- Sweden

- /

- Real Estate

- /

- OM:WALL B

3 Growth Stocks With Insider Ownership Reaching Up To 35%

Reviewed by Simply Wall St

In recent weeks, global markets have experienced heightened volatility, with U.S. stocks facing broad-based declines amid cautious commentary from the Federal Reserve and looming political uncertainties. Despite these challenges, the resilience of growth companies with significant insider ownership can offer a compelling investment narrative, as insiders often have aligned interests with shareholders and confidence in the company's long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

SK oceanplantLtd (KOSE:A100090)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SK oceanplant Co., Ltd. operates in South Korea, focusing on the manufacturing of steel and stainless steel pipes, hull blocks, and shipbuilding equipment, with a market cap of ₩794.99 billion.

Operations: The company generates revenue primarily from its Shipbuilding/Marine segment, amounting to ₩847.12 million, and the Steel Pipe Division, contributing ₩20.86 million.

Insider Ownership: 20.7%

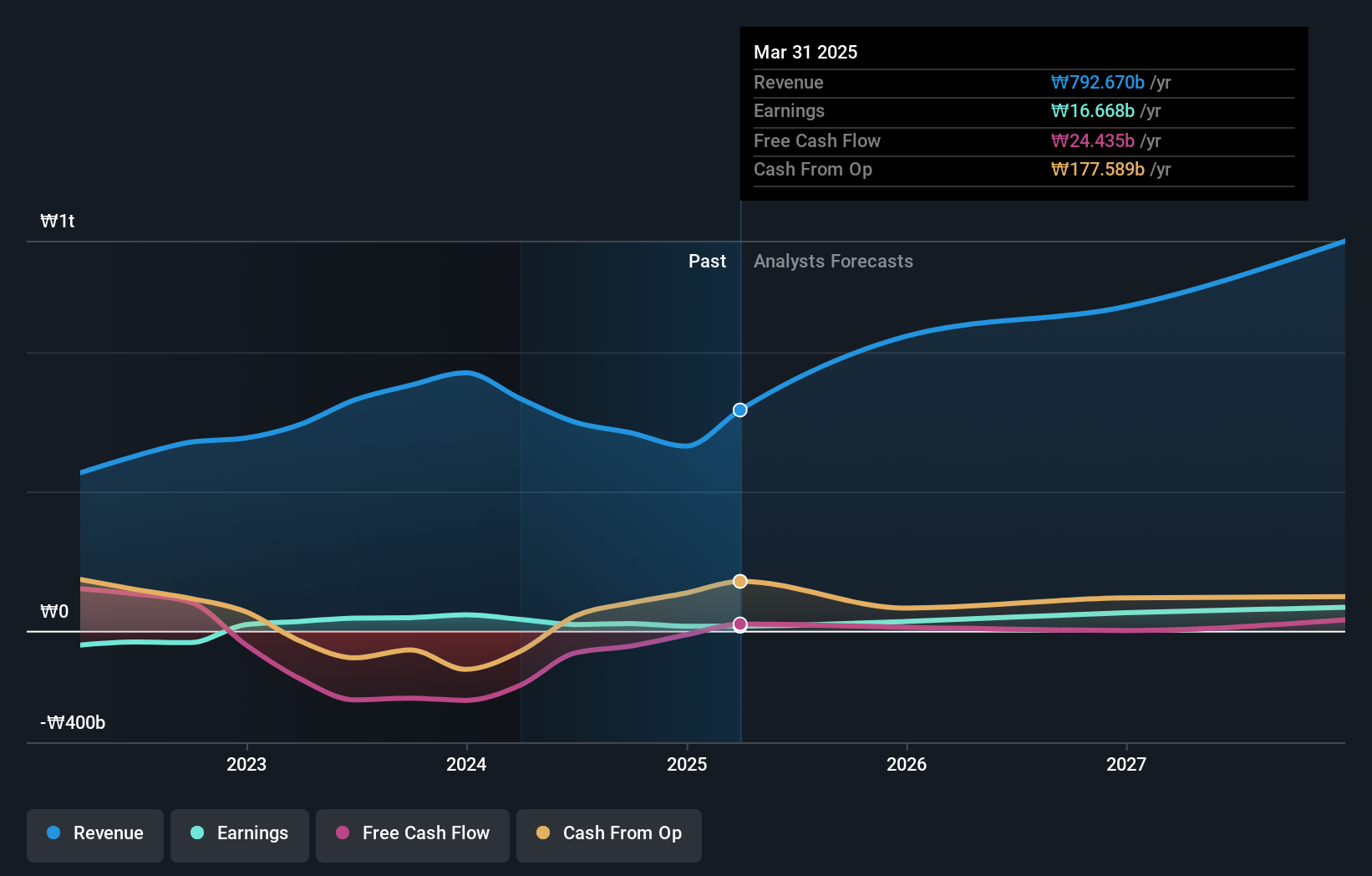

SK oceanplant Ltd is poised for significant growth, with revenue and earnings forecast to grow faster than the Korean market at 21.2% and 36.1% per year, respectively. Despite a decrease in profit margins this year, recent earnings show strong sales growth from KRW 1.36 billion to KRW 3.53 billion in Q3 year-over-year, though net income declined over nine months compared to last year’s figures due to lower profit margins.

- Take a closer look at SK oceanplantLtd's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that SK oceanplantLtd is trading beyond its estimated value.

Swedencare (OM:SECARE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swedencare AB (publ) develops, manufactures, markets, and sells animal healthcare products for cats, dogs, and horses across Sweden, the United Kingdom, Europe, North America, Asia, and internationally with a market cap of SEK7.78 billion.

Operations: The company's revenue segments include SEK397.40 million from Europe, SEK659 million from Production, and SEK1.66 billion from North America.

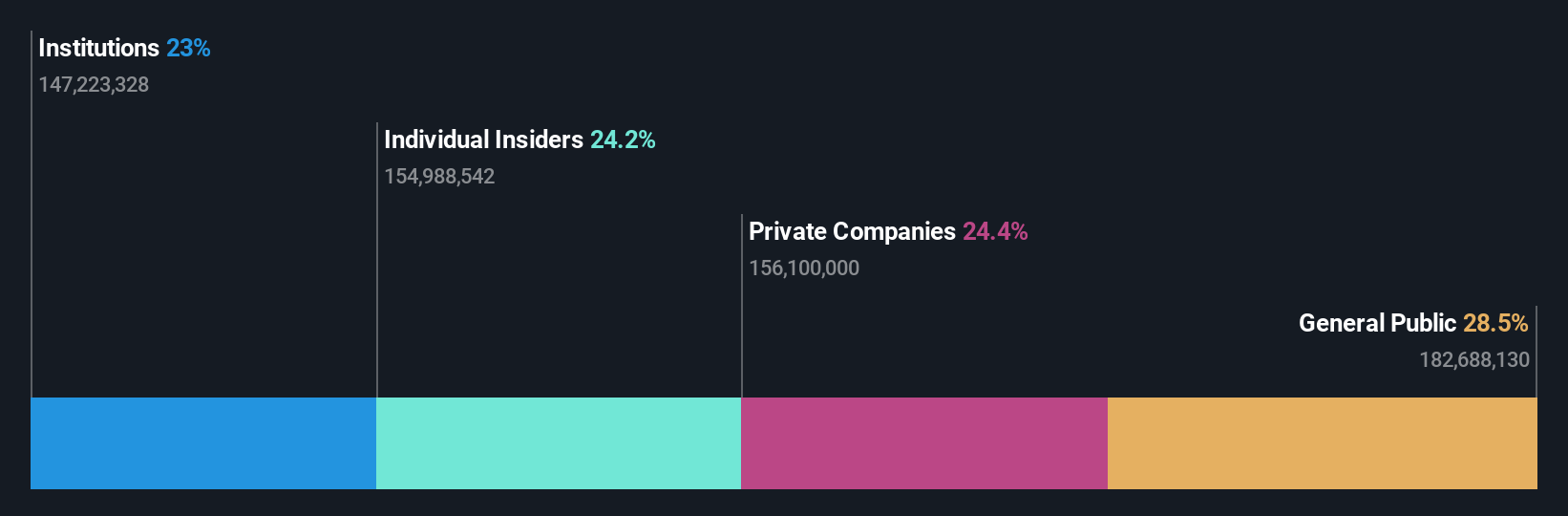

Insider Ownership: 12.2%

Swedencare is experiencing robust growth prospects, with earnings expected to rise significantly at 64.2% annually, outpacing the Swedish market's 14.7%. Revenue is also set to grow faster than the market at 12% per year. Despite a decline in profit margins from 4% to 2.5%, insider confidence remains high, with substantial share purchases recently and no significant sales. The stock trades well below its estimated fair value, suggesting potential upside for investors seeking growth opportunities.

- Get an in-depth perspective on Swedencare's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Swedencare's current price could be inflated.

Wallenstam (OM:WALL B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wallenstam AB (publ) is a Swedish property company with a market capitalization of SEK30.89 billion.

Operations: The company generates revenue from its property operations in Sweden, with SEK947 million coming from Stockholm and SEK1.96 billion from Gothenburg.

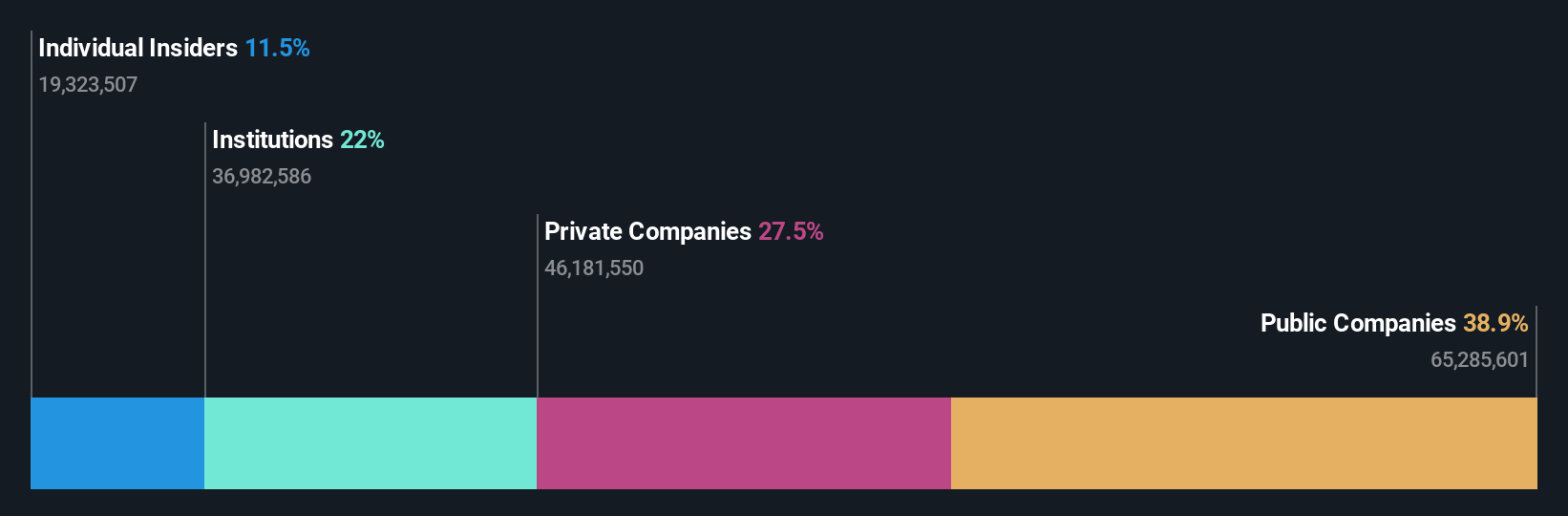

Insider Ownership: 35.2%

Wallenstam's growth potential is underscored by insider confidence, with substantial share purchases in the last three months. The company anticipates revenue growth of 4.5% annually, outpacing the Swedish market average. Despite a recent net loss of SEK 269 million in Q3 2024, Wallenstam is expected to become profitable within three years. Recent strategic lettings and construction projects in Gothenburg and Arstaberg highlight its focus on expanding office and residential spaces.

- Navigate through the intricacies of Wallenstam with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Wallenstam's shares may be trading at a premium.

Next Steps

- Explore the 1511 names from our Fast Growing Companies With High Insider Ownership screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wallenstam might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:WALL B

Limited growth unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives