Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Lifco AB (publ) (STO:LIFCO B) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Lifco

How Much Debt Does Lifco Carry?

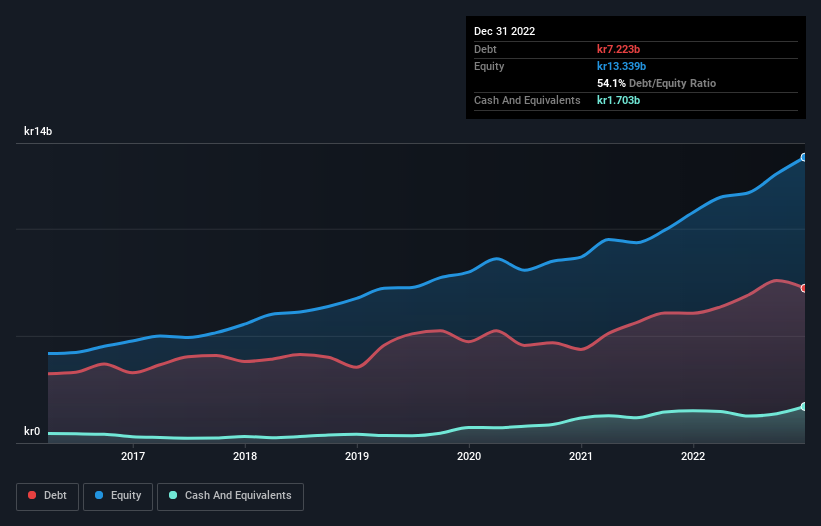

As you can see below, at the end of December 2022, Lifco had kr7.22b of debt, up from kr6.06b a year ago. Click the image for more detail. However, it does have kr1.70b in cash offsetting this, leading to net debt of about kr5.52b.

How Healthy Is Lifco's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Lifco had liabilities of kr10.7b due within 12 months and liabilities of kr5.78b due beyond that. Offsetting these obligations, it had cash of kr1.70b as well as receivables valued at kr3.37b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr11.4b.

Since publicly traded Lifco shares are worth a total of kr95.4b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Lifco has a low net debt to EBITDA ratio of only 1.1. And its EBIT covers its interest expense a whopping 35.9 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Also positive, Lifco grew its EBIT by 26% in the last year, and that should make it easier to pay down debt, going forward. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Lifco can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Lifco recorded free cash flow worth a fulsome 84% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

The good news is that Lifco's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Overall, we don't think Lifco is taking any bad risks, as its debt load seems modest. So we're not worried about the use of a little leverage on the balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Lifco you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:LIFCO B

Lifco

Engages in the dental, demolition and tools, and systems solutions businesses in Sweden, Norway, Germany, rest of Europe, the United Kingdom, Asia, Australia, Italy, North America, and internationally.

Adequate balance sheet with moderate growth potential.