3 Undervalued Small Caps Across Regions With Recent Insider Activity

Reviewed by Simply Wall St

In recent weeks, global markets have experienced significant volatility, with small-cap stocks notably underperforming their large-cap peers as the Russell 2000 Index dipped into correction territory. Amid concerns over inflation and political uncertainties, investors are closely monitoring economic indicators and policy developments that could impact market sentiment. In such a turbulent environment, identifying promising small-cap companies can be challenging but rewarding. A good stock in this context often exhibits strong fundamentals, resilience to economic fluctuations, and strategic insider activity that may signal confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 23.9x | 0.8x | 29.45% | ★★★★★☆ |

| Maharashtra Seamless | 9.8x | 1.7x | 37.30% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 36.30% | ★★★★★☆ |

| Avia Avian | 15.0x | 3.4x | 18.44% | ★★★★☆☆ |

| Logistri Fastighets | 12.3x | 8.7x | 43.36% | ★★★★☆☆ |

| McEwen Mining | 4.3x | 2.2x | 43.92% | ★★★★☆☆ |

| Robert Walters | 35.7x | 0.2x | 29.03% | ★★★☆☆☆ |

| ProPetro Holding | NA | 0.7x | 14.24% | ★★★☆☆☆ |

| Digital Mediatama Maxima | NA | 1.2x | 16.07% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -89.95% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

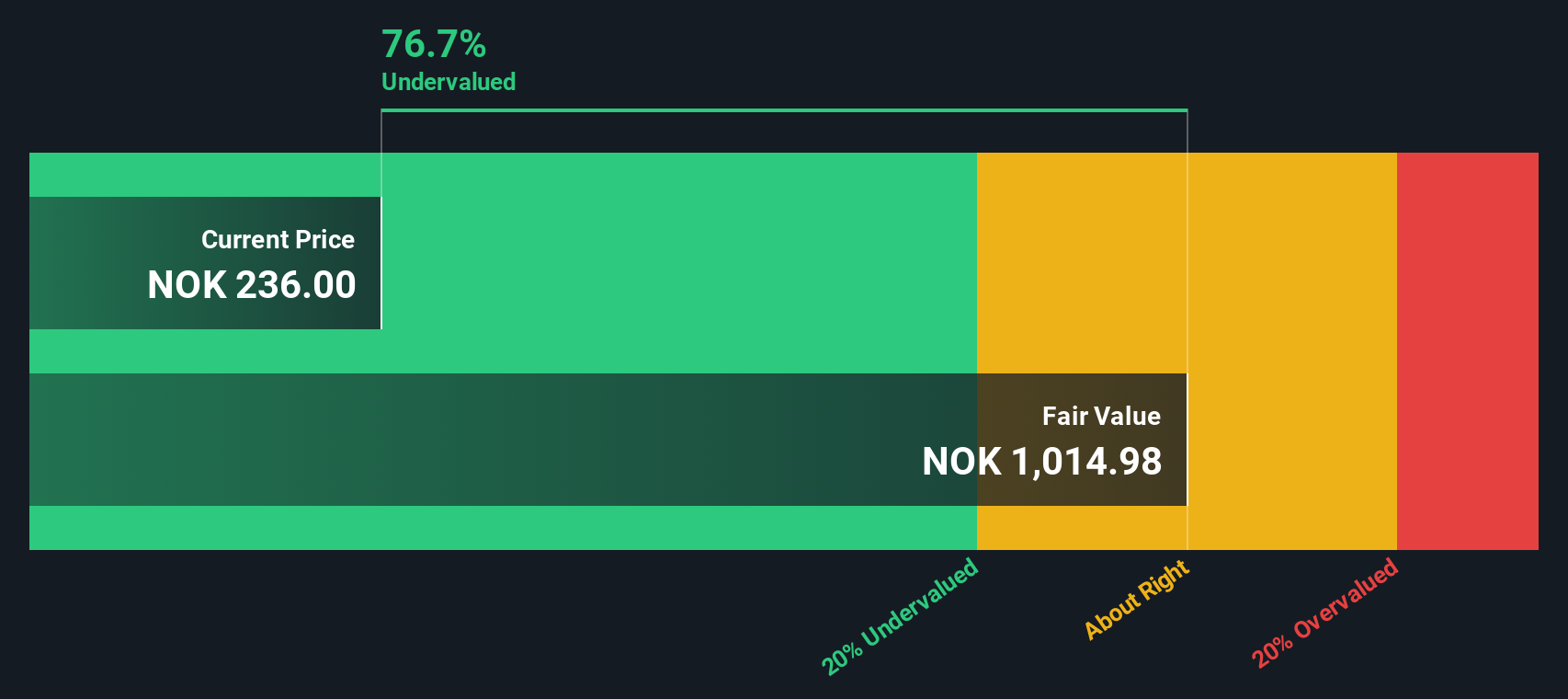

Okeanis Eco Tankers (OB:OET)

Simply Wall St Value Rating: ★★★★★☆

Overview: Okeanis Eco Tankers is a company engaged in the operation of tanker vessels, with a market capitalization of $0.64 billion.

Operations: The company's primary revenue stream is from tanker vessels, with recent revenue reported at $399.71 million. The gross profit margin has shown variability, most recently recorded at 57.99%. Operating expenses and depreciation & amortization are significant cost components impacting the net income margin, which was last noted at 29.25%.

PE: 6.8x

Okeanis Eco Tankers, a player in the shipping industry, recently reported Q3 2024 earnings with sales of US$84.93 million and net income of US$14.55 million, both down from the previous year. Despite challenges like high debt and reliance on external borrowing, insider confidence is reflected in recent share purchases over the past year. The company also declared a dividend of $0.45 per share for November 2024, indicating potential value for investors seeking dividends amidst growth prospects forecasted at 5.8% annually.

- Take a closer look at Okeanis Eco Tankers' potential here in our valuation report.

Explore historical data to track Okeanis Eco Tankers' performance over time in our Past section.

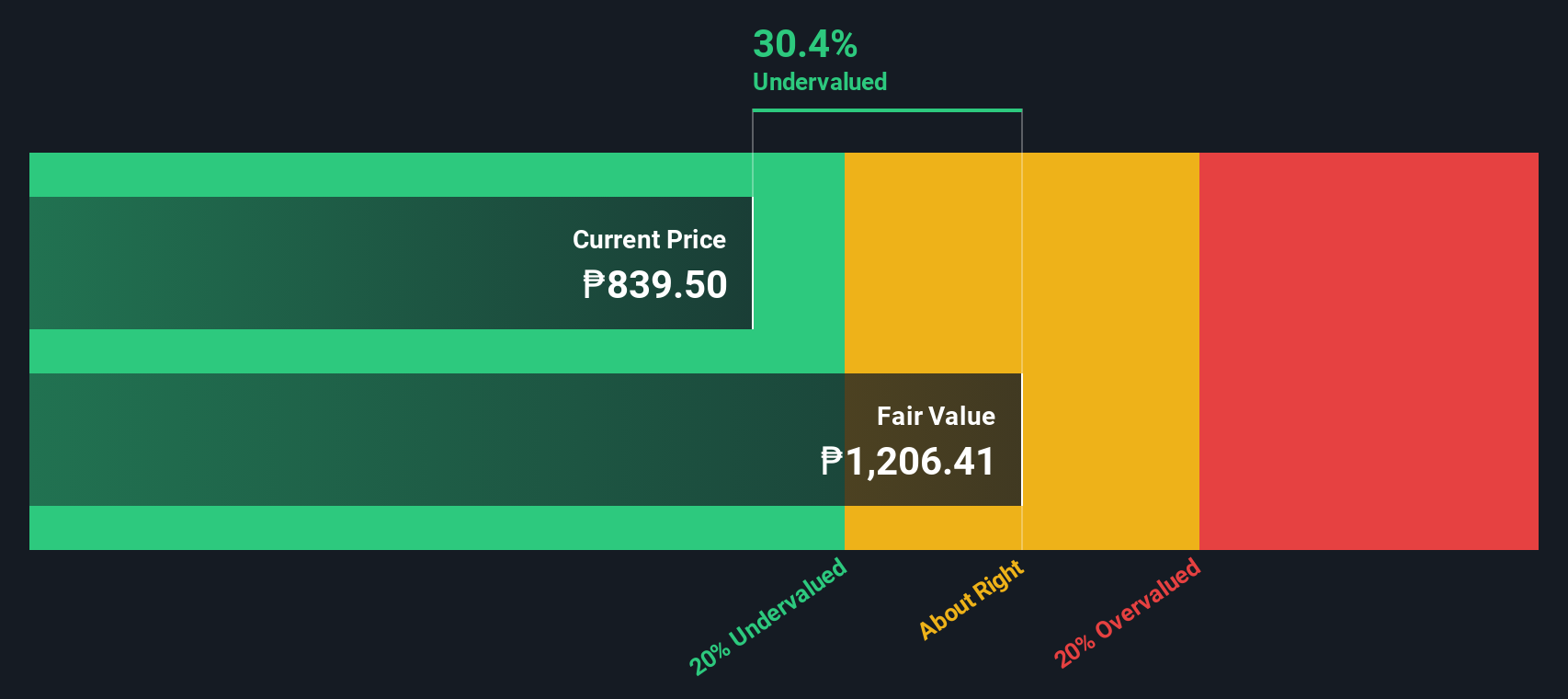

Far Eastern University (PSE:FEU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Far Eastern University operates as an educational institution in the Philippines, offering undergraduate and graduate programs with a market capitalization of ₱10.92 billion.

Operations: FEU generates revenue primarily through its operations, with recent figures reaching ₱5.60 billion as of November 2024. The company's cost structure includes a significant portion allocated to the cost of goods sold (COGS), which was approximately ₱2.35 billion in the same period. Notably, FEU's net profit margin has shown variability, with a recent figure at 35.34%.

PE: 9.5x

Far Eastern University, a smaller company, has shown growth with second-quarter revenue at PHP 1.72 billion, up from PHP 1.59 billion the previous year, and net income rising to PHP 729.58 million from PHP 664.71 million. Insider confidence is evident as Anthony Raymond Goquingco increased their stake by purchasing shares valued at approximately PHP 236,300 in October 2024. Despite relying on external borrowing for funding, recent earnings suggest potential for continued performance improvements within its sector context.

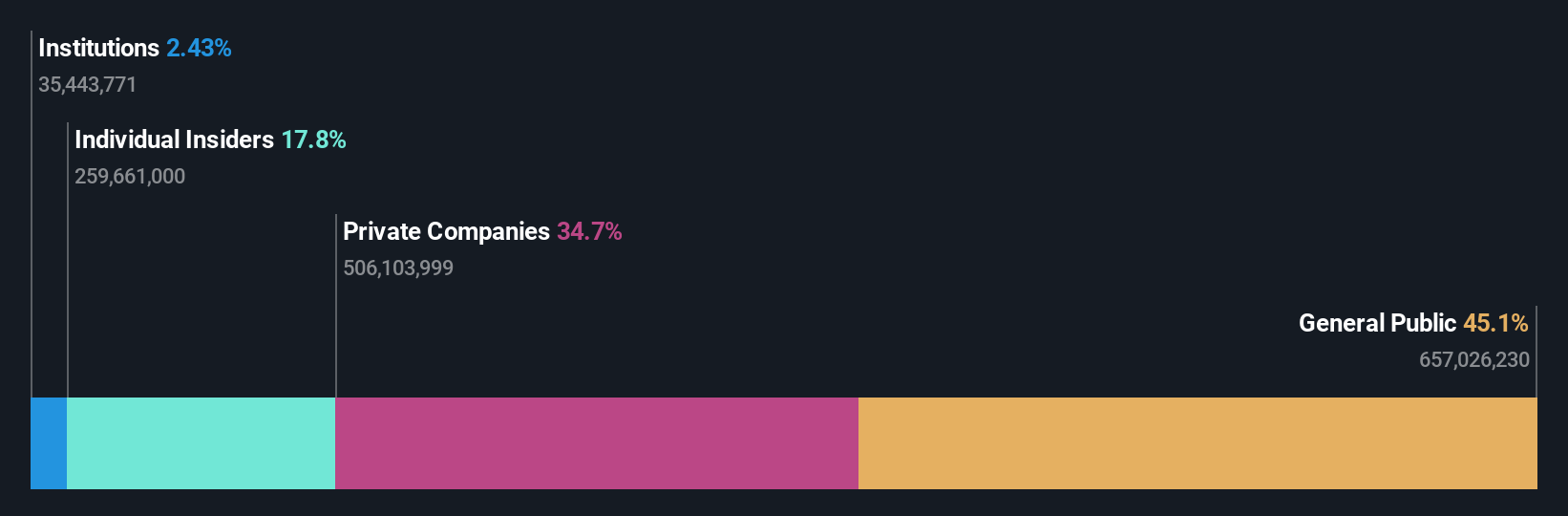

China XLX Fertiliser (SEHK:1866)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China XLX Fertiliser is a company engaged in the production and sale of chemical fertilizers and related products, with a market capitalization of CN¥7.77 billion.

Operations: The company's primary revenue streams include Urea and Compound Fertiliser, contributing significantly to its total earnings. Over recent periods, the gross profit margin has shown fluctuations, reaching a high of 24.49% in September 2021 before decreasing to 18.83% by June 2024. Operating expenses have consistently impacted profitability, with notable allocations towards sales and marketing as well as general and administrative costs.

PE: 4.1x

China XLX Fertiliser, a smaller company in the fertiliser industry, has caught attention with insider confidence reflected through share purchases over the past year. Despite facing high debt levels due to reliance on external borrowing, the company is positioned for growth with earnings projected to increase by 11.59% annually. A recent board meeting on October 30, 2024, highlighted their commitment to transparency as they announced unaudited Q3 results. Future prospects appear promising amidst these dynamics.

- Dive into the specifics of China XLX Fertiliser here with our thorough valuation report.

Understand China XLX Fertiliser's track record by examining our Past report.

Key Takeaways

- Gain an insight into the universe of 179 Undervalued Small Caps With Insider Buying by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1866

China XLX Fertiliser

An investment holding company, engages in the development, manufacture, and sale of urea primarily in Mainland China and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives