- France

- /

- Retail REITs

- /

- ENXTPA:FREY

Exploring 3 Undiscovered European Gems with Solid Potential

Reviewed by Simply Wall St

The European market has been navigating a complex landscape, with the STOXX Europe 600 Index recently snapping a 10-week streak of gains amid uncertainties surrounding U.S. trade policies. Despite these challenges, opportunities have emerged as Germany and the EU plan to increase spending on defense and infrastructure, potentially boosting certain sectors. In this environment, stocks that demonstrate resilience through strong fundamentals and adaptability to changing economic conditions may present solid potential for investors seeking undiscovered gems in Europe.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| OHB | 57.88% | 1.74% | 24.66% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Frey (ENXTPA:FREY)

Simply Wall St Value Rating: ★★★★★☆

Overview: Frey SA is involved in the development, ownership, and management of commercial real estate assets primarily in France, with a market cap of €893.60 million.

Operations: Frey SA generates revenue through the development, ownership, and management of commercial real estate assets in France. The company's financial performance is characterized by a focus on maximizing returns from its real estate portfolio.

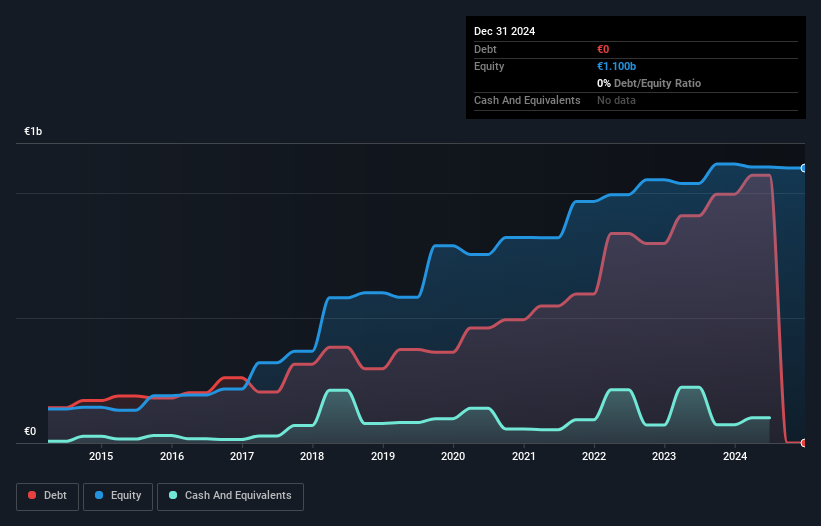

Frey, a nimble player in the European market, has seen its earnings grow by 7.4% annually over the past five years while maintaining a debt-free status compared to a 45.9% debt-to-equity ratio five years ago. The company reported net income of €40 million for 2024, up from €18.9 million the previous year, despite being impacted by a significant one-off gain of €22.5 million in its latest financial results. Frey trades at 69.3% below its estimated fair value, suggesting potential undervaluation amidst robust revenue growth from €113.5 million to €135.7 million year-on-year.

- Click here to discover the nuances of Frey with our detailed analytical health report.

Review our historical performance report to gain insights into Frey's's past performance.

SpareBank 1 Helgeland (OB:HELG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SpareBank 1 Helgeland offers a range of financial products and services to retail customers, small and medium enterprises, municipal authorities, and institutions in Norway, with a market capitalization of NOK4.33 billion.

Operations: The bank generates revenue primarily from its Retail segment (NOK446 million) and Corporate Market segment (NOK291 million).

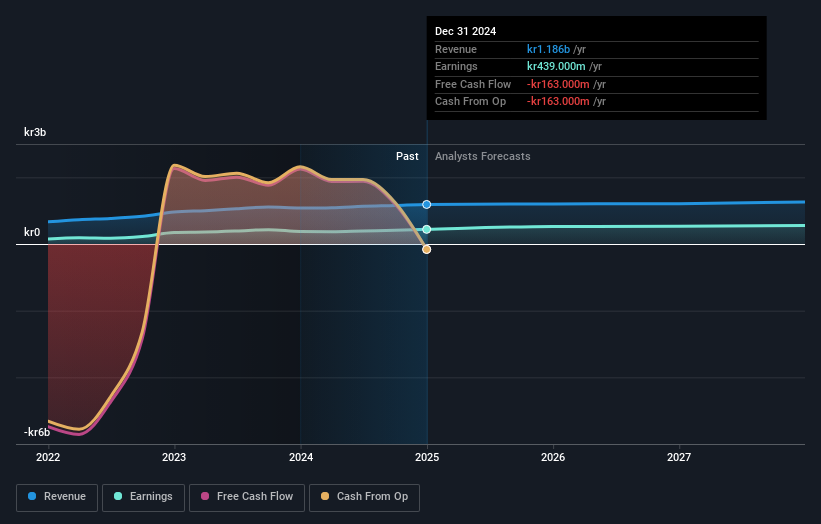

SpareBank 1 Helgeland, a nimble player in the European financial landscape, holds total assets of NOK39 billion and equity of NOK5.2 billion. With deposits at NOK25.1 billion and loans totaling NOK31.3 billion, it has a net interest margin of 2.7%. The bank's earnings have grown 17% annually over the past five years but lagged behind industry growth last year at 17% versus 23%. Despite trading at a discount to its estimated fair value by about 35%, its bad loan allowance is low at just 50%. Recent earnings show an increase in net income to NOK571 million from NOK490 million previously.

Linc (OM:LINC)

Simply Wall St Value Rating: ★★★★★★

Overview: Linc AB is a private equity and venture capital firm that focuses on early and mature stage investments in pharmaceutical, life-science, and med-tech companies, with a market cap of SEK4.14 billion.

Operations: Linc generates revenue primarily from its listed holdings, amounting to SEK481.12 million, while unlisted holdings contribute SEK6.80 million.

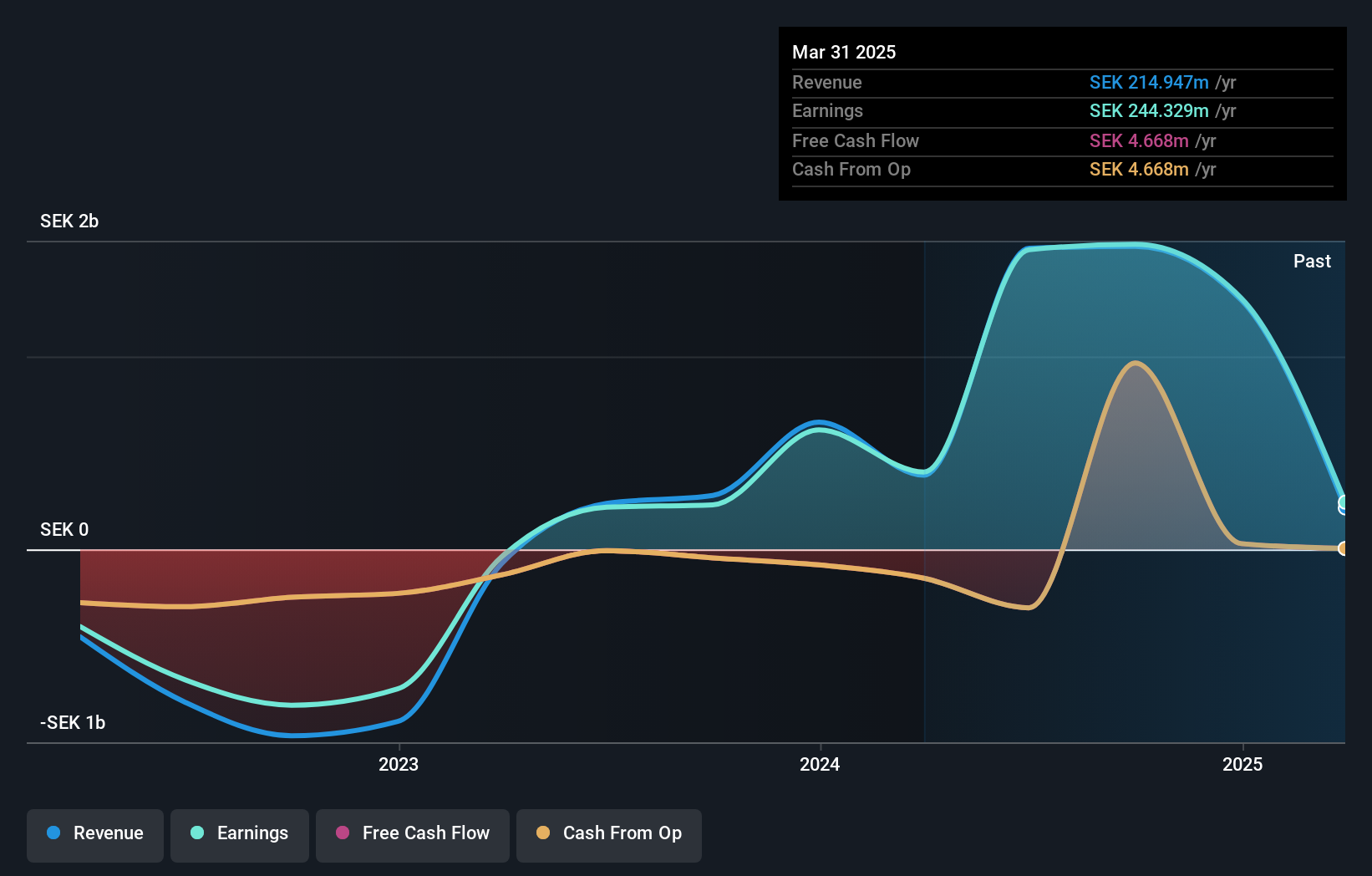

Linc, a promising player in the European market, has demonstrated impressive earnings growth of 110.1% over the past year, outpacing the Capital Markets industry average of 49.8%. The company is debt-free and boasts a price-to-earnings ratio of 3.2x, significantly lower than Sweden's market average of 22.2x. However, recent significant insider selling might raise eyebrows among investors. Despite being dropped from the OMX Nordic All-Share Index recently, Linc reported strong full-year results with net income reaching SEK 1.3 billion compared to SEK 619 million last year, indicating robust financial health and potential for future growth.

- Unlock comprehensive insights into our analysis of Linc stock in this health report.

Assess Linc's past performance with our detailed historical performance reports.

Make It Happen

- Investigate our full lineup of 367 European Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FREY

Frey

Engages in developing, owning, and managing commercial real estate assets primarily located in France.

Established dividend payer with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)