Cloud Technologies (WSE:CLD) Has Affirmed Its Dividend Of PLN1.25

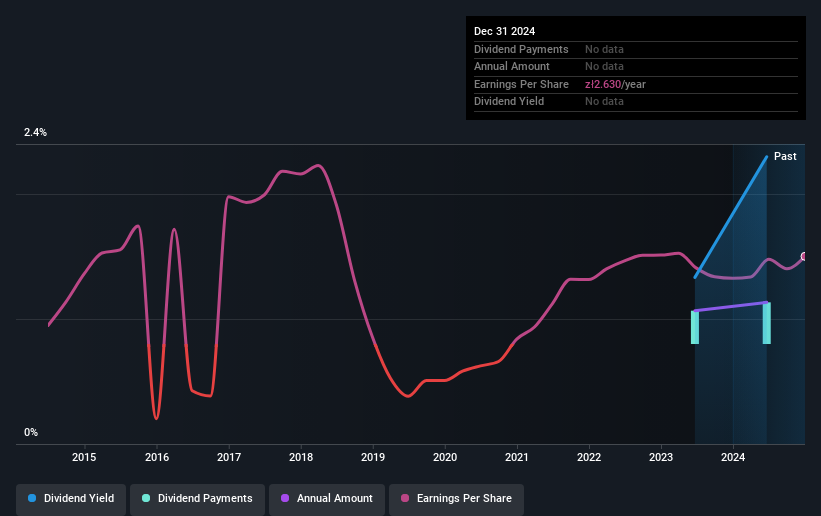

The board of Cloud Technologies S.A. (WSE:CLD) has announced that it will pay a dividend on the 27th of June, with investors receiving PLN1.25 per share. Including this payment, the dividend yield on the stock will be 2.3%, which is a modest boost for shareholders' returns.

We've discovered 2 warning signs about Cloud Technologies. View them for free.Cloud Technologies' Payment Could Potentially Have Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. The last dividend was quite easily covered by Cloud Technologies' earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

If the trend of the last few years continues, EPS will grow by 39.5% over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio will be 31%, which is in the range that makes us comfortable with the sustainability of the dividend.

View our latest analysis for Cloud Technologies

Cloud Technologies Is Still Building Its Track Record

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. Since 2023, the annual payment back then was PLN1.00, compared to the most recent full-year payment of PLN1.25. This means that it has been growing its distributions at 12% per annum over that time. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see that Cloud Technologies has been growing its earnings per share at 39% a year over the past five years. The company's earnings per share has grown rapidly in recent years, and it has a good balance between reinvesting and paying dividends to shareholders, so we think that Cloud Technologies could prove to be a strong dividend payer.

Cloud Technologies Looks Like A Great Dividend Stock

Overall, we like to see the dividend staying consistent, and we think Cloud Technologies might even raise payments in the future. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for Cloud Technologies that you should be aware of before investing. Is Cloud Technologies not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:CLD

Cloud Technologies

Engages in the big data marketing and data monetization businesses.

Flawless balance sheet with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026