European Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

The European stock markets recently experienced a downturn, with the pan-European STOXX Europe 600 Index declining by 1.10% amid profit-taking and political unrest in France, alongside heightened international trade tensions. In this environment of uncertainty and market volatility, identifying stocks that may be trading below their estimated value can present potential opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €1.17 | €2.30 | 49.1% |

| SBO (WBAG:SBO) | €26.80 | €53.44 | 49.8% |

| Mowi (OB:MOWI) | NOK223.20 | NOK436.94 | 48.9% |

| Mo-BRUK (WSE:MBR) | PLN294.50 | PLN582.77 | 49.5% |

| Lingotes Especiales (BME:LGT) | €5.80 | €11.34 | 48.9% |

| High Quality Food (BIT:HQF) | €0.62 | €1.22 | 49% |

| Envipco Holding (ENXTAM:ENVI) | €5.80 | €11.51 | 49.6% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.33 | €6.63 | 49.8% |

| Atea (OB:ATEA) | NOK142.20 | NOK281.61 | 49.5% |

| Allegro.eu (WSE:ALE) | PLN33.65 | PLN66.18 | 49.2% |

Let's review some notable picks from our screened stocks.

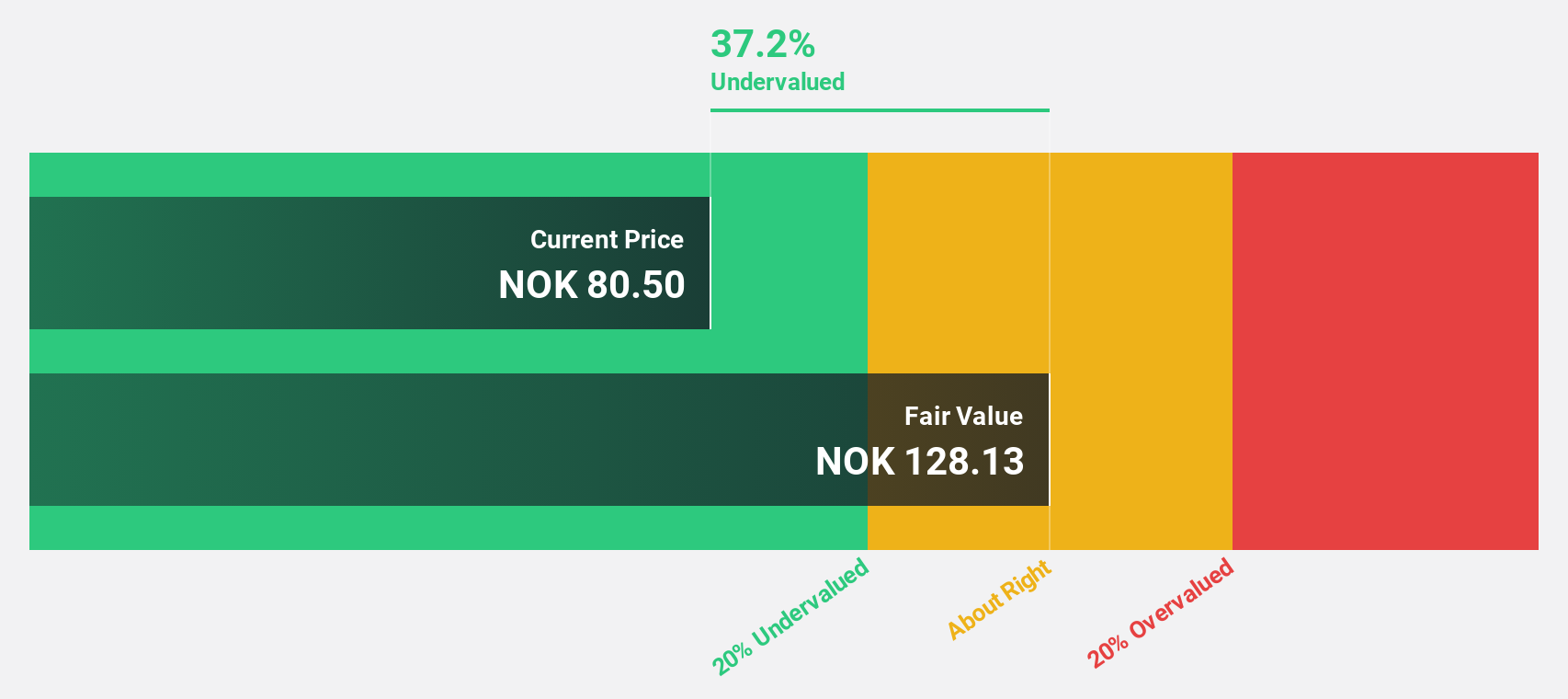

Europris (OB:EPR)

Overview: Europris ASA is a discount variety retailer operating in Norway with a market cap of NOK16.05 billion.

Operations: Europris ASA generates revenue from its retail segment, specifically through variety stores, amounting to NOK14.36 billion.

Estimated Discount To Fair Value: 33.9%

Europris, trading at NOK98.1, is significantly undervalued compared to its fair value estimate of NOK148.42. Despite a high debt level, the company shows promising growth prospects with earnings expected to grow 24.6% annually over the next three years, outpacing the Norwegian market's growth rate. Recent expansions include new store openings and full ownership of Swedish retailer OoB, enhancing its footprint in Scandinavia and supporting continued revenue growth above market averages.

- Our earnings growth report unveils the potential for significant increases in Europris' future results.

- Take a closer look at Europris' balance sheet health here in our report.

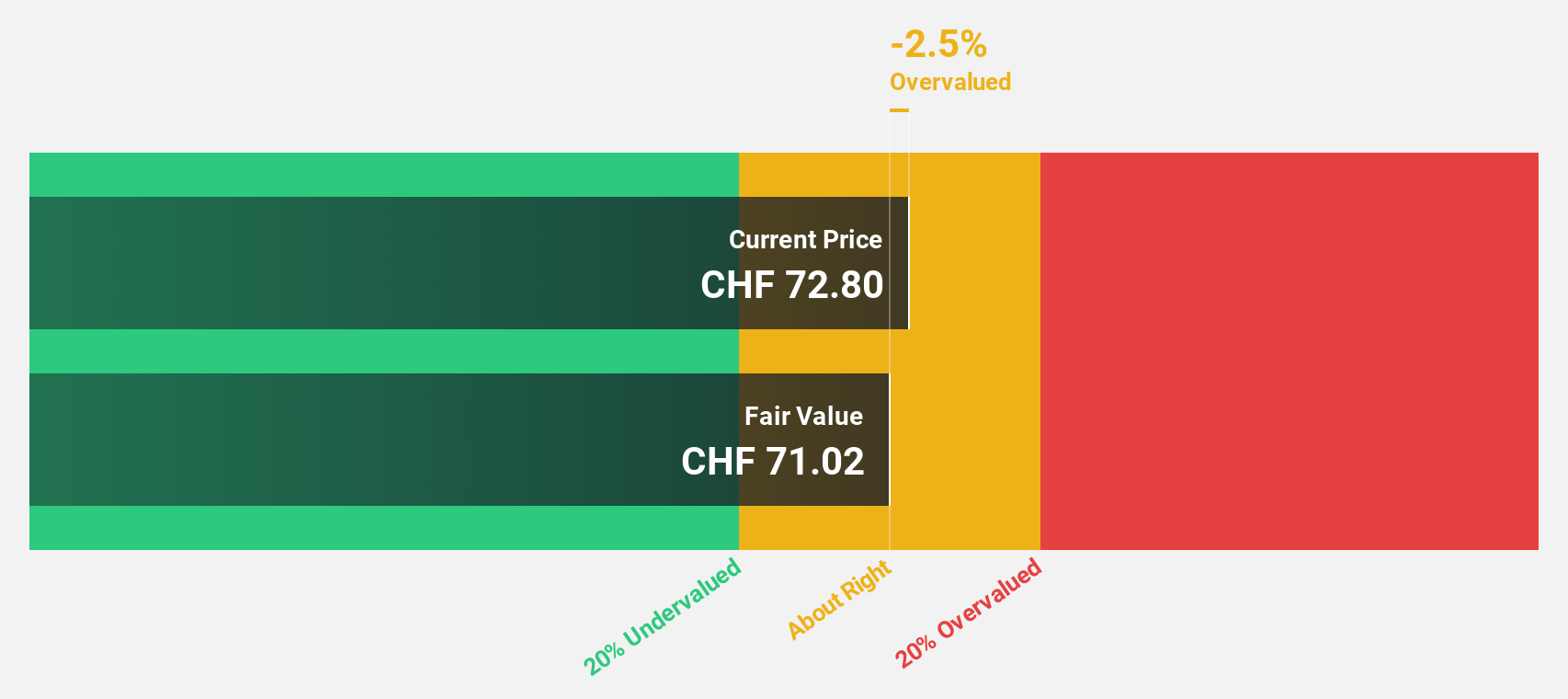

Zehnder Group (SWX:ZEHN)

Overview: Zehnder Group AG, with a market cap of CHF762.37 million, develops, manufactures, and sells indoor climate systems across Europe, North America, and China.

Operations: The company's revenue is derived from two main segments: Radiators, which contribute €269.80 million, and Ventilation, accounting for €474.10 million.

Estimated Discount To Fair Value: 32.2%

Zehnder Group, trading at CHF68.5, is undervalued relative to its fair value estimate of CHF100.96. The company's earnings are forecast to grow 33.12% annually over the next three years, surpassing Swiss market growth rates. Despite large one-off items affecting recent results, Zehnder reported a significant increase in net income for H1 2025 (EUR23 million vs EUR6.6 million year-over-year). Revenue guidance for 2025 is between EUR740 million and EUR770 million, indicating steady growth prospects.

- Our comprehensive growth report raises the possibility that Zehnder Group is poised for substantial financial growth.

- Click here to discover the nuances of Zehnder Group with our detailed financial health report.

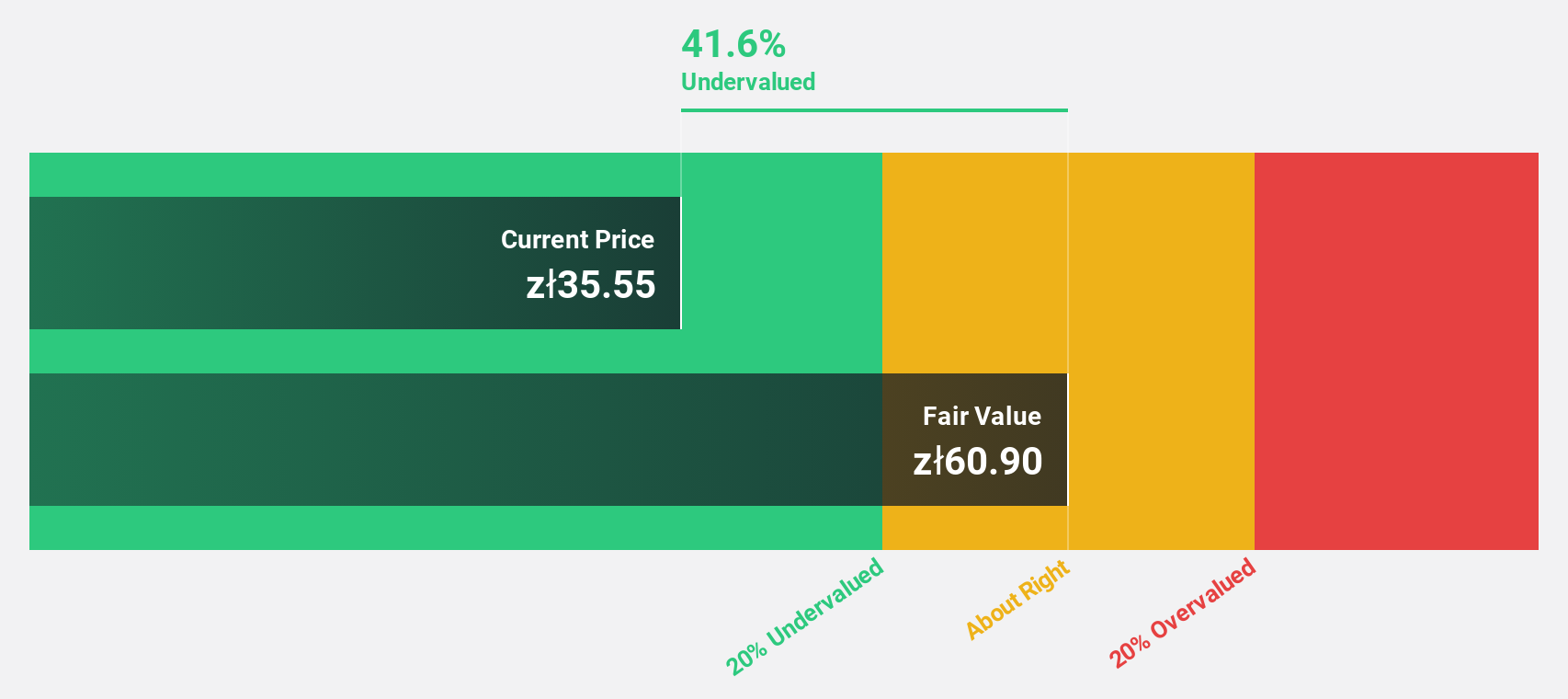

Allegro.eu (WSE:ALE)

Overview: Allegro.eu S.A. operates a commerce platform serving consumers in Poland, the Czech Republic, and internationally, with a market cap of PLN34.25 billion.

Operations: The company's revenue is primarily derived from its Allegro segment, contributing PLN9.76 billion, and the Ceneo segment, which adds PLN357.29 million.

Estimated Discount To Fair Value: 49.2%

Allegro.eu is trading at PLN33.65, significantly undervalued compared to its estimated fair value of PLN66.18, with a 49.2% discount. The company's earnings are projected to grow 24.94% annually over the next three years, outpacing the Polish market's growth rate of 15.9%. Recent results show robust performance with Q2 net income rising to PLN385.75 million from PLN347.05 million year-over-year, supported by revenue growth and strong cash flows despite slower-than-20% annual revenue increase forecasts.

- In light of our recent growth report, it seems possible that Allegro.eu's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Allegro.eu.

Key Takeaways

- Get an in-depth perspective on all 207 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ALE

Allegro.eu

Operates a commerce platform for consumers in Poland, Czech Republic, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026