- Sweden

- /

- Entertainment

- /

- OM:G5EN

Top European Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As European markets experience a positive uptick, with the STOXX Europe 600 Index rising by 2.77% amid easing trade tensions, investors are increasingly looking toward dividend stocks as a stable investment option in uncertain economic times. A good dividend stock typically offers consistent payouts and demonstrates resilience amidst market fluctuations, making it an appealing choice for those seeking reliable income streams in today's dynamic environment.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.97% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.03% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.35% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.00% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.98% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.13% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.42% | ★★★★★★ |

Click here to see the full list of 239 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

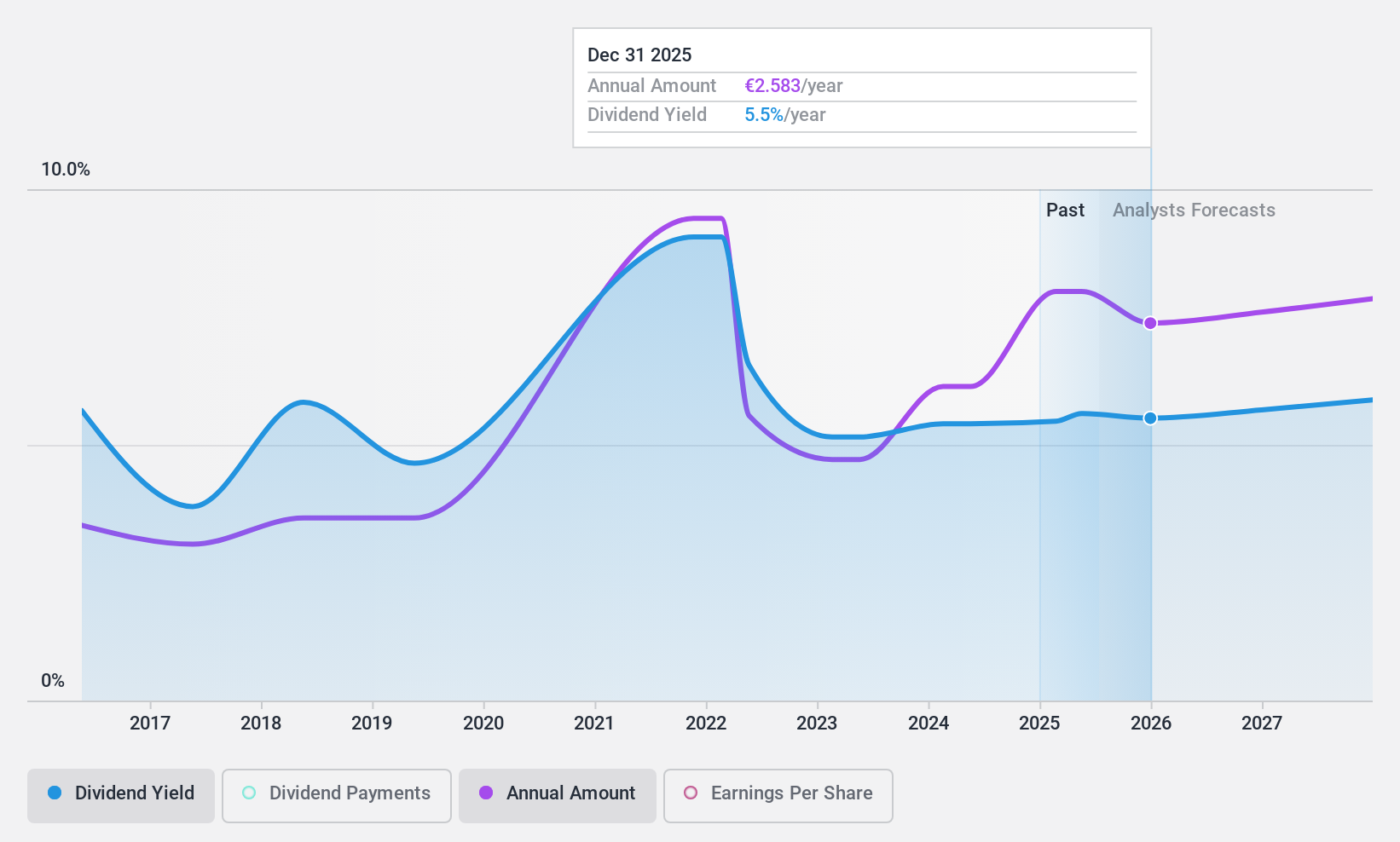

Banca Generali (BIT:BGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banca Generali S.p.A. provides financial products and services to high net worth, affluent, and private customers in Italy through financial advisors, with a market cap of €5.85 billion.

Operations: Banca Generali's revenue segments include €83.85 million from the Corporate Center, €104.04 million from Senior Partner (SP CGU), and €808.95 million from Private Banking (PB CGU).

Dividend Yield: 5.5%

Banca Generali's dividends are currently covered by earnings with a payout ratio of 74% and are forecast to remain sustainable over the next three years. Despite this, its dividend payments have been volatile over the past decade. The stock trades at a good value relative to peers, with a price-to-earnings ratio of 13.6x below the Italian market average. Recent news includes an acquisition offer from Mediobanca for €3.4 billion, pending regulatory approvals and shareholder consent.

- Click to explore a detailed breakdown of our findings in Banca Generali's dividend report.

- Our valuation report unveils the possibility Banca Generali's shares may be trading at a discount.

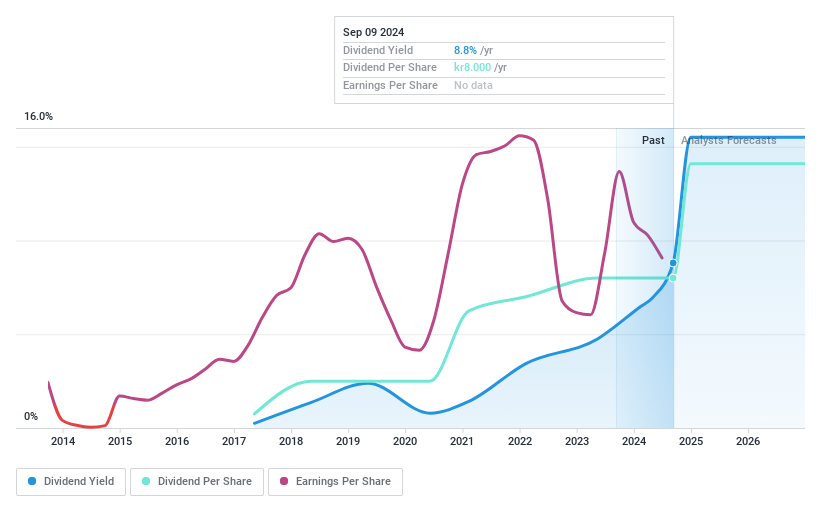

G5 Entertainment (OM:G5EN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: G5 Entertainment AB (publ) is a Swedish company that develops and publishes free-to-play games for smartphones, tablets, and personal computers, with a market cap of approximately SEK979.55 million.

Operations: G5 Entertainment AB (publ) generates revenue primarily from the development and sales of casual games, amounting to SEK1.13 billion.

Dividend Yield: 6.4%

G5 Entertainment's dividend of SEK 8 per share, representing 53% of net profit, is well-covered by earnings and cash flows with payout ratios of 52.5% and 35%, respectively. Despite trading at a significant discount to its estimated fair value, the company has only an eight-year dividend history. The dividend yield stands at a competitive 6.37%, placing it among the top quartile in Sweden, though future growth relies on reinvestment strategies in product development and marketing.

- Unlock comprehensive insights into our analysis of G5 Entertainment stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of G5 Entertainment shares in the market.

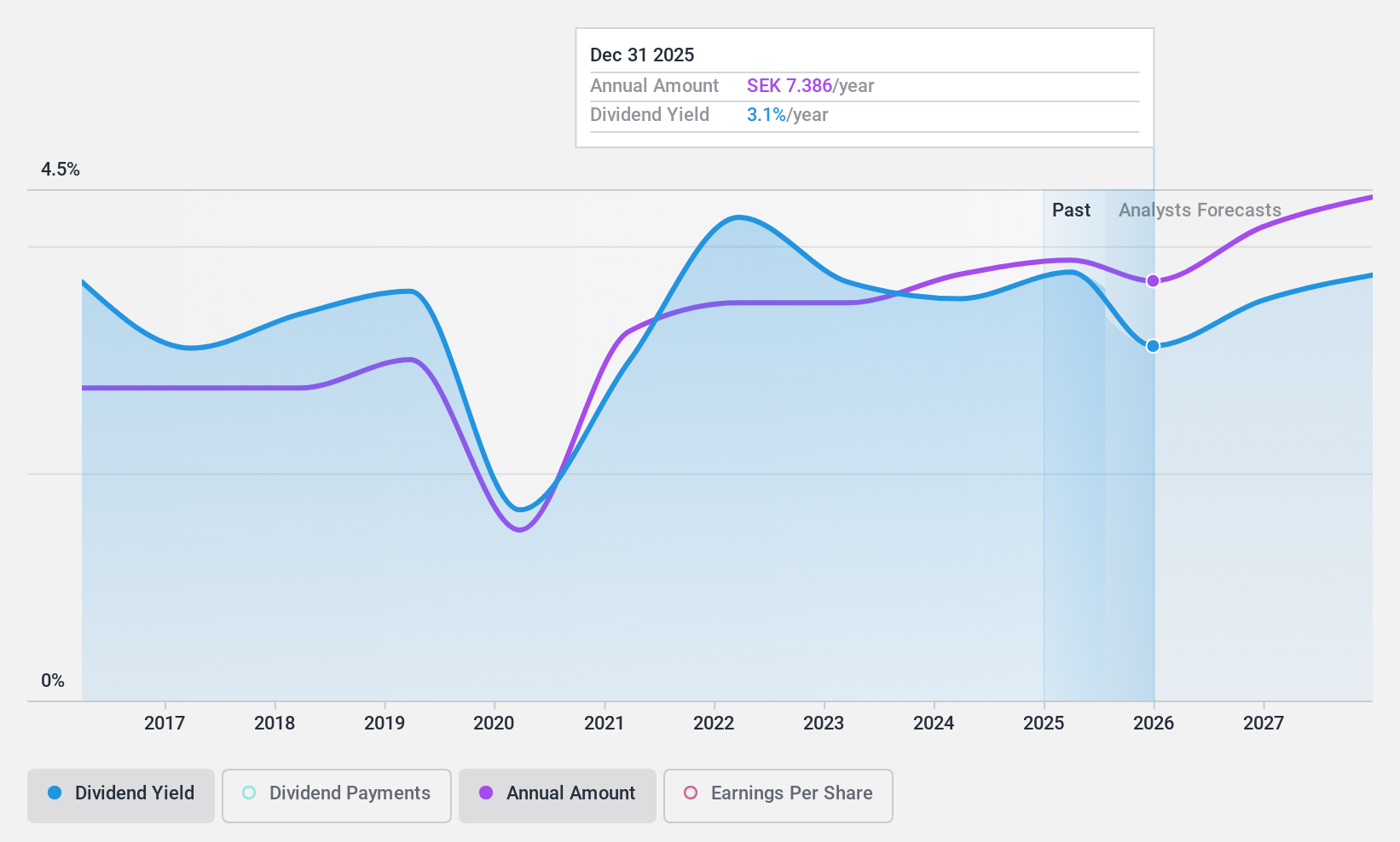

AB SKF (OM:SKF B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: AB SKF (publ) is a global company that designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring products, and services with a market cap of SEK86.43 billion.

Operations: AB SKF generates revenue from two main segments: Automotive, contributing SEK28.97 billion, and Industrial, which accounts for SEK69.02 billion.

Dividend Yield: 4.1%

AB SKF's dividend of SEK 7.75 per share is supported by a payout ratio of 55.3% from earnings and 69.7% from cash flows, indicating solid coverage despite its historically volatile dividend payments. Trading at a notable discount to its estimated fair value, it offers a competitive yield in the top quartile for Sweden. Recent earnings showed slight declines in sales and net income year-over-year, with guidance suggesting potential challenges ahead due to currency impacts on profits.

- Dive into the specifics of AB SKF here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that AB SKF is priced lower than what may be justified by its financials.

Make It Happen

- Get an in-depth perspective on all 239 Top European Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:G5EN

G5 Entertainment

Develops and publishes free-to-play games for smartphones, tablets, and personal computers in Sweden.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives