European markets have experienced a challenging week, with the pan-European STOXX Europe 600 Index declining by about 1.4% following new U.S. trade tariffs that dampened investor sentiment. For those looking to invest in smaller or newer companies, penny stocks—despite the name's vintage feel—can still offer surprising value. In this article, we highlight several penny stocks that demonstrate financial strength and see if they have some long-term potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.00 | SEK1.91B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.21 | SEK206.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.55 | SEK266.2M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.88 | SEK236.05M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.42 | PLN115.92M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.986 | €33.02M | ✅ 4 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.00 | €58.93M | ✅ 2 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.50 | €26.05M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.04 | €83.78M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.115 | €292.01M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 421 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Patria Bank (BVB:PBK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Patria Bank SA offers banking and financial services to small and medium enterprises, micro enterprises, agribusinesses, and retail clients in Romania with a market cap of RON272.14 million.

Operations: The company generates RON227.07 million in revenue from its banking segment.

Market Cap: RON272.14M

Patria Bank SA, with a market cap of RON272.14 million and revenue of RON227.07 million, shows promising growth in the penny stock landscape. Its earnings have surged by 59.4% over the past year, outpacing both its five-year average and industry peers. The bank maintains an appropriate Loans to Assets ratio (55%) and a strong net profit margin improvement from 13.3% to 17.9%. Despite a high level of bad loans (4.6%), its Price-To-Earnings ratio (6.7x) suggests good value relative to the Romanian market average, supported by stable funding primarily from low-risk sources like customer deposits.

- Dive into the specifics of Patria Bank here with our thorough balance sheet health report.

- Explore Patria Bank's analyst forecasts in our growth report.

Bergen Carbon Solutions (OB:BCS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bergen Carbon Solutions AS develops, manufactures, and sells nanofibers, nanotubes, and graphite using carbon dioxide and hydropower, with a market cap of NOK 134.09 million.

Operations: The company generates revenue from its Chemicals segment, amounting to NOK 0.12 million.

Market Cap: NOK134.09M

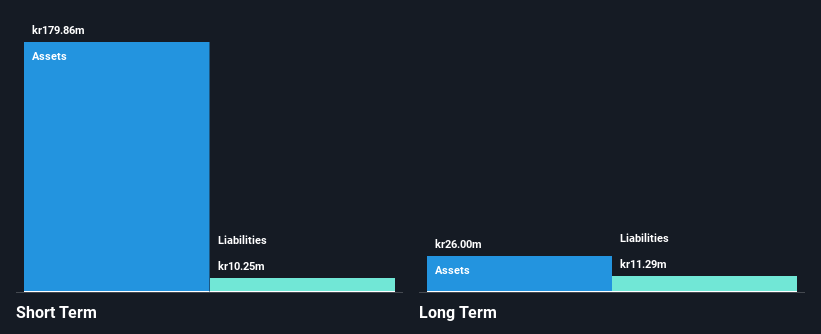

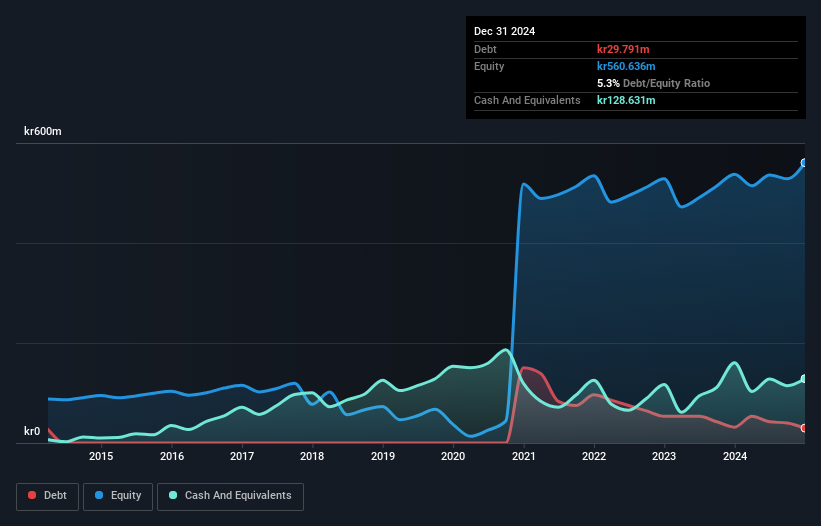

Bergen Carbon Solutions, with a market cap of NOK 134.09 million, remains pre-revenue, generating minimal revenue from its Chemicals segment. Despite being debt-free and having short-term assets that comfortably cover liabilities, the company faces challenges with a net loss of NOK 9.91 million for Q4 2024 and increasing losses over five years at an annual rate of 35.2%. Its share price has been highly volatile recently, though shareholders haven't faced significant dilution in the past year. While earnings are forecast to grow significantly by over 50% annually, its unprofitability persists alongside an inexperienced board averaging only 2.3 years in tenure.

- Click to explore a detailed breakdown of our findings in Bergen Carbon Solutions' financial health report.

- Review our growth performance report to gain insights into Bergen Carbon Solutions' future.

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden, with a market cap of SEK1.91 billion.

Operations: The company generates revenue primarily from its National Broadband Service, amounting to SEK1.73 billion.

Market Cap: SEK1.91B

Bredband2 i Skandinavien AB, with a market cap of SEK1.91 billion, has shown robust financial health and growth potential. The company reported Q4 2024 earnings with sales increasing to SEK444.74 million and net income rising to SEK29.61 million year-over-year, reflecting strong operational performance. Its interest payments are well-covered by EBIT, and the company's debt is effectively managed with operating cash flow coverage at 860%. Despite short-term liabilities exceeding assets, long-term liabilities are comfortably covered. Bredband2 offers an attractive dividend yield of 5%, while its earnings growth outpaces the Telecom industry average significantly.

- Jump into the full analysis health report here for a deeper understanding of Bredband2 i Skandinavien.

- Evaluate Bredband2 i Skandinavien's prospects by accessing our earnings growth report.

Taking Advantage

- Click this link to deep-dive into the 421 companies within our European Penny Stocks screener.

- Curious About Other Options? The end of cancer? These 21 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bergen Carbon Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BCS

Bergen Carbon Solutions

Develops, manufactures, and sells nanofibers, nanotubes, and graphite using carbon dioxide and hydropower.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives