- Sweden

- /

- Auto Components

- /

- OM:DOM

Assessing Dometic Group (OM:DOM) Valuation Following Recent Share Price Rebound

Reviewed by Kshitija Bhandaru

Dometic Group (OM:DOM) has been catching investors’ attention lately, especially given its performance over the past three months, where shares have climbed more than 22%. The company’s recent results are getting a closer look as many are weighing the current valuation.

See our latest analysis for Dometic Group.

While Dometic Group’s share price has rallied over 22% in the past three months, momentum has cooled this year, and its 1-year total shareholder return is modestly in the red. Investors appear split between optimism about a rebound and ongoing caution as markets weigh up growth potential and risk factors.

If recent moves in automotive stocks have you thinking broader, now is a timely moment to uncover See the full list for free.

With shares rebounding in recent months but the longer-term picture showing mixed returns, investors now face a key question: is Dometic Group trading at a bargain, or has the market fully accounted for all future growth prospects?

Price-to-Sales of 0.7x: Is it justified?

Dometic Group’s latest close of SEK51.45 puts its stock at a price-to-sales (P/S) ratio of 0.7x, notably above both peer and industry averages. Comparing this ratio to peers is key for investors considering whether the recent rebound truly reflects the company’s fundamentals or if the market is getting ahead of itself.

The price-to-sales ratio measures how much investors are willing to pay per krona of revenue. For industrial and auto-related businesses like Dometic Group, P/S is often used when profits are inconsistent or negative, as it focuses on top line sales rather than earnings reliability. A higher P/S can either signal optimism about future growth or suggest the shares are overpriced versus underlying results.

At 0.7x, the company looks expensive compared to both the local peer average of 0.6x and the broader European auto components figure of 0.3x. The estimated fair P/S ratio is just 0.3x, a level the market could move toward if near-term results disappoint.

Explore the SWS fair ratio for Dometic Group

Result: Price-to-Sales of 0.7x (OVERVALUED)

However, persistent net losses and sluggish annual revenue growth remain concerns. These factors could dampen the stock’s rebound if unresolved in upcoming results.

Find out about the key risks to this Dometic Group narrative.

Another View: What Does the SWS DCF Model Say?

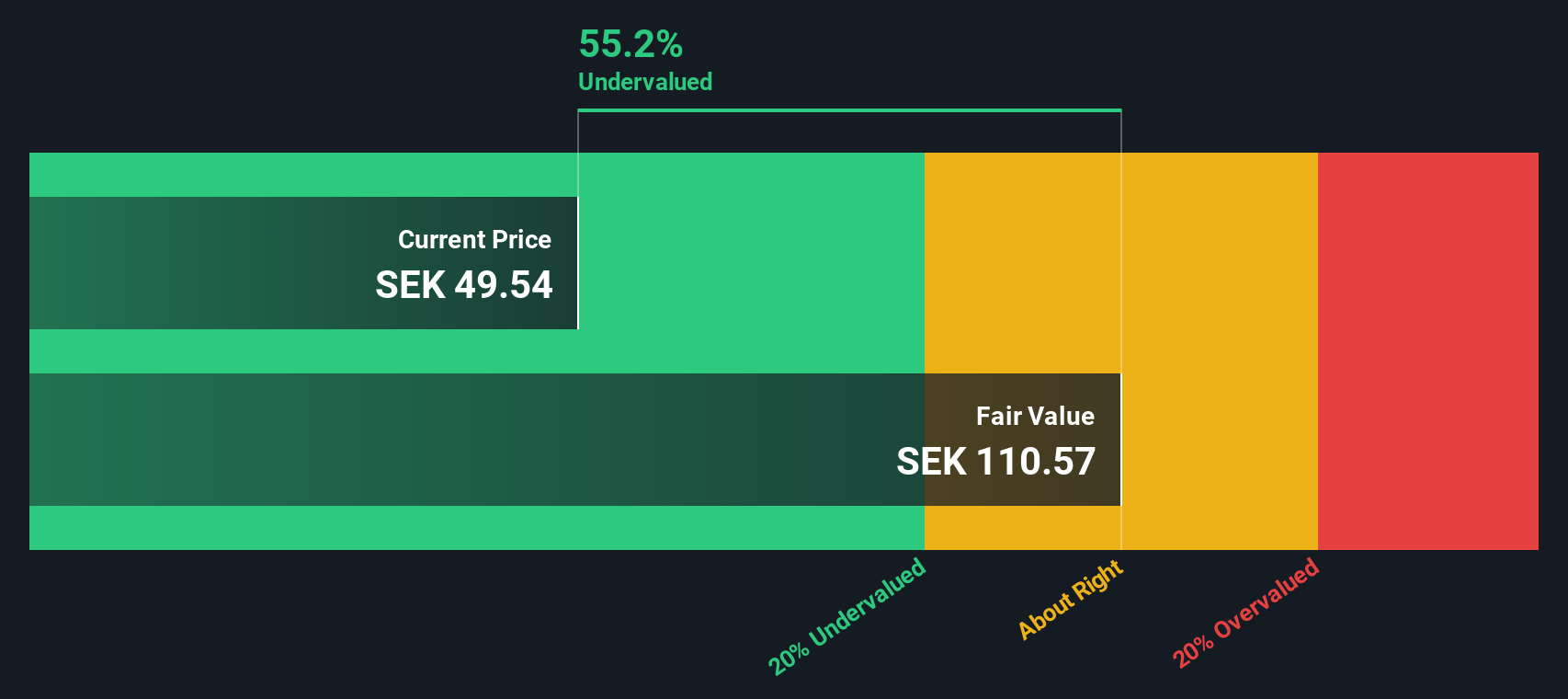

While the price-to-sales ratio points to overvaluation, our DCF model gives a starkly different picture. By estimating the present value of Dometic Group’s future cash flows, it suggests the stock could actually be undervalued by a wide margin. Could the market’s caution be an opportunity in disguise?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dometic Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dometic Group Narrative

If you see things differently or want to dive deeper into the numbers on your own terms, you can create a personalized assessment in just a few minutes. Do it your way.

A great starting point for your Dometic Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stick to just one opportunity? Get ahead of the curve by spotting other stocks with major upside potential using our tailored lists below.

- Boost your search for market gems by targeting these 3561 penny stocks with strong financials that combine robust financials with high-growth potential many investors overlook.

- Start earning while you hold by checking out these 19 dividend stocks with yields > 3% offering yields greater than 3%. This can be a smart way to add reliable income to your portfolio.

- Surf the wave of financial innovation and tap into these 78 cryptocurrency and blockchain stocks for exposure to businesses at the forefront of blockchain and digital currency breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DOM

Dometic Group

Provides mobile living solutions for food and beverage, climate, power and control, and other applications in the United States, Germany, Australia, Italy, France, the United Kingdom, Japan, Canada, the Netherlands, Sweden, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026