Is Volvo (OM:VOLV B) Undervalued? Assessing the Stock’s True Worth After Recent Momentum Shift

Reviewed by Simply Wall St

Recent moves in AB Volvo (OM:VOLV B) stock have likely raised a few eyebrows among investors trying to make sense of what’s next for the trucking giant. There hasn't been a headline-grabbing event driving the action this time. When a stock’s momentum shifts, it’s natural to wonder if the market is sending a signal about future prospects or simply taking a breather. For those weighing what to do with their shares, now is a good time to step back and review where things stand before making any moves.

Looking at the bigger picture, Volvo’s shares gained 15% over the past year and have climbed steadily for three years, boasting a total return near 92%. Momentum has cooled in recent weeks with modest declines this month and last, even as the company reported annual revenue and net income expansion. Long-term holders have enjoyed strong returns, but recent softness hints at changing risk perceptions or possible shifts in sentiment.

With the year’s gains holding but short-term pressure mounting, the question now becomes whether Volvo’s current valuation offers a genuine entry point or if higher growth is already reflected in the price. What do you think—is this a buying opportunity?

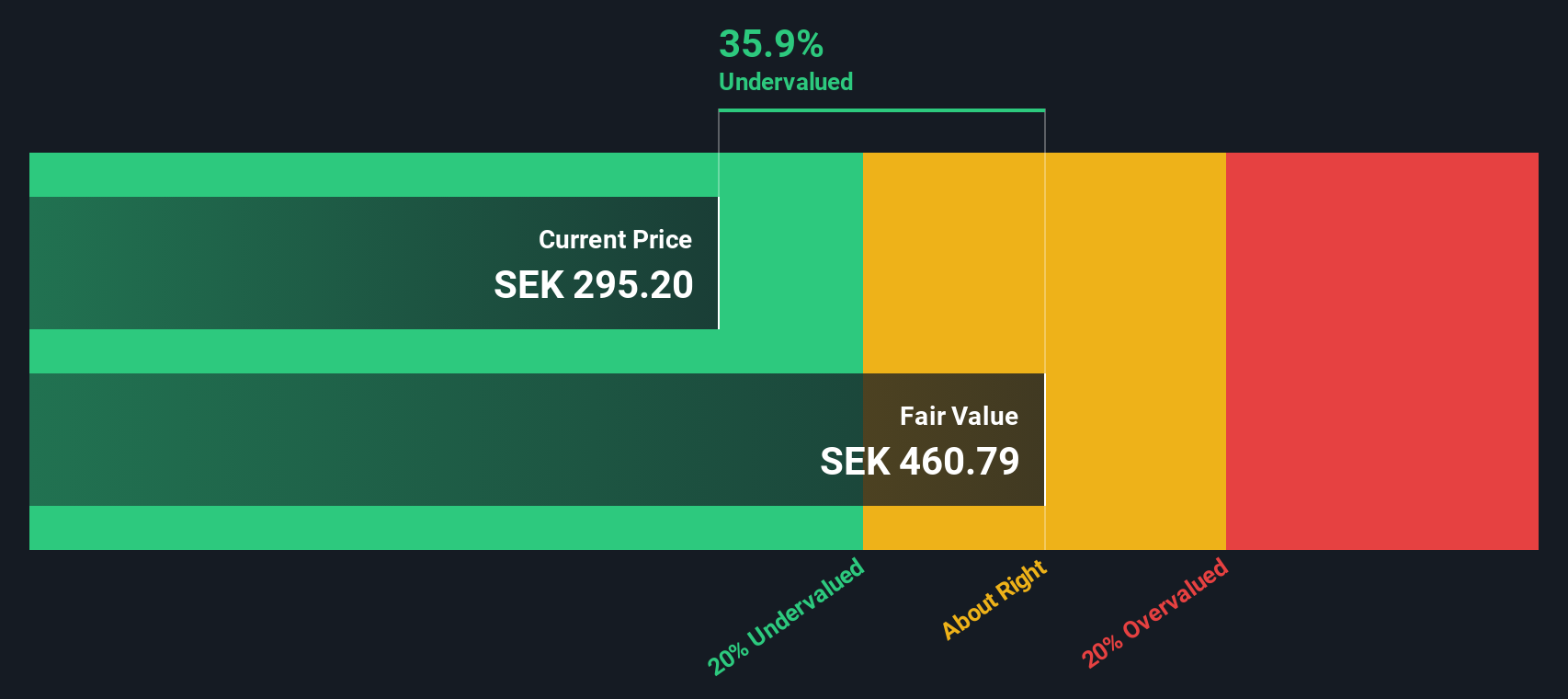

Most Popular Narrative: 37.5% Undervalued

The prevailing narrative points to AB Volvo being significantly undervalued compared to its fair value, driven by expectations of rapid transformation and leadership in electric and autonomous vehicles.

Catalysts

Most Immediate Catalyst (1 to 2 Years):

- Electric Truck & Bus Expansion: Volvo is aggressively expanding its electric truck and bus lineup, capitalizing on increasing demand for zero-emission transport solutions in Europe and North America.

- Strong Order Book & Pricing Power: Despite macroeconomic concerns, Volvo’s order intake remains robust, with pricing discipline helping offset cost inflation.

The next five years could change everything for Volvo. This narrative hints at ambitious targets, powered by new technologies and bold financial assumptions. Think high-margin growth, disruptive innovation, and a valuation model that would surprise even seasoned investors. Want to uncover which untapped revenue streams and futuristic trends are fueling this outsized target? Dive into the full narrative for all the details behind that eye-catching fair value.

Result: Fair Value of $438.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, supply chain pressures and increasing competition from new electric truck manufacturers could quickly challenge Volvo’s edge if the landscape shifts unexpectedly.

Find out about the key risks to this AB Volvo narrative.Another View: Discounted Cash Flow Perspective

Taking a step back, our DCF model paints a picture in line with the narrative. It also suggests Volvo could be trading below its estimated fair value. But does this reaffirmation ignore risks that multiples might catch?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AB Volvo Narrative

If you think this outlook misses something crucial or prefer to follow your own path, you can craft your own view of Volvo’s story in just a few minutes. Do it your way.

A great starting point for your AB Volvo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Curious about what else is out there? Don’t let great opportunities pass you by. Use our powerful tools to uncover stocks with huge potential right now.

- Turbocharge your search for up-and-coming companies by hunting for penny stocks with strong financials in our penny stocks with strong financials resource.

- Unleash the future of medicine by spotting trailblazers in health-tech innovation via our selection of healthcare AI stocks opportunities.

- Find wealth-building value plays by targeting stocks trading below intrinsic worth through our curated list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OM:VOLV B

AB Volvo

Manufactures and sells trucks, buses, construction equipment, and marine and industrial engines in Europe, the United States, Asia, Africa, and Oceania.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)