- Sweden

- /

- Trade Distributors

- /

- OM:OEM B

Here's Why OEM International (STO:OEM B) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like OEM International (STO:OEM B). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for OEM International

How Fast Is OEM International Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that OEM International has managed to grow EPS by 27% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

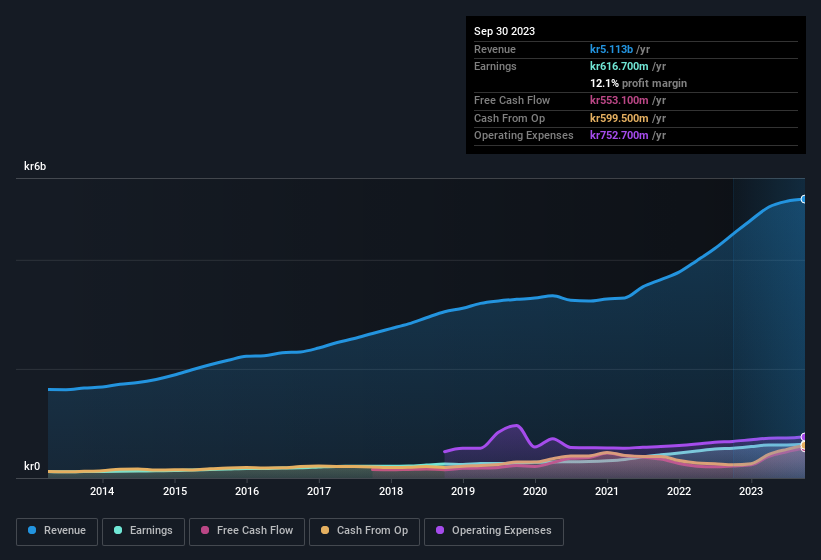

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for OEM International remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 14% to kr5.1b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check OEM International's balance sheet strength, before getting too excited.

Are OEM International Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

In the last twelve months OEM International insiders spent kr243k on stock; good news for shareholders. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling.

Along with the insider buying, another encouraging sign for OEM International is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth kr2.5b. That equates to 17% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Does OEM International Deserve A Spot On Your Watchlist?

You can't deny that OEM International has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of OEM International. You might benefit from giving it a glance today.

The good news is that OEM International is not the only growth stock with insider buying. Here's a list of growth-focused companies in SE with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade OEM International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OEM B

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives