- Sweden

- /

- Commercial Services

- /

- OM:GREEN

Need To Know: One Analyst Is Much More Bullish On Green Landscaping Group AB (publ) (STO:GREEN) Revenues

Celebrations may be in order for Green Landscaping Group AB (publ) (STO:GREEN) shareholders, with the covering analyst delivering a significant upgrade to their statutory estimates for the company. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

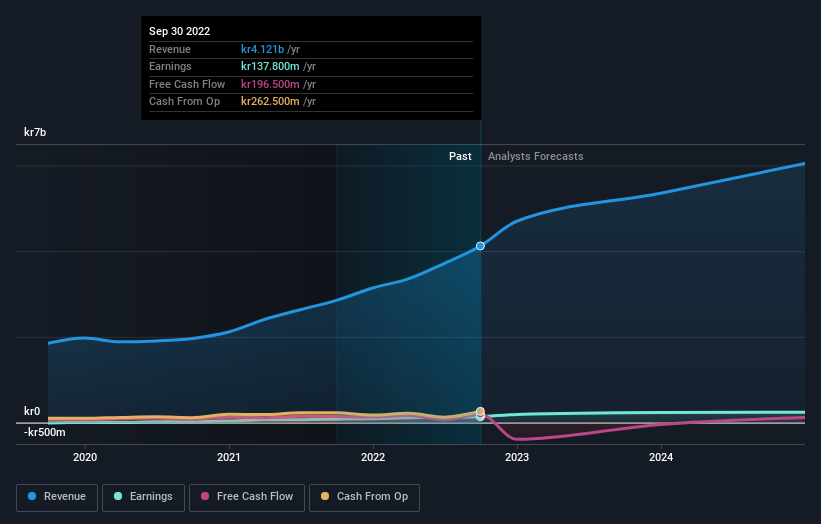

After the upgrade, the solo analyst covering Green Landscaping Group is now predicting revenues of kr5.4b in 2023. If met, this would reflect a huge 30% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to jump 71% to kr4.29. Before this latest update, the analyst had been forecasting revenues of kr4.6b and earnings per share (EPS) of kr4.12 in 2023. The most recent forecasts are noticeably more optimistic, with a nice gain to revenue estimates and a lift to earnings per share as well.

Our analysis indicates that GREEN is potentially undervalued!

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Green Landscaping Group's past performance and to peers in the same industry. It's pretty clear that there is an expectation that Green Landscaping Group's revenue growth will slow down substantially, with revenues to the end of 2023 expected to display 23% growth on an annualised basis. This is compared to a historical growth rate of 30% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 6.1% annually. Even after the forecast slowdown in growth, it seems obvious that Green Landscaping Group is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that the analyst upgraded their earnings per share estimates for next year, expecting improving business conditions. They also upgraded their revenue estimates for next year, and sales are expected to grow faster than the wider market. Given that the analyst appears to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Green Landscaping Group.

The covering analyst is definitely bullish on Green Landscaping Group, but no company is perfect. Indeed, you should know that there are several potential concerns to be aware of, including dilutive stock issuance over the past year. You can learn more, and discover the 1 other risk we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GREEN

Green Landscaping Group

Engages in the green space management and landscaping business in Sweden, Norway, and rest of Europe.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)