As European markets experience a lift from hopes of lower U.S. borrowing costs, with the pan-European STOXX Europe 600 Index ending 1.40% higher, investors are increasingly turning their attention to potential opportunities within the region's small-cap sector. In this environment, identifying stocks that exhibit strong fundamentals and resilience amid economic fluctuations can be key to uncovering hidden gems like Linedata Services and others in Europe’s dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Linedata Services (ENXTPA:LIN)

Simply Wall St Value Rating: ★★★★★☆

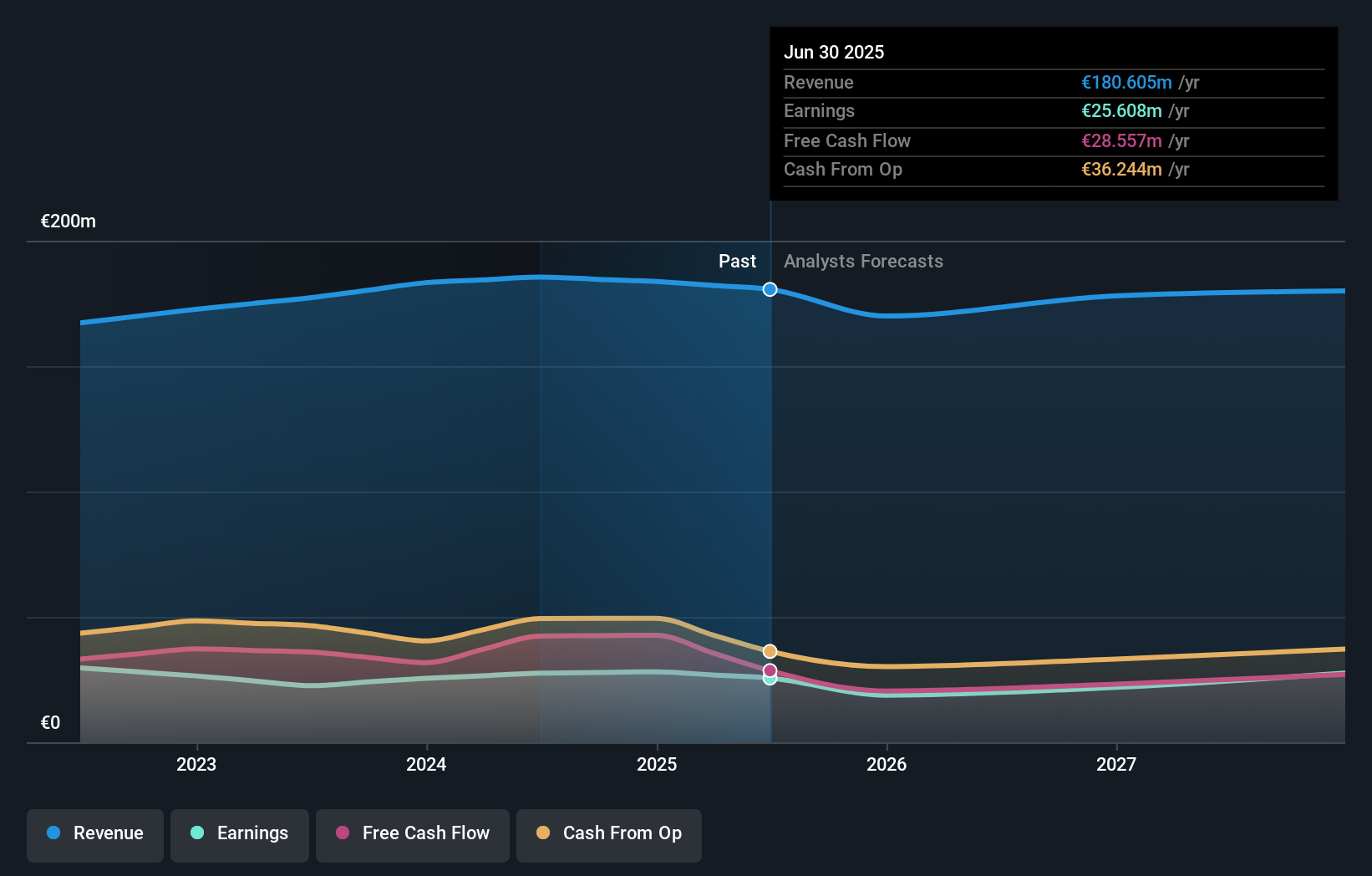

Overview: Linedata Services S.A. specializes in developing, publishing, and distributing financial software across Southern Europe, Northern Europe, North America, and Asia with a market capitalization of €313.51 million.

Operations: Linedata Services generates revenue primarily from its Asset Management segment (€120.73 million) and Lending & Leasing segment (€62.99 million). The company's financial performance is influenced by these core revenue streams.

Linedata Services, a smaller player in the software sector, has seen earnings grow at 7.7% annually over five years, showcasing solid performance. Despite not outpacing the industry’s recent 15.4% growth rate, Linedata's earnings quality remains high with interest payments well-covered by EBIT at 10.2x coverage and a net debt to equity ratio of 33.9%, reflecting satisfactory financial health. Its price-to-earnings ratio of 11.1x suggests it trades below the French market average of 16.3x, indicating good relative value despite reporting EUR €86.6 million in revenue for H1 2025 compared to €89.7 million previously.

VP Bank (SWX:VPBN)

Simply Wall St Value Rating: ★★★★★☆

Overview: VP Bank AG, along with its subsidiaries, offers wealth management and investment advisory services to private and institutional investors across Liechtenstein, Europe, and globally, with a market capitalization of CHF522.43 million.

Operations: VP Bank AG generates revenue primarily through wealth management and investment advisory services. The company's market capitalization is CHF522.43 million.

VP Bank, a Swiss financial entity with total assets of CHF11.4 billion and equity of CHF1.1 billion, has shown resilience despite a 12.3% earnings drop over five years. Its price-to-earnings ratio of 14.6x is attractive compared to the Swiss market's 21x, indicating potential value for investors. The bank's recent earnings growth of 18.2% outpaced the industry average, highlighting its competitive edge in capital markets. With total deposits at CHF9.4 billion and loans at CHF5.9 billion, VP Bank maintains an appropriate bad loans level at 1.5%, supported by a low allowance for bad loans (28%).

- Get an in-depth perspective on VP Bank's performance by reading our health report here.

Evaluate VP Bank's historical performance by accessing our past performance report.

Comp (WSE:CMP)

Simply Wall St Value Rating: ★★★★★★

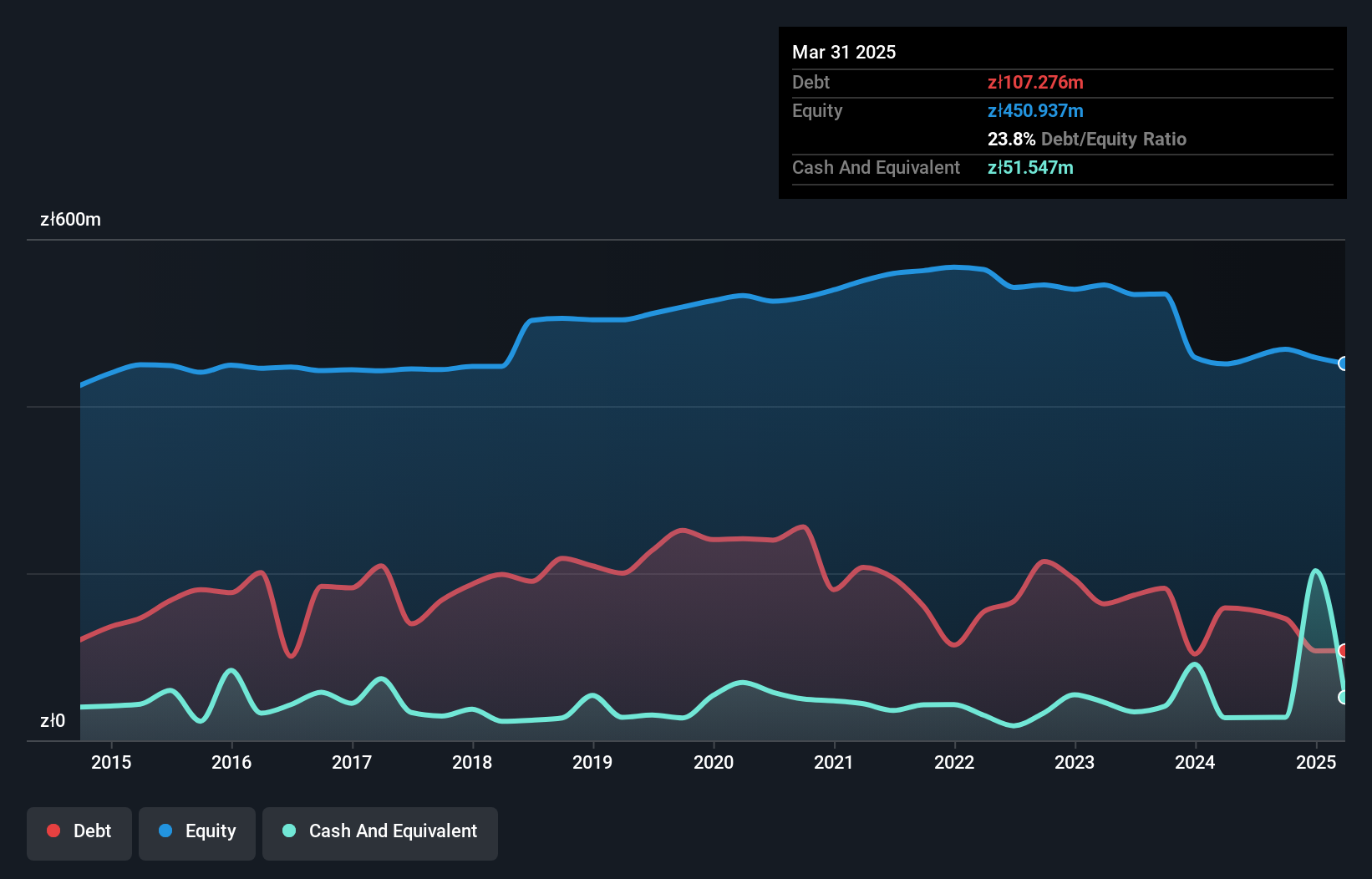

Overview: Comp S.A. is a technology company based in Poland that specializes in IT and network security services and solutions, with a market capitalization of PLN 1.15 billion.

Operations: Comp S.A. generates revenue primarily from its IT and Retail segments, with the IT segment contributing PLN 560.81 million and the Retail segment contributing PLN 355.95 million. The company's net profit margin is a key financial metric to consider when evaluating its financial performance.

Comp has demonstrated resilience with high-quality earnings and satisfactory debt management. Over five years, the net debt to equity ratio improved from 45.3% to 23.8%, indicating prudent financial handling. Despite a modest earnings growth of 5.4% annually over the same period, it hasn't outpaced the IT industry but shows potential with a forecasted annual growth rate of 17.38%. The company's interest obligations are well covered by EBIT at a ratio of 6.7x, ensuring stability in financial commitments while trading at nearly 10% below its estimated fair value suggests room for appreciation in market valuation.

- Delve into the full analysis health report here for a deeper understanding of Comp.

Gain insights into Comp's historical performance by reviewing our past performance report.

Where To Now?

- Delve into our full catalog of 329 European Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CMP

Comp

A technology firm, provides IT security and network security services and solutions in Poland.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)