- Sweden

- /

- Consumer Finance

- /

- OM:HOFI

Here's Why We Think Hoist Finance (STO:HOFI) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Hoist Finance (STO:HOFI). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Hoist Finance

How Fast Is Hoist Finance Growing Its Earnings Per Share?

Over the last three years, Hoist Finance has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Hoist Finance's EPS catapulted from kr3.20 to kr8.48, over the last year. It's a rarity to see 165% year-on-year growth like that. The best case scenario? That the business has hit a true inflection point.

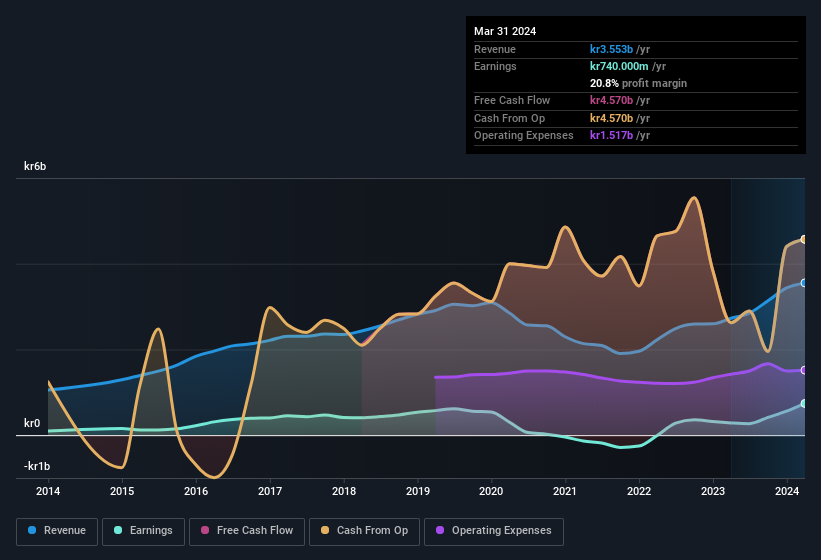

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Hoist Finance's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Hoist Finance remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 30% to kr3.6b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Hoist Finance's forecast profits?

Are Hoist Finance Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While Hoist Finance insiders did net kr7.3m selling stock over the last year, they invested kr14m, a much higher figure. This overall confidence in the company at current the valuation signals their optimism. It is also worth noting that it was Executive Chairman Lars Wollung who made the biggest single purchase, worth kr7.3m, paying kr31.00 per share.

Along with the insider buying, another encouraging sign for Hoist Finance is that insiders, as a group, have a considerable shareholding. To be specific, they have kr297m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 5.8% of the company; visible skin in the game.

Does Hoist Finance Deserve A Spot On Your Watchlist?

Hoist Finance's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Hoist Finance belongs near the top of your watchlist. It is worth noting though that we have found 1 warning sign for Hoist Finance that you need to take into consideration.

Keen growth investors love to see insider buying. Thankfully, Hoist Finance isn't the only one. You can see a a curated list of Swedish companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hoist Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HOFI

Hoist Finance

A credit market company, engages in the loan acquisition and management operations in Europe.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives