- Sweden

- /

- Electrical

- /

- OM:FAG

3 Stocks Estimated To Be Trading Below Fair Value By At Least 34.5%

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. indices showing resilience despite profit-taking and economic uncertainties like the Chicago PMI contraction and revised GDP forecasts, investors are increasingly on the lookout for opportunities that may be trading below their intrinsic value. In such an environment, identifying stocks that are undervalued can offer potential upside as market conditions stabilize or improve; these stocks often present a compelling case for those seeking to capitalize on discrepancies between current prices and perceived fair values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1888.00 | ¥3757.10 | 49.7% |

| Decisive Dividend (TSXV:DE) | CA$5.98 | CA$11.88 | 49.7% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.725 | €5.45 | 50% |

| EnomotoLtd (TSE:6928) | ¥1450.00 | ¥2887.97 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.45 | SEK122.25 | 49.7% |

| W5 Solutions (OM:W5) | SEK46.85 | SEK93.57 | 49.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$93.54 | US$186.41 | 49.8% |

| Exosens (ENXTPA:EXENS) | €22.42 | €44.72 | 49.9% |

| Cicor Technologies (SWX:CICN) | CHF59.80 | CHF118.90 | 49.7% |

| Vogo (ENXTPA:ALVGO) | €2.93 | €5.85 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

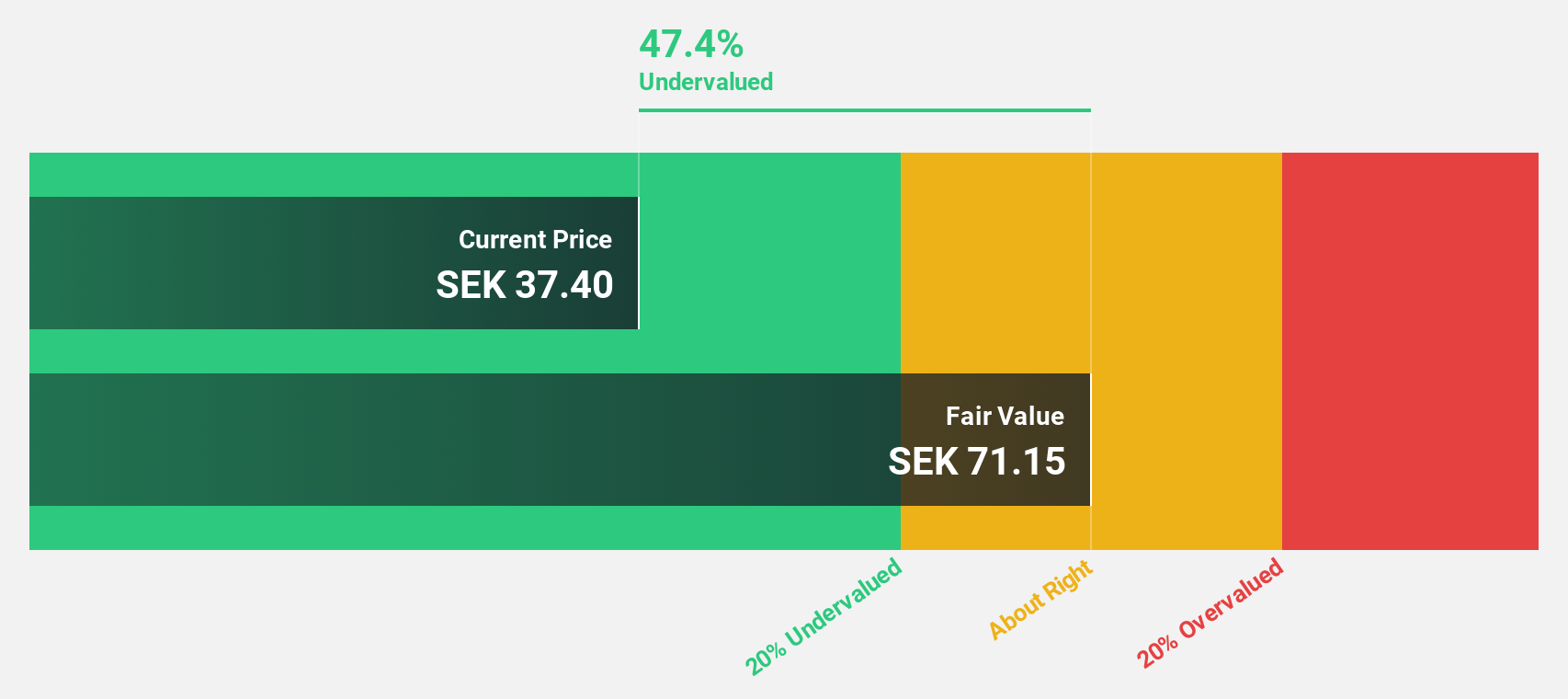

Fagerhult Group (OM:FAG)

Overview: Fagerhult Group AB, along with its subsidiaries, manufactures and sells professional lighting solutions globally, with a market cap of SEK9.33 billion.

Operations: The company's revenue segments include Premium at SEK2.87 billion, Collection at SEK3.91 billion, Professional at SEK1.03 billion, and Infrastructure at SEK843.90 million.

Estimated Discount To Fair Value: 44.2%

Fagerhult Group is trading at SEK 52.9, significantly below its estimated fair value of SEK 94.87, indicating it may be undervalued based on cash flows. Despite recent earnings declines and a challenging market, the company forecasts robust annual profit growth of 24.4%, outpacing the Swedish market's projected growth of 14.3%. Recent strategic initiatives include seeking acquisitions to enhance sustainability and smart lighting capabilities, potentially bolstering future financial performance.

- Our comprehensive growth report raises the possibility that Fagerhult Group is poised for substantial financial growth.

- Click here to discover the nuances of Fagerhult Group with our detailed financial health report.

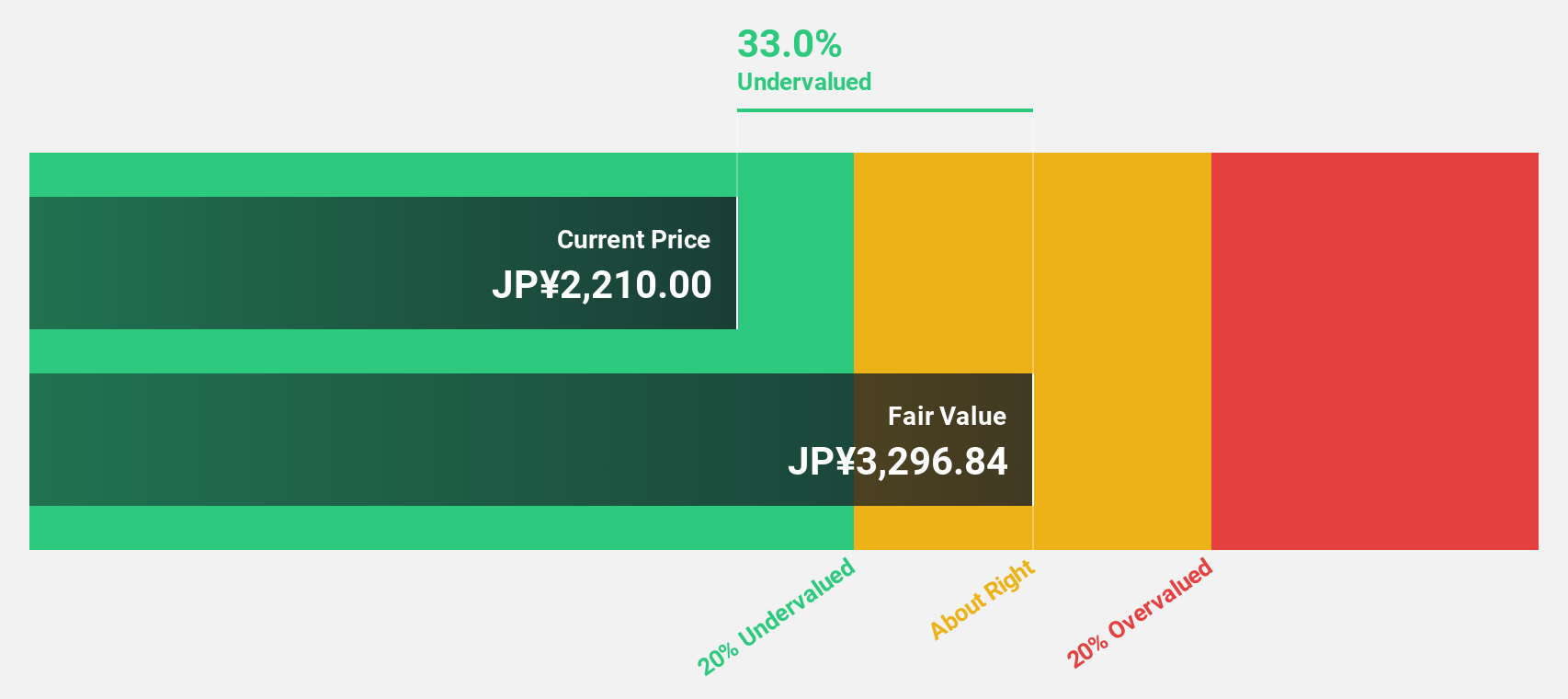

COVER (TSE:5253)

Overview: COVER Corporation operates in the virtual platform, VTuber production, and media mix sectors with a market capitalization of ¥160.22 billion.

Operations: COVER Corporation generates revenue from its virtual platform, VTuber production, and media mix businesses.

Estimated Discount To Fair Value: 35.7%

COVER is trading at ¥2,574, significantly below its estimated fair value of ¥4,002.64. Despite recent share price volatility, its revenue and earnings are forecast to grow at 20.4% and 30.3% annually, respectively—outpacing the JP market averages. The company has demonstrated strong profit growth of 35.2% over the past year and is expected to maintain high return on equity in the coming years, highlighting its potential undervaluation based on cash flows.

- Our earnings growth report unveils the potential for significant increases in COVER's future results.

- Dive into the specifics of COVER here with our thorough financial health report.

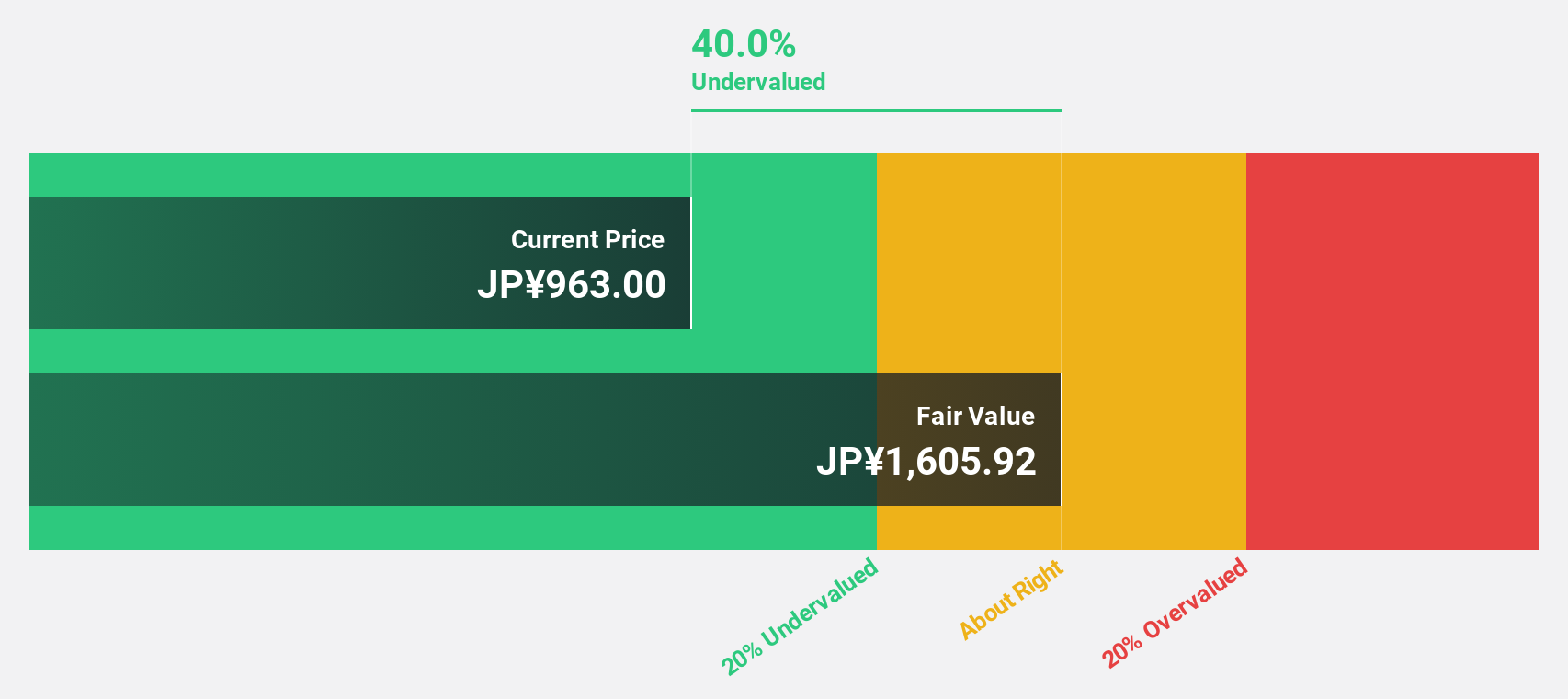

Insource (TSE:6200)

Overview: Insource Co., Ltd. offers lecturer dispatch type training, open lectures, and related services in Japan with a market cap of ¥91.29 billion.

Operations: The company generates revenue of ¥12.47 billion from its Education Service Business segment in Japan.

Estimated Discount To Fair Value: 34.5%

Insource is trading at ¥1,088, well below its estimated fair value of ¥1,660.45. The company's earnings are forecast to grow 18.2% annually, surpassing the JP market average of 7.9%, while revenue growth is expected at 15.1%, outpacing the market's 4.2%. Recent profit growth was strong at 25.4%, and analysts agree on a potential price increase of over 50%. Insource's return on equity is projected to remain high in three years, supporting its undervaluation based on cash flows.

- The analysis detailed in our Insource growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Insource stock in this financial health report.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 878 more companies for you to explore.Click here to unveil our expertly curated list of 881 Undervalued Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FAG

Fagerhult Group

Designs, manufactures, and markets professional lighting solutions worldwide.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives