- Poland

- /

- Metals and Mining

- /

- WSE:COG

Three Prominent Stocks Estimated Below Intrinsic Value In January 2025

Reviewed by Simply Wall St

As we enter 2025, global markets have shown mixed performances, with U.S. indices closing a strong year despite some recent profit-taking and economic indicators like the Chicago PMI highlighting ongoing challenges in manufacturing. Amid these fluctuating conditions, identifying stocks that are undervalued relative to their intrinsic value can offer potential opportunities for investors seeking to navigate this complex landscape.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | US$30.89 | US$61.61 | 49.9% |

| Wasion Holdings (SEHK:3393) | HK$7.05 | HK$14.02 | 49.7% |

| Tourmaline Oil (TSX:TOU) | CA$66.79 | CA$133.01 | 49.8% |

| Camden National (NasdaqGS:CAC) | US$42.08 | US$83.90 | 49.8% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Zhende Medical (SHSE:603301) | CN¥21.00 | CN¥41.99 | 50% |

| Ally Financial (NYSE:ALLY) | US$35.85 | US$71.62 | 49.9% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥23.89 | CN¥47.76 | 50% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.44 | NZ$2.88 | 50% |

| LG Energy Solution (KOSE:A373220) | ₩356000.00 | ₩709677.60 | 49.8% |

Let's review some notable picks from our screened stocks.

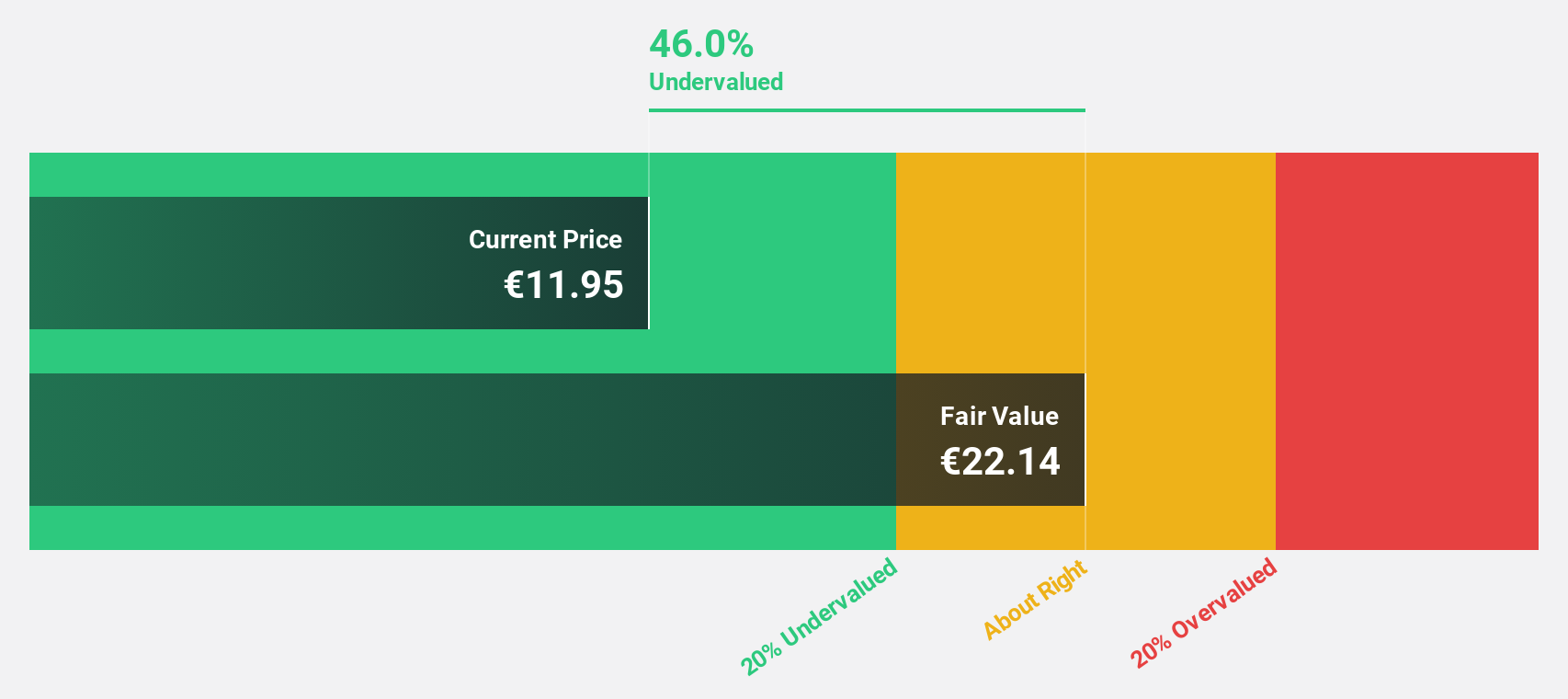

Figeac Aero Société Anonyme (ENXTPA:FGA)

Overview: Figeac Aero Société Anonyme manufactures, supplies, and sells equipment and sub-assemblies for the aeronautics sector in France, with a market cap of €245.67 million.

Operations: The company's revenue is primarily derived from its Aerostructures & Aeromotors segment, which accounts for €382.40 million, complemented by €33.50 million from Diversification Activities.

Estimated Discount To Fair Value: 47.7%

Figeac Aero Société Anonyme is currently trading at €6, significantly below its estimated fair value of €11.46, highlighting potential undervaluation based on discounted cash flow analysis. The company reported a decrease in net loss for the half year ended September 30, 2024, with sales rising to €200 million from €181.2 million the previous year. While earnings are forecasted to grow substantially at 107.18% annually, return on equity remains low at a projected 17.2%.

- Our earnings growth report unveils the potential for significant increases in Figeac Aero Société Anonyme's future results.

- Get an in-depth perspective on Figeac Aero Société Anonyme's balance sheet by reading our health report here.

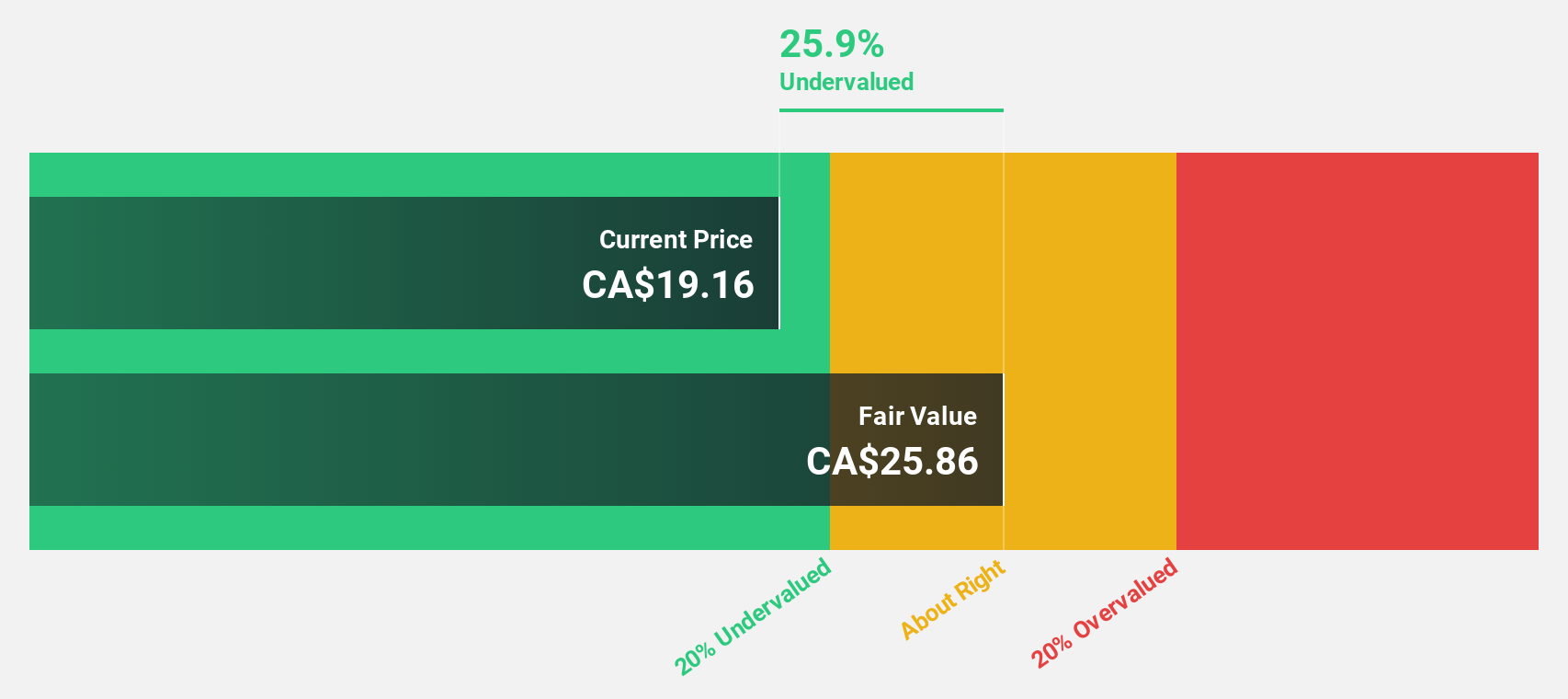

Savaria (TSX:SIS)

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally, with a market cap of CA$1.45 billion.

Operations: The company's revenue segments include Patient Care, which generated CA$184.01 million, and a Segment Adjustment of CA$677.25 million.

Estimated Discount To Fair Value: 26.5%

Savaria Corporation is trading at CA$20.35, significantly below its estimated fair value of CA$27.69, indicating potential undervaluation based on cash flows. Despite some shareholder dilution over the past year, earnings grew 20.6% and are forecasted to grow 31.42% annually, outpacing the Canadian market's profit growth rate of 15.4%. Although revenue growth is slower than the market average, Savaria maintains a reliable dividend policy with recent affirmations supporting its stability.

- Upon reviewing our latest growth report, Savaria's projected financial performance appears quite optimistic.

- Dive into the specifics of Savaria here with our thorough financial health report.

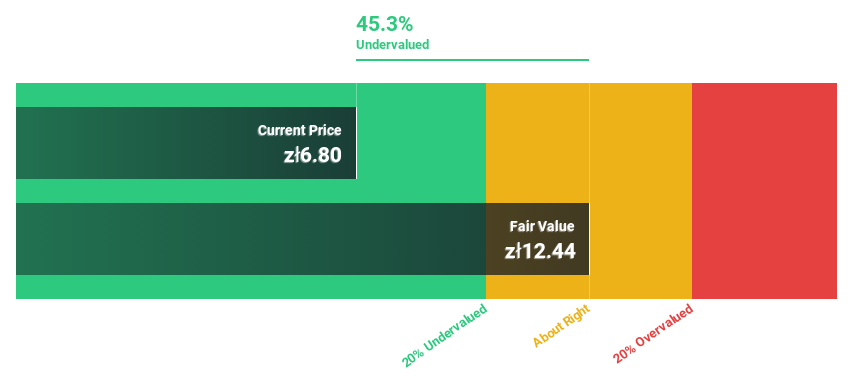

Cognor Holding (WSE:COG)

Overview: Cognor Holding S.A. is involved in the production and distribution of steel products across Poland, Czechia, Germany, and internationally, with a market cap of PLN 1.17 billion.

Operations: The company's revenue segments include Hsj at PLN 1.07 billion, Ferrostal (fer) at PLN 881.94 million, Zlomrex Metal (zlmet) at PLN 599.89 million, Jap at PLN 122.18 million, and Oms at PLN 117.12 million.

Estimated Discount To Fair Value: 45.4%

Cognor Holding, trading at PLN6.84, is significantly below its estimated fair value of PLN12.52, highlighting potential undervaluation based on cash flows. Despite recent net losses and a volatile share price, the company is forecast to achieve profitability within three years with annual earnings growth of 70.06%. Revenue growth is projected at 14% annually, outpacing the Polish market's average. However, return on equity remains low in forecasts over the same period.

- In light of our recent growth report, it seems possible that Cognor Holding's financial performance will exceed current levels.

- Click here to discover the nuances of Cognor Holding with our detailed financial health report.

Summing It All Up

- Embark on your investment journey to our 899 Undervalued Stocks Based On Cash Flows selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:COG

Cognor Holding

Engages in the production and distribution of steel products in Poland, Czechia, Germany, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives