- Turkey

- /

- Wireless Telecom

- /

- IBSE:TCELL

Global Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and cautious economic outlooks, investors are closely watching developments such as the U.S.-UK trade deal and ongoing tariff discussions between major economies. Amid these uncertainties, identifying stocks that might be trading below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies. In the current environment, a good stock is often characterized by strong fundamentals that remain resilient despite broader market fluctuations and geopolitical tensions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Benefit Systems (WSE:BFT) | PLN3480.00 | PLN6957.37 | 50% |

| adidas (XTRA:ADS) | €223.60 | €443.59 | 49.6% |

| Kolmar Korea (KOSE:A161890) | ₩84500.00 | ₩167760.09 | 49.6% |

| Cosmax (KOSE:A192820) | ₩214000.00 | ₩424695.54 | 49.6% |

| Arcure (ENXTPA:ALCUR) | €4.64 | €9.28 | 50% |

| Tesmec (BIT:TES) | €0.0567 | €0.11 | 49.5% |

| Montana Aerospace (SWX:AERO) | CHF20.15 | CHF39.80 | 49.4% |

| MilDef Group (OM:MILDEF) | SEK222.00 | SEK443.08 | 49.9% |

| illimity Bank (BIT:ILTY) | €3.652 | €7.23 | 49.5% |

| Bactiguard Holding (OM:BACTI B) | SEK31.10 | SEK61.56 | 49.5% |

Let's explore several standout options from the results in the screener.

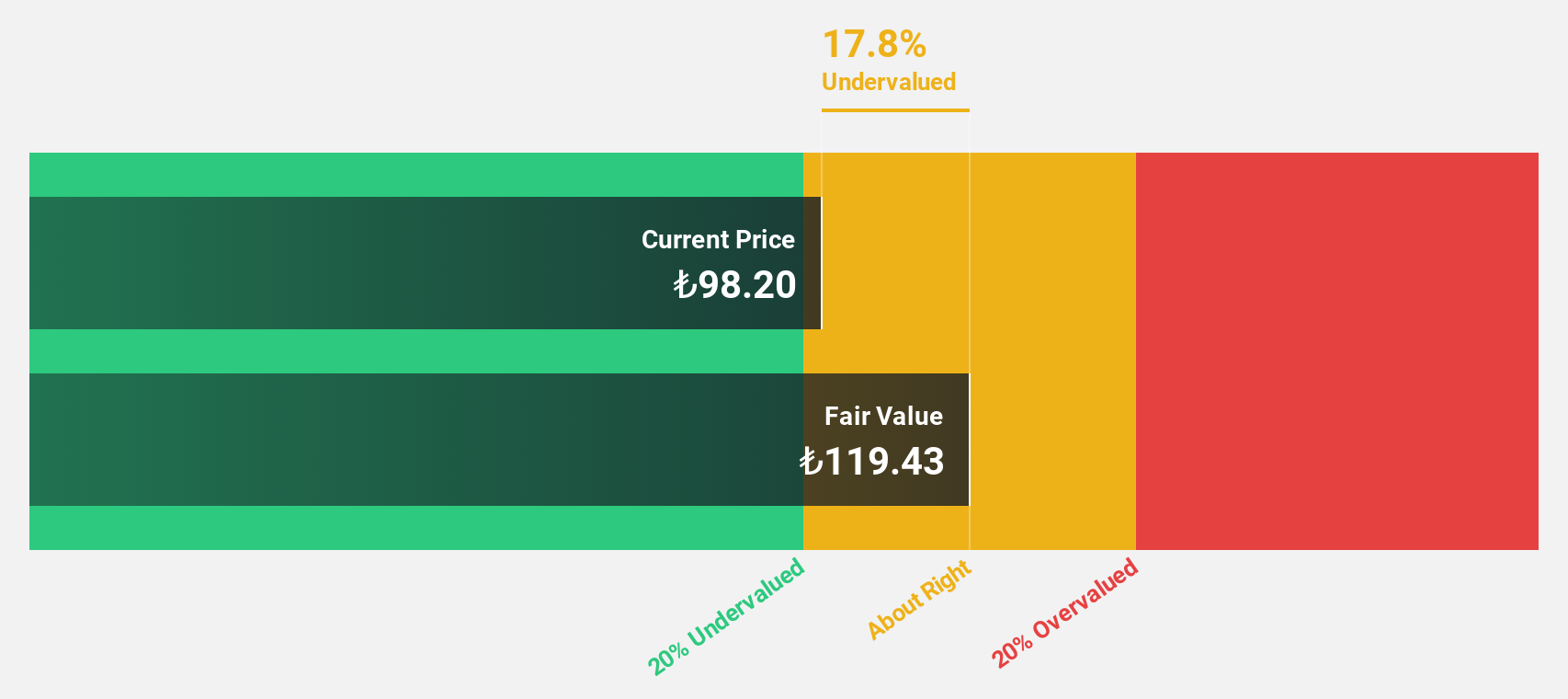

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Overview: Turkcell Iletisim Hizmetleri A.S. offers digital services in Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands with a market cap of TRY208.59 billion.

Operations: The company's revenue is primarily derived from its Turkcell Turkey segment, which contributes TRY148.31 billion, followed by its Techfin segment at TRY9.29 billion.

Estimated Discount To Fair Value: 49.2%

Turkcell Iletisim Hizmetleri is trading significantly below its estimated fair value, with a stock price of TRY 95.75 against a fair value estimate of TRY 188.65, suggesting potential undervaluation based on discounted cash flow analysis. Despite a decrease in net income from TRY 3,638.4 million to TRY 3,082.11 million year-over-year for Q1 2025, revenue growth remains robust and outpaces market expectations at 24.5% annually. However, lower profit margins and large one-off items impact financial results stability.

- Insights from our recent growth report point to a promising forecast for Turkcell Iletisim Hizmetleri's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Turkcell Iletisim Hizmetleri.

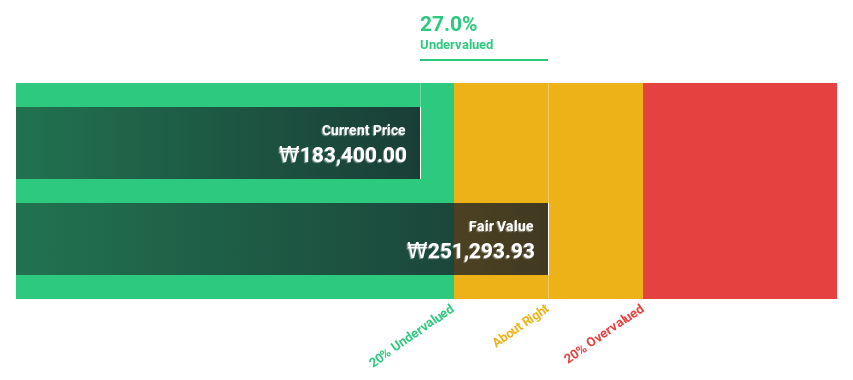

Cosmax (KOSE:A192820)

Overview: Cosmax, Inc. is a company that specializes in the research, development, production, and manufacturing of cosmetic and health functional food products both in Korea and internationally, with a market cap of ₩2.18 trillion.

Operations: The company's revenue primarily comes from the Cosmetics Sector, which generated ₩2.17 billion.

Estimated Discount To Fair Value: 49.6%

Cosmax is trading at ₩214,000, significantly below its estimated fair value of ₩424,695.54 based on discounted cash flow analysis. Despite revenue growth projections of 13.2% annually being lower than desired, earnings are expected to grow significantly at 26.3% per year over the next three years. However, operating cash flow does not adequately cover debt obligations. Recent conference presentations highlight ongoing investor engagement and strategic focus on future growth opportunities in the competitive cosmetics market.

- Our expertly prepared growth report on Cosmax implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Cosmax with our detailed financial health report.

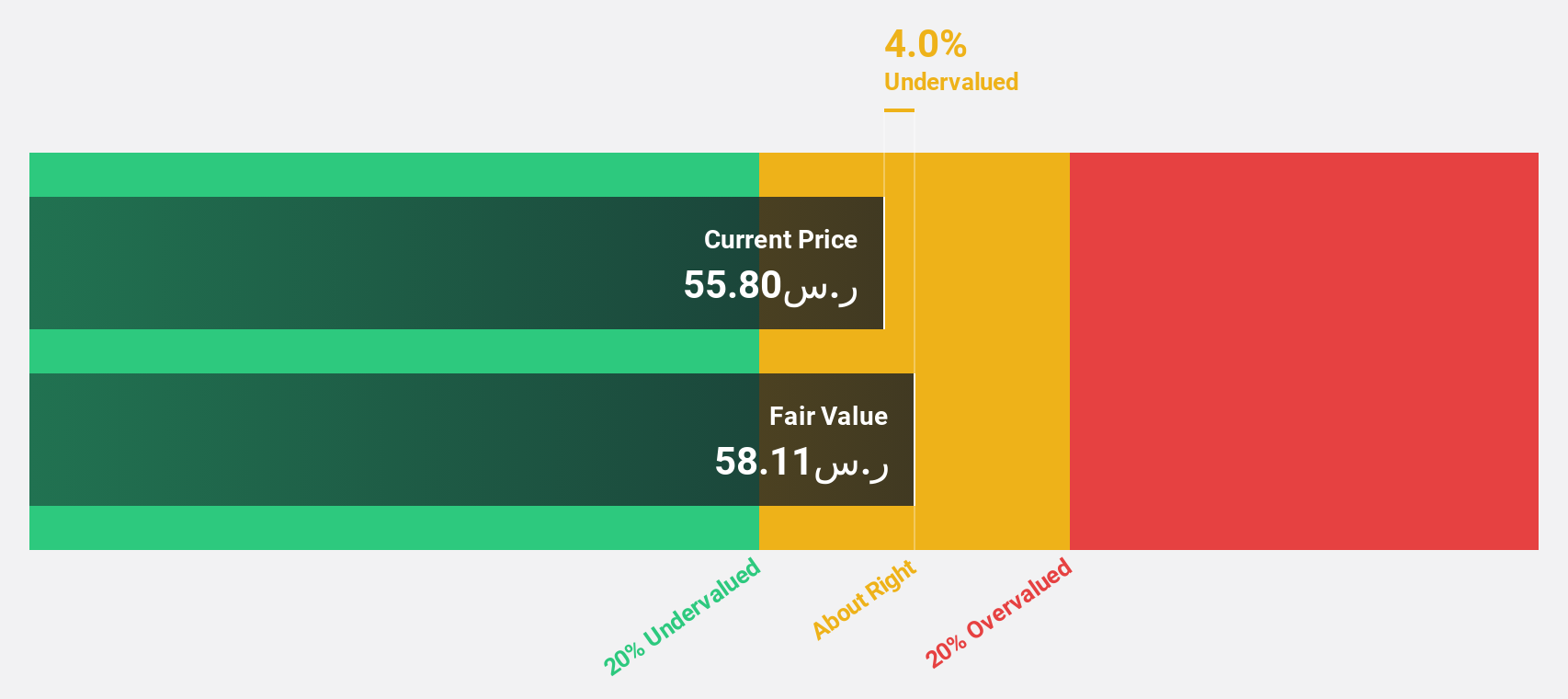

Saudi Basic Industries (SASE:2010)

Overview: Saudi Basic Industries Corporation manufactures, markets, and distributes chemicals, polymers, plastics, and agri-nutrients worldwide with a market cap of SAR181.20 billion.

Operations: Saudi Basic Industries generates revenue through its global operations in chemicals, polymers, plastics, and agri-nutrients.

Estimated Discount To Fair Value: 26.9%

Saudi Basic Industries is trading at SAR 60.8, which is more than 20% below its estimated fair value of SAR 83.14 based on discounted cash flow analysis, suggesting it may be undervalued. Despite a net loss in Q1 2025 and profit margins declining to 0.2%, earnings are forecasted to grow significantly at 37.33% annually over the next three years, outpacing the Saudi Arabian market's growth rate of 7.1%.

- The growth report we've compiled suggests that Saudi Basic Industries' future prospects could be on the up.

- Get an in-depth perspective on Saudi Basic Industries' balance sheet by reading our health report here.

Make It Happen

- Discover the full array of 475 Undervalued Global Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turkcell Iletisim Hizmetleri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TCELL

Turkcell Iletisim Hizmetleri

Provides digital services in Turkey, Belarus, Turkish Republic of Northern Cyprus, and the Netherlands.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives