Do Commercial Bank (P.S.Q.C.)'s (DSM:CBQK) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Commercial Bank (P.S.Q.C.) (DSM:CBQK), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Commercial Bank (P.S.Q.C.)

Commercial Bank (P.S.Q.C.)'s Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. We can see that in the last three years Commercial Bank (P.S.Q.C.) grew its EPS by 15% per year. That's a pretty good rate, if the company can sustain it.

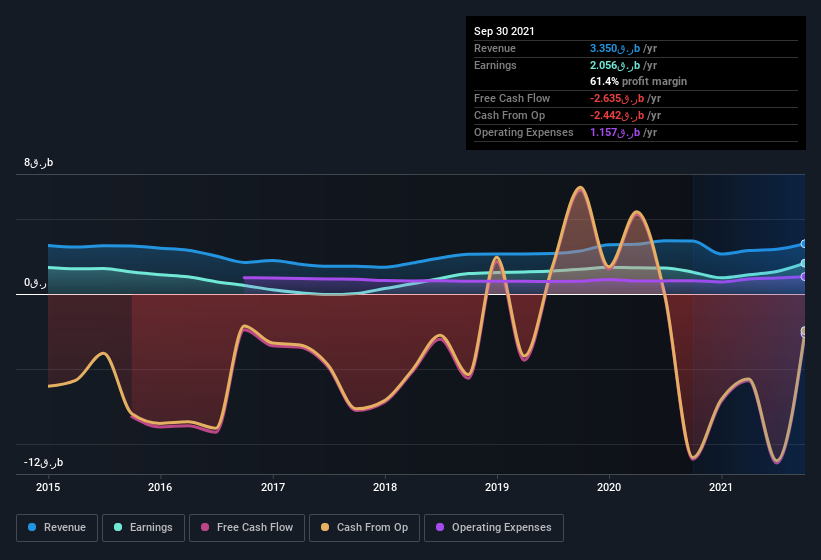

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Commercial Bank (P.S.Q.C.)'s revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While Commercial Bank (P.S.Q.C.) may have maintained EBIT margins over the last year, revenue has fallen. Suffice it to say that is not a great sign of growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Commercial Bank (P.S.Q.C.).

Are Commercial Bank (P.S.Q.C.) Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a ر.ق26b company like Commercial Bank (P.S.Q.C.). But we are reassured by the fact they have invested in the company. Indeed, they have a glittering mountain of wealth invested in it, currently valued at ر.ق632m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Is Commercial Bank (P.S.Q.C.) Worth Keeping An Eye On?

One positive for Commercial Bank (P.S.Q.C.) is that it is growing EPS. That's nice to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Commercial Bank (P.S.Q.C.) is trading on a high P/E or a low P/E, relative to its industry.

Although Commercial Bank (P.S.Q.C.) certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Commercial Bank (P.S.Q.C.), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:CBQK

Commercial Bank (P.S.Q.C.)

Engages in the conventional banking, brokerage, and credit card businesses in Qatar and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives