In a week where rising U.S. Treasury yields have exerted pressure on global markets, with the S&P 500 and other major indices experiencing declines, investors are seeking stability amid economic uncertainty. As market dynamics shift, dividend stocks often stand out as attractive options for those looking to balance potential income with long-term growth opportunities.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.20% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.00% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Southside Bancshares (NasdaqGS:SBSI) | 4.51% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.03% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.92% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.99% | ★★★★★★ |

Click here to see the full list of 2040 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

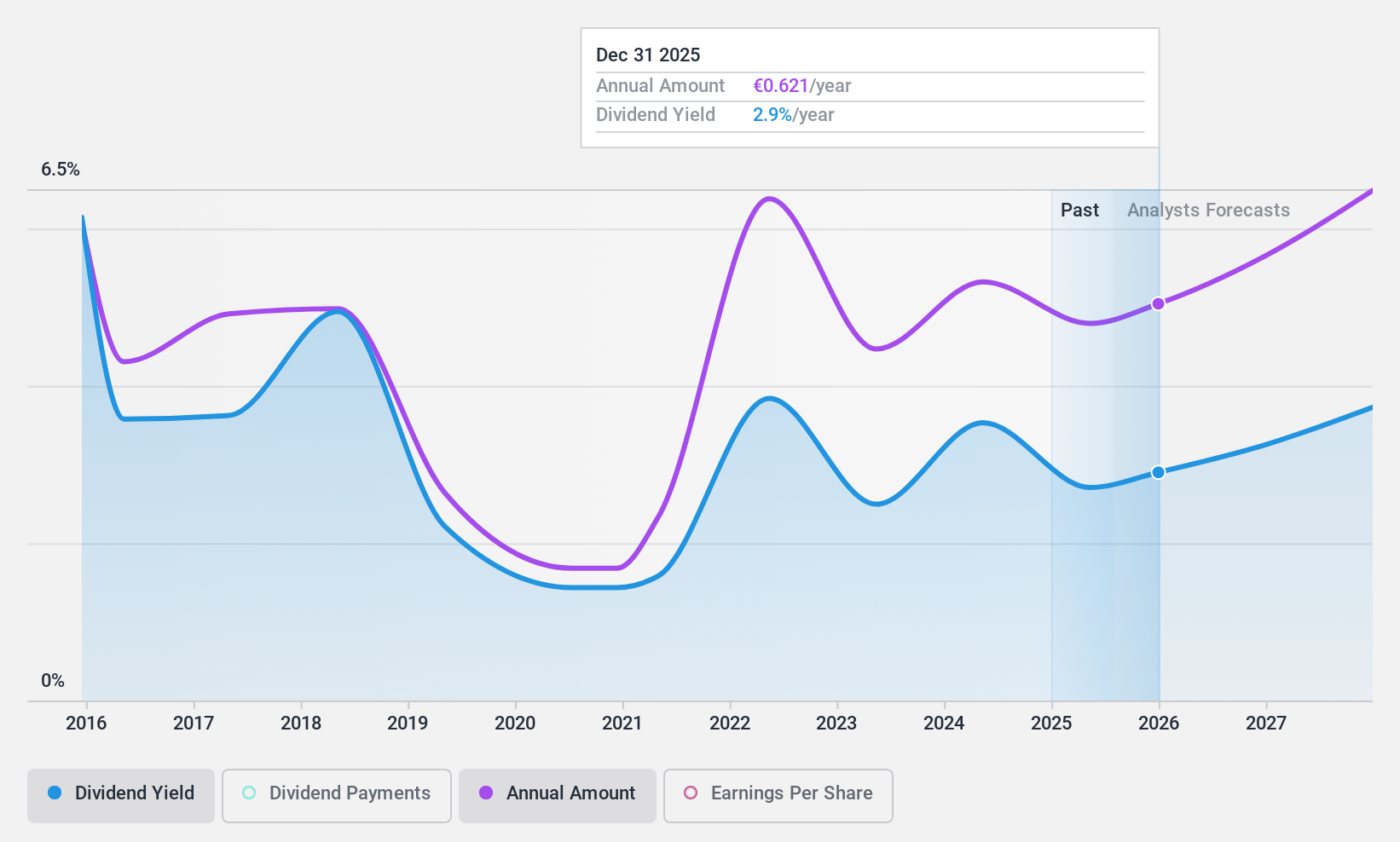

Jerónimo Martins SGPS (ENXTLS:JMT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jerónimo Martins SGPS operates in the food distribution and specialized retail sectors across Portugal, Poland, and Colombia, with a market cap of €11.23 billion.

Operations: Jerónimo Martins SGPS generates revenue from its key segments, with Biedronka contributing €22.72 billion, Pingo Doce €5.60 billion, Ara €2.78 billion, and Recheio €1.35 billion.

Dividend Yield: 3.6%

Jerónimo Martins SGPS's dividend sustainability is supported by a payout ratio of 63.4% and a cash payout ratio of 39.1%, indicating dividends are well-covered by earnings and cash flows. However, its dividend yield of 3.59% is lower than the top quartile in Portugal, and past payments have been volatile, impacting reliability. Despite recent revenue growth to €24.77 billion for nine months ending September 2024, net income has declined compared to last year.

- Get an in-depth perspective on Jerónimo Martins SGPS' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Jerónimo Martins SGPS' current price could be quite moderate.

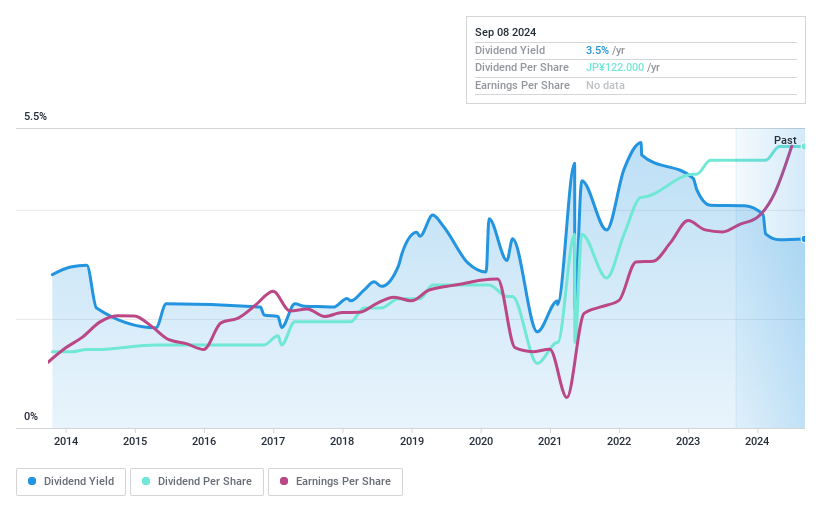

Chori (TSE:8014)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chori Co., Ltd. operates in the textiles, chemicals, and machinery sectors both in China and internationally, with a market cap of ¥100.06 billion.

Operations: Chori Co., Ltd.'s revenue is primarily derived from its Chemicals Business at ¥157.69 billion, followed by the Textile Business at ¥150.36 billion, and the Machinery Business contributing ¥1.12 billion.

Dividend Yield: 3%

Chori's dividend payments are well-supported by a low payout ratio of 25.6% and a cash payout ratio of 39.7%, ensuring coverage by both earnings and cash flows. Despite recent earnings growth of 39.3%, the dividend yield is relatively low at 3% compared to top-tier Japanese payers, and its track record is marked by volatility, with past payments experiencing significant drops. The stock trades significantly below estimated fair value, offering potential upside for investors focused on valuation.

- Delve into the full analysis dividend report here for a deeper understanding of Chori.

- According our valuation report, there's an indication that Chori's share price might be on the cheaper side.

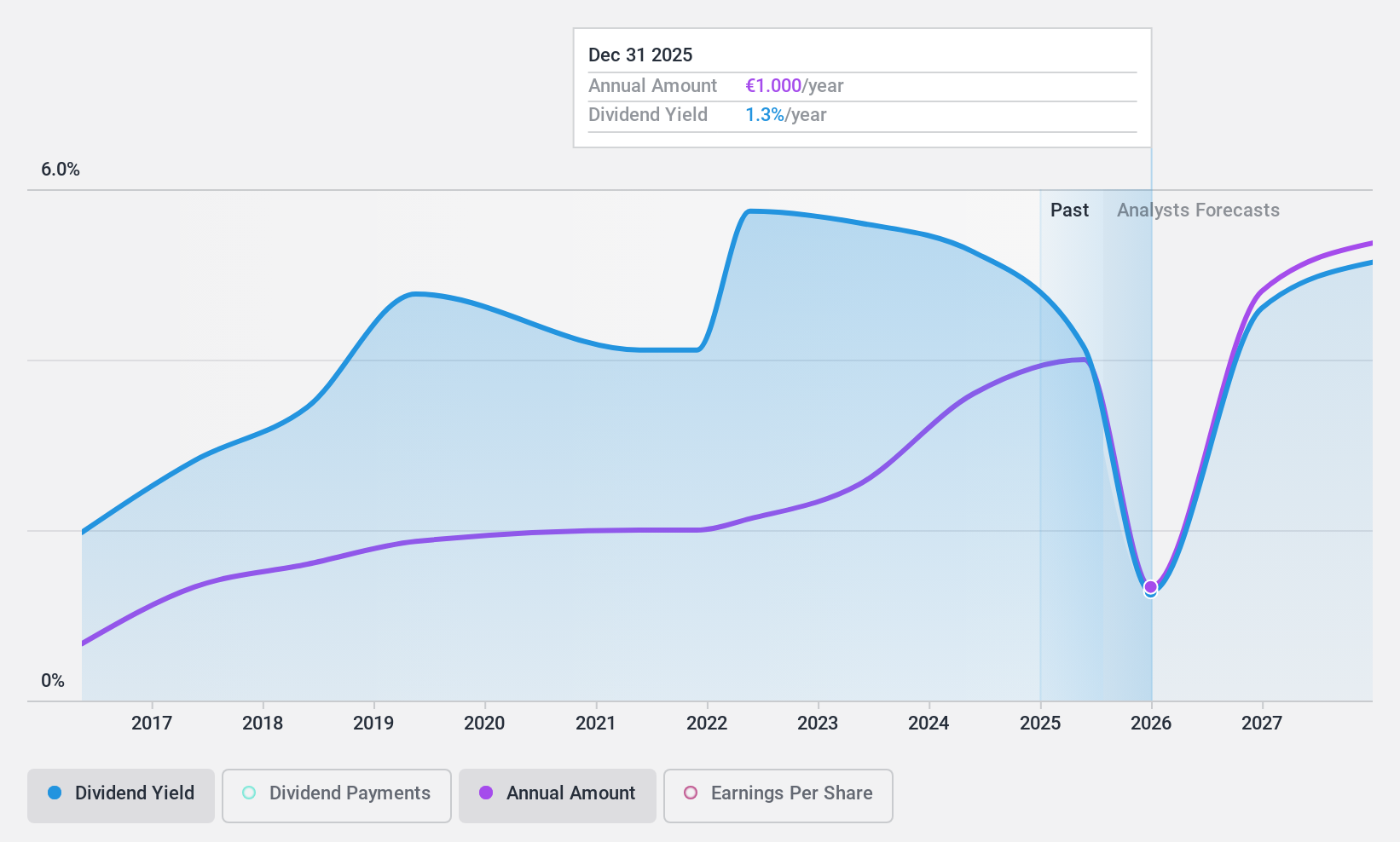

Erste Group Bank (WBAG:EBS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Erste Group Bank AG offers a variety of banking and financial services to retail, corporate, and public sector clients, with a market cap of €21.08 billion.

Operations: Erste Group Bank AG's revenue is primarily derived from its Retail segment (€4.66 billion), Corporates (€2.36 billion), Savings Banks (€2.32 billion), and Group Markets (€680 million).

Dividend Yield: 5.2%

Erste Group Bank's dividend payments are currently covered by earnings with a payout ratio of 37.6%, expected to remain sustainable at 51% in three years. Despite a history of volatility and an unstable track record, dividends have grown over the past decade. The bank's dividend yield is relatively low at 5.22% compared to top Austrian payers, and it faces challenges with a high level of bad loans (2.1%). Recent earnings reports show consistent growth, supporting its financial stability.

- Dive into the specifics of Erste Group Bank here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Erste Group Bank shares in the market.

Next Steps

- Click this link to deep-dive into the 2040 companies within our Top Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erste Group Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:EBS

Erste Group Bank

Provides a range of banking and other financial services to retail, corporate, and public sector customers.

Adequate balance sheet average dividend payer.