- Sweden

- /

- Consumer Finance

- /

- OM:HOFI

Exploring Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

Amid a backdrop of mixed performances in major stock indices, with the S&P 500 and Nasdaq Composite reaching record highs while the Russell 2000 saw declines, investors are keenly observing economic indicators such as job growth and interest rate expectations. In this environment, where growth stocks have outshone their value counterparts by significant margins, identifying promising small-cap opportunities requires a focus on companies with strong fundamentals and potential for sustainable growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

SpareBank 1 Østlandet (OB:SPOL)

Simply Wall St Value Rating: ★★★★★☆

Overview: SpareBank 1 Østlandet offers a wide range of financial products and services to individuals, businesses, the public sector, clubs, and societies, with a market cap of NOK17.70 billion.

Operations: SpareBank 1 Østlandet generates revenue primarily through its Retail Division and Corporate Division, contributing NOK2.49 billion and NOK2.06 billion respectively. The company's net profit margin is a key indicator of its financial health, reflecting the efficiency in managing costs relative to its revenue streams.

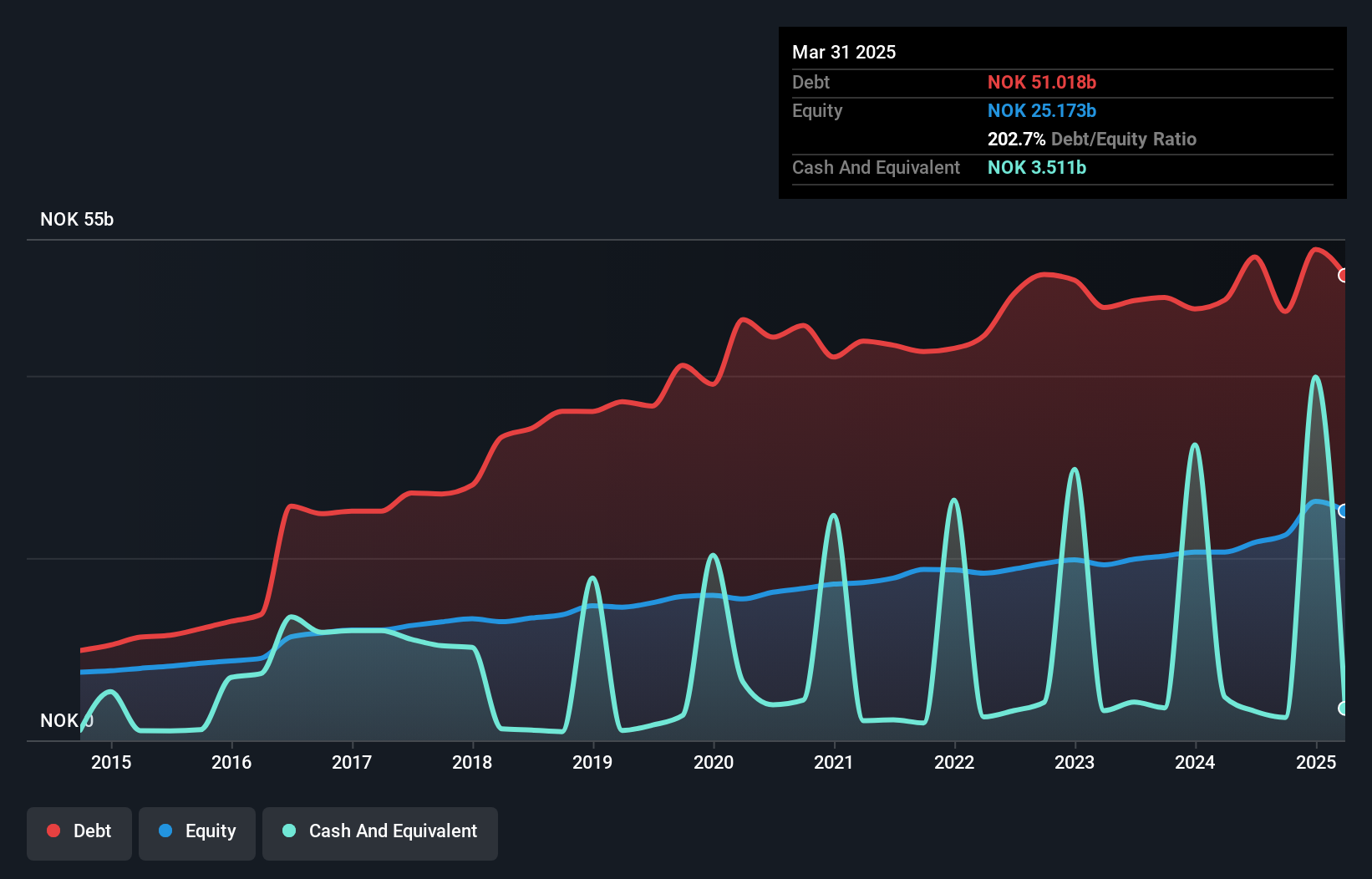

SpareBank 1 Østlandet, a notable player with total assets of NOK186 billion and equity of NOK22.5 billion, showcases a robust financial standing. Its customer deposits, totaling NOK114.2 billion, form 70% of its primarily low-risk funding sources, which is less risky than external borrowing. The bank's total loans stand at NOK140.5 billion with non-performing loans at an appropriate level of 1.5%. Despite trading at 38.7% below estimated fair value and growing earnings by 63%, it has insufficient allowance for bad loans (36%). Recent earnings reveal a significant rise in net income to NOK1,080 million for Q3 compared to last year's NOK417 million.

- Navigate through the intricacies of SpareBank 1 Østlandet with our comprehensive health report here.

Assess SpareBank 1 Østlandet's past performance with our detailed historical performance reports.

Gränges (OM:GRNG)

Simply Wall St Value Rating: ★★★★★★

Overview: Gränges AB (publ) is a company that develops, produces, and distributes rolled aluminum products for thermal management systems, specialty packaging, and niche applications across Europe, Asia, and the Americas with a market cap of approximately SEK13.99 billion.

Operations: Gränges generates revenue primarily from its Gränges Eurasia and Gränges Americas segments, contributing SEK12.45 billion and SEK10.83 billion respectively.

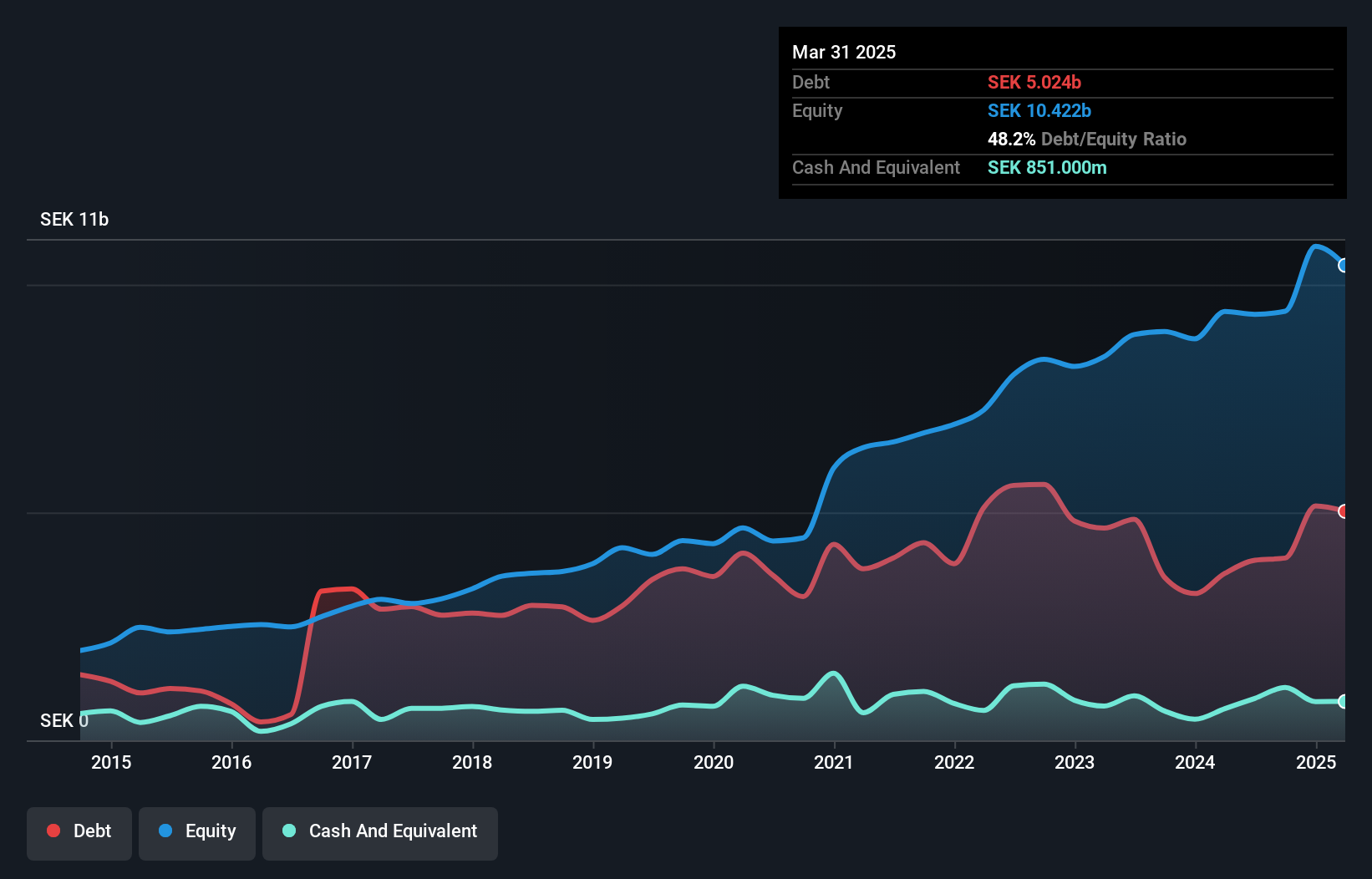

Gränges, a notable player in the metals sector, showcases impressive financial resilience with high-quality earnings and satisfactory net debt to equity ratio at 30.2%. Despite a slight dip in earnings growth by 1% last year, it outpaces the industry average decline of 15.3%. The company trades significantly below its estimated fair value by 72.7%, offering potential upside. Recent refinancing of a SEK 3 billion sustainability-linked credit facility underscores its commitment to climate goals and may lower financing costs. Although Q3 sales rose to SEK 5,750 million from SEK 5,575 million last year, net income slightly decreased to SEK 285 million from SEK 332 million.

- Click here to discover the nuances of Gränges with our detailed analytical health report.

Gain insights into Gränges' historical performance by reviewing our past performance report.

Hoist Finance (OM:HOFI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hoist Finance AB (publ) is a credit market company involved in loan acquisition and management operations across Europe, with a market cap of SEK8.45 billion.

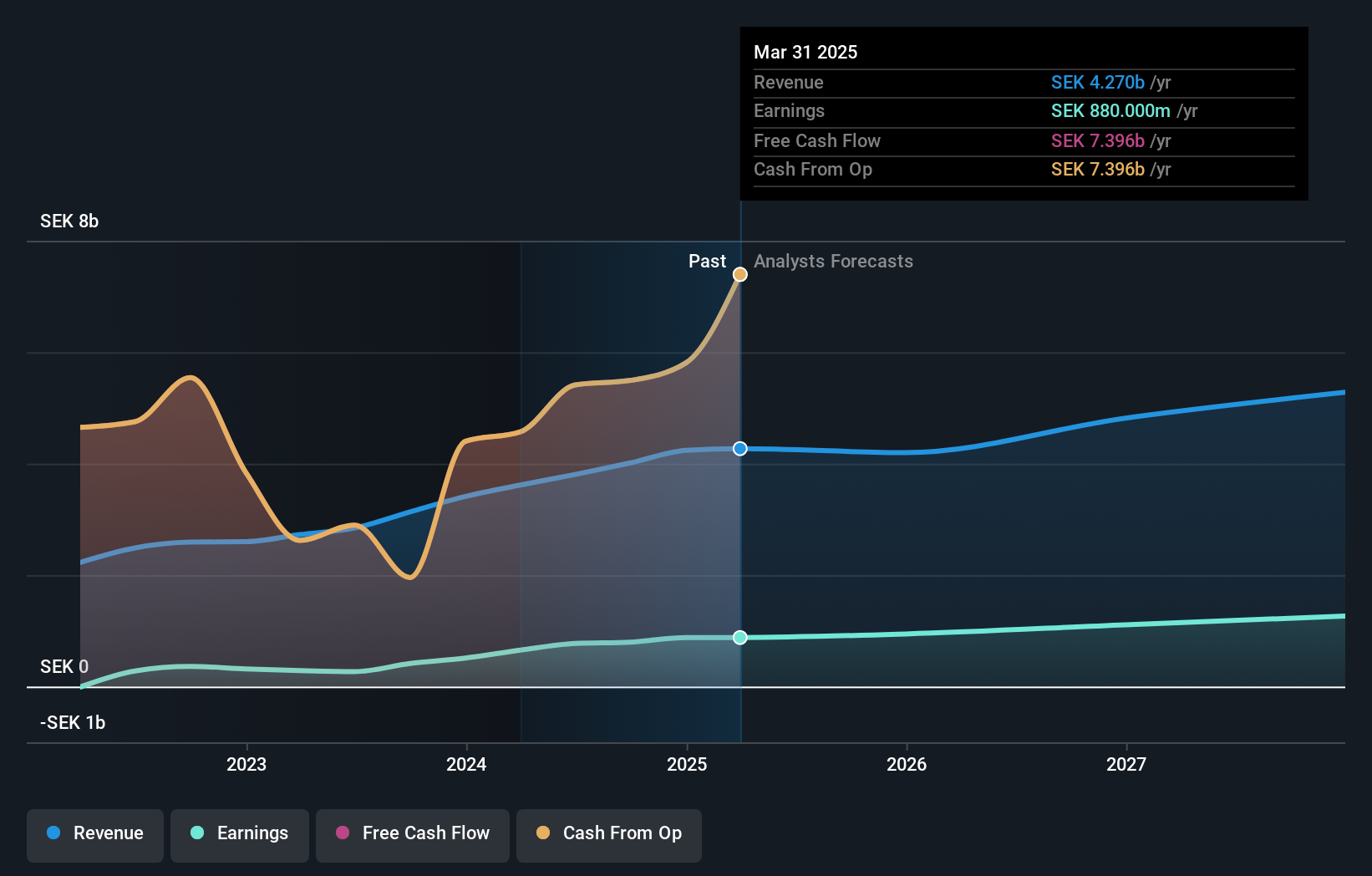

Operations: Hoist Finance generates revenue primarily from unsecured loans, amounting to SEK 3.04 billion, and secured loans, contributing SEK 935 million. Group items add an additional SEK 131 million to the total revenue.

Hoist Finance, a financial player with a notable presence in the consumer finance sector, has shown impressive earnings growth of 107% over the past year, outpacing its industry peers. Despite this growth, it carries a high net debt to equity ratio of 112%, although this is an improvement from 181% five years ago. The company's price-to-earnings ratio stands at 10x, which is significantly lower than the Swedish market average of 23x, indicating potential value for investors. Recently completed fixed-income offerings totaling SEK 1.95 billion reflect robust demand and strategic capital raising efforts amidst significant insider selling activity.

- Take a closer look at Hoist Finance's potential here in our health report.

Examine Hoist Finance's past performance report to understand how it has performed in the past.

Key Takeaways

- Get an in-depth perspective on all 4621 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hoist Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HOFI

Hoist Finance

A credit market company, engages in the loan acquisition and management operations in Europe.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives