the company is poised above the Swedish market average (5.2%), reflecting its potential despite current unprofitability. The recent board enhancements signal strategic shifts likely to bolster future governance and operational dynamics.

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Synektik Spólka Akcyjna is a Polish company offering products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications with a market cap of PLN1.79 billion.

Operations: Synektik Spólka Akcyjna generates revenue primarily from diagnostic and IT equipment, amounting to PLN57.90 billion, and the production of radiopharmaceuticals at PLN4.66 billion. The company's operations focus on providing specialized solutions in Poland's healthcare sector.

Synektik Spólka Akcyjna, a player in the European tech landscape, recently showcased modest financial growth with its half-year revenue reaching PLN 327.82 million, a slight dip from the previous year's PLN 359 million. Despite this, net income saw a marginal increase to PLN 47.56 million from PLN 46.9 million, indicating resilience in profitability. Notably, the company's earnings per share also edged up from PLN 5.5 to PLN 5.58, reflecting an improved earnings quality marked by high non-cash components. With projected annual earnings growth at an impressive rate of 23.4%, Synektik is outpacing the broader Polish market's forecast of 13.6%. This robust profit outlook is further complemented by an anticipated strong return on equity of 48.2% in three years' time—positioning it well above industry benchmarks and highlighting its potential for sustained financial health amidst competitive pressures.

- Take a closer look at Synektik Spólka Akcyjna's potential here in our health report.

Gain insights into Synektik Spólka Akcyjna's past trends and performance with our Past report.

Where To Now?

- Click this link to deep-dive into the 232 companies within our European High Growth Tech and AI Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DVYSR

Devyser Diagnostics

Engages in the development, manufacture, and sale of diagnostic kits and solutions for DNA testing within hereditary diseases, oncology, and post-transplantation monitoring in Sweden, rest of Europe, the Middle East, Africa, North and South America, and Asia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives