- Saudi Arabia

- /

- Chemicals

- /

- SASE:2010

3 Global Stocks Estimated To Be Up To 47.1% Below Intrinsic Value

Reviewed by Simply Wall St

Amid escalating trade tensions and fluctuating consumer sentiment, global markets have recently experienced significant volatility. Despite these challenges, certain stocks are estimated to be trading well below their intrinsic value, presenting potential opportunities for investors seeking undervalued assets. Identifying such stocks involves assessing factors like fundamental strength and resilience in the face of current market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Cenergy Holdings (ENXTBR:CENER) | €8.19 | €16.34 | 49.9% |

| Hyundai Rotem (KOSE:A064350) | ₩104900.00 | ₩209149.91 | 49.8% |

| Lindab International (OM:LIAB) | SEK185.90 | SEK370.29 | 49.8% |

| Bairong (SEHK:6608) | HK$6.85 | HK$13.51 | 49.3% |

| Schaeffler (XTRA:SHA0) | €3.558 | €7.06 | 49.6% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.17 | CN¥41.64 | 49.2% |

| GMO internet group (TSE:9449) | ¥3042.00 | ¥5988.45 | 49.2% |

| Komplett (OB:KOMPL) | NOK11.50 | NOK22.68 | 49.3% |

| giftee (TSE:4449) | ¥1487.00 | ¥2965.25 | 49.9% |

| note (TSE:5243) | ¥1793.00 | ¥3564.60 | 49.7% |

Let's uncover some gems from our specialized screener.

Saudi Basic Industries (SASE:2010)

Overview: Saudi Basic Industries Corporation operates globally in the manufacturing, marketing, and distribution of chemicals, polymers, plastics, and agri-nutrients with a market capitalization of SAR183.60 billion.

Operations: The company's revenue is primarily derived from its Petrochemicals & Specialties segment, which generated SAR129.50 billion, and its Agri-Nutrients segment, contributing SAR10.48 billion.

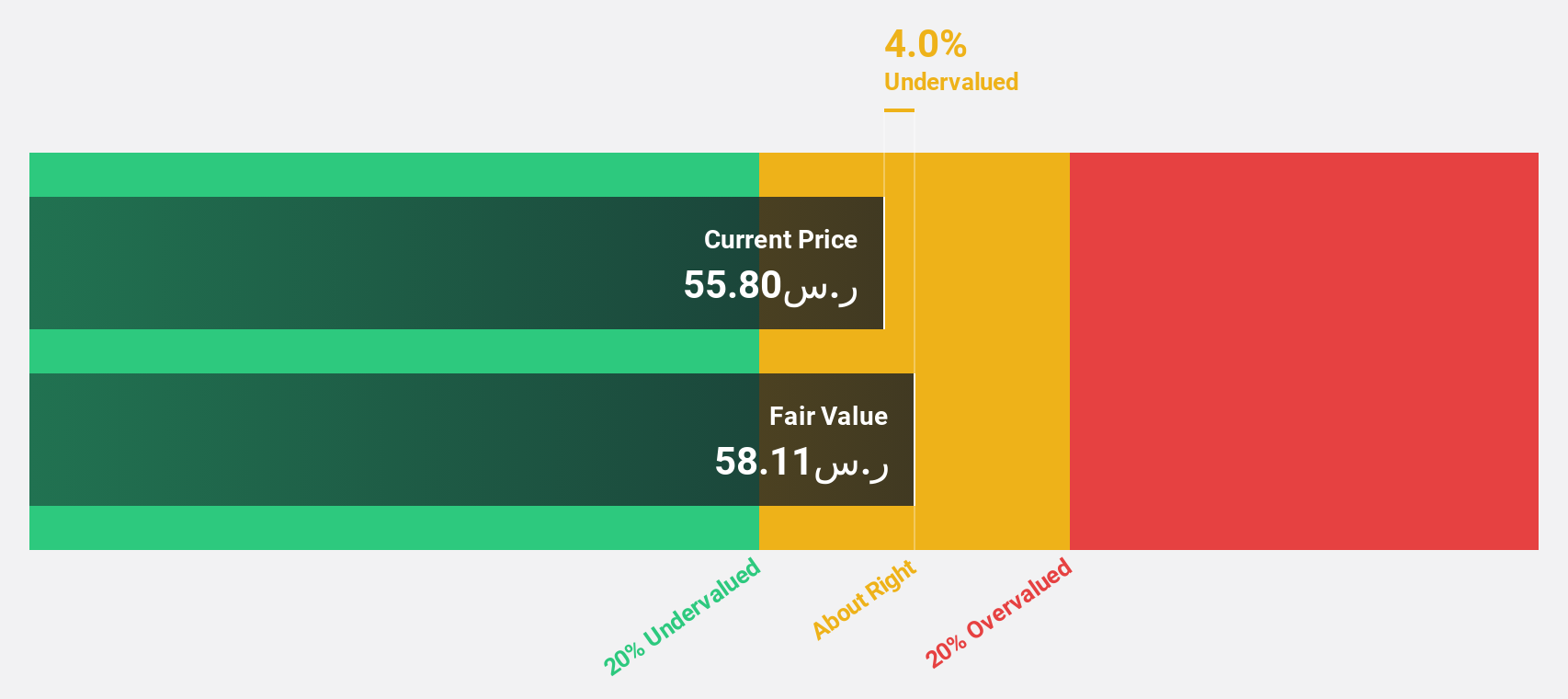

Estimated Discount To Fair Value: 24.1%

Saudi Basic Industries (SABIC) is trading at SAR61.3, which is 24.1% below its estimated fair value of SAR80.79, indicating potential undervaluation based on discounted cash flow analysis. Despite recent profit growth and a forecasted earnings increase of 43.8% annually, the company's dividend yield of 5.55% is not well covered by earnings or free cash flows. Recent board changes include forming a new Audit Committee to enhance governance and oversight, potentially impacting future financial performance positively.

- Insights from our recent growth report point to a promising forecast for Saudi Basic Industries' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Saudi Basic Industries.

J&T Global Express (SEHK:1519)

Overview: J&T Global Express Limited is an investment holding company providing integrated express delivery services across several countries including China, Indonesia, and Brazil, with a market cap of HK$54.34 billion.

Operations: The company's revenue from transportation - air freight amounts to $10.26 billion.

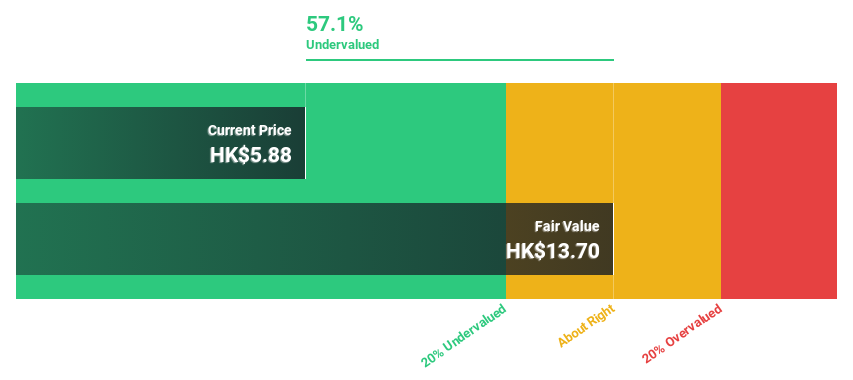

Estimated Discount To Fair Value: 33%

J&T Global Express, trading at HK$5.49, is priced 33% below its fair value estimate of HK$8.19, highlighting a potential undervaluation based on discounted cash flow analysis. The company reported a significant turnaround with net income of US$113.7 million for 2024 compared to a substantial loss the previous year. While revenue growth is forecasted at 10.5% annually, earnings are expected to grow significantly faster than the Hong Kong market average.

- Our earnings growth report unveils the potential for significant increases in J&T Global Express' future results.

- Unlock comprehensive insights into our analysis of J&T Global Express stock in this financial health report.

Rockchip Electronics (SHSE:603893)

Overview: Rockchip Electronics Co., Ltd. is a fabless IC design company based in China with a market capitalization of CN¥65.20 billion.

Operations: Rockchip Electronics Co., Ltd. generates revenue primarily through its operations as a fabless integrated circuit design company in China.

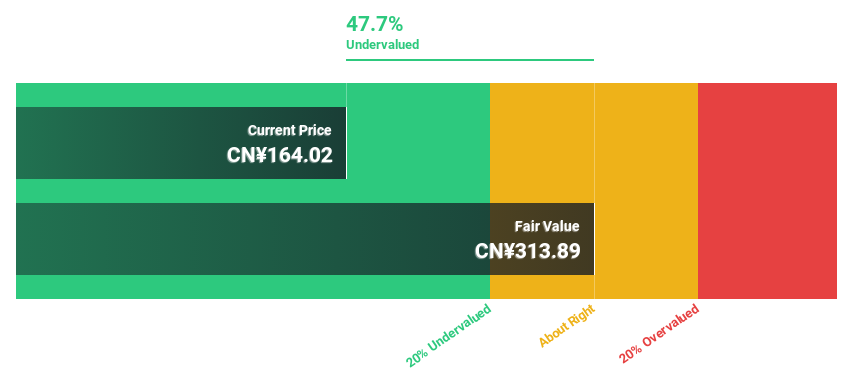

Estimated Discount To Fair Value: 47.1%

Rockchip Electronics, priced at CN¥153.15, is trading 47.1% below its fair value estimate of CN¥289.72, indicating it may be undervalued based on discounted cash flow analysis. The company anticipates significant earnings growth of 34.2% annually, outpacing the Chinese market average of 24%. Despite recent share price volatility and a forecasted low return on equity in three years (19.4%), revenue is expected to grow rapidly at 23.8% per year.

- In light of our recent growth report, it seems possible that Rockchip Electronics' financial performance will exceed current levels.

- Click here to discover the nuances of Rockchip Electronics with our detailed financial health report.

Summing It All Up

- Delve into our full catalog of 476 Undervalued Global Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Saudi Basic Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2010

Saudi Basic Industries

Manufactures, markets, and distributes chemicals, polymers, plastics, and agri-nutrients worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives