- Poland

- /

- Entertainment

- /

- WSE:CDR

Investors in CD Projekt (WSE:CDR) have seen strong returns of 111% over the past year

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example CD Projekt S.A. (WSE:CDR). Its share price is already up an impressive 109% in the last twelve months. It's also good to see the share price up 23% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 14% in 90 days). And shareholders have also done well over the long term, with an increase of 36% in the last three years.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for CD Projekt

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

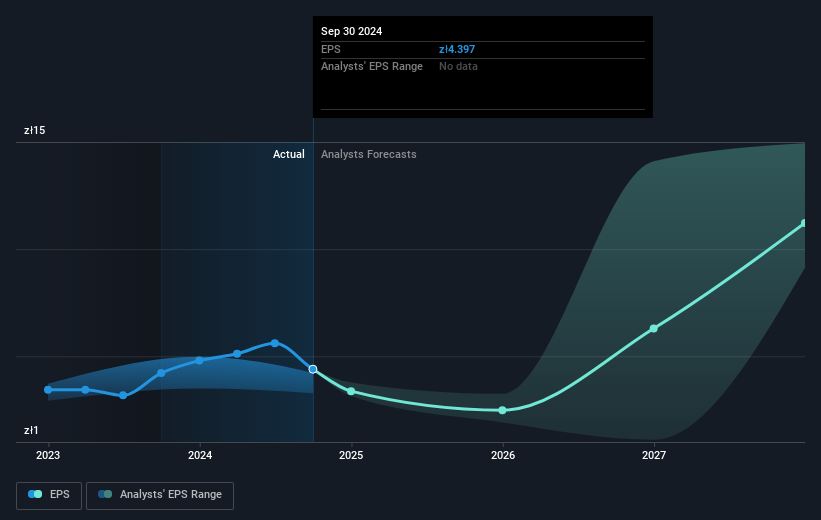

During the last year CD Projekt grew its earnings per share (EPS) by 4.3%. This EPS growth is significantly lower than the 109% increase in the share price. So it's fair to assume the market has a higher opinion of the business than it a year ago. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 50.40.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into CD Projekt's key metrics by checking this interactive graph of CD Projekt's earnings, revenue and cash flow.

A Different Perspective

It's good to see that CD Projekt has rewarded shareholders with a total shareholder return of 111% in the last twelve months. That's including the dividend. Notably the five-year annualised TSR loss of 3% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before deciding if you like the current share price, check how CD Projekt scores on these 3 valuation metrics.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

If you're looking to trade CD Projekt, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:CDR

CD Projekt

Together its subsidiaries, engages in the development, publishing, and digital distribution of video games for personal computers and video game consoles in Poland.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives