- Hong Kong

- /

- Auto Components

- /

- SEHK:1899

Exploring 3 Undervalued Small Caps With Insider Action In Global Markets

Reviewed by Simply Wall St

Amidst a backdrop of rising inflation and volatile treasury yields, global markets have shown mixed performance, with small-cap stocks underperforming compared to their larger counterparts. As investors navigate these uncertain times, identifying opportunities in undervalued small-cap stocks can be appealing, especially when insider activity suggests potential confidence in the company's prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 17.8x | 1.5x | 28.99% | ★★★★★☆ |

| Maharashtra Seamless | 10.2x | 1.6x | 47.72% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 24.81% | ★★★★★☆ |

| Gamma Communications | 22.9x | 2.4x | 33.35% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 11.6x | 1.8x | 22.46% | ★★★★☆☆ |

| Logistri Fastighets | 12.6x | 8.9x | 36.22% | ★★★★☆☆ |

| Franchise Brands | 40.6x | 2.1x | 22.04% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 47.04% | ★★★★☆☆ |

| Fourlis Holdings | 8.3x | 0.4x | -195.34% | ★★★☆☆☆ |

| Mukand | 14.7x | 0.3x | 5.61% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

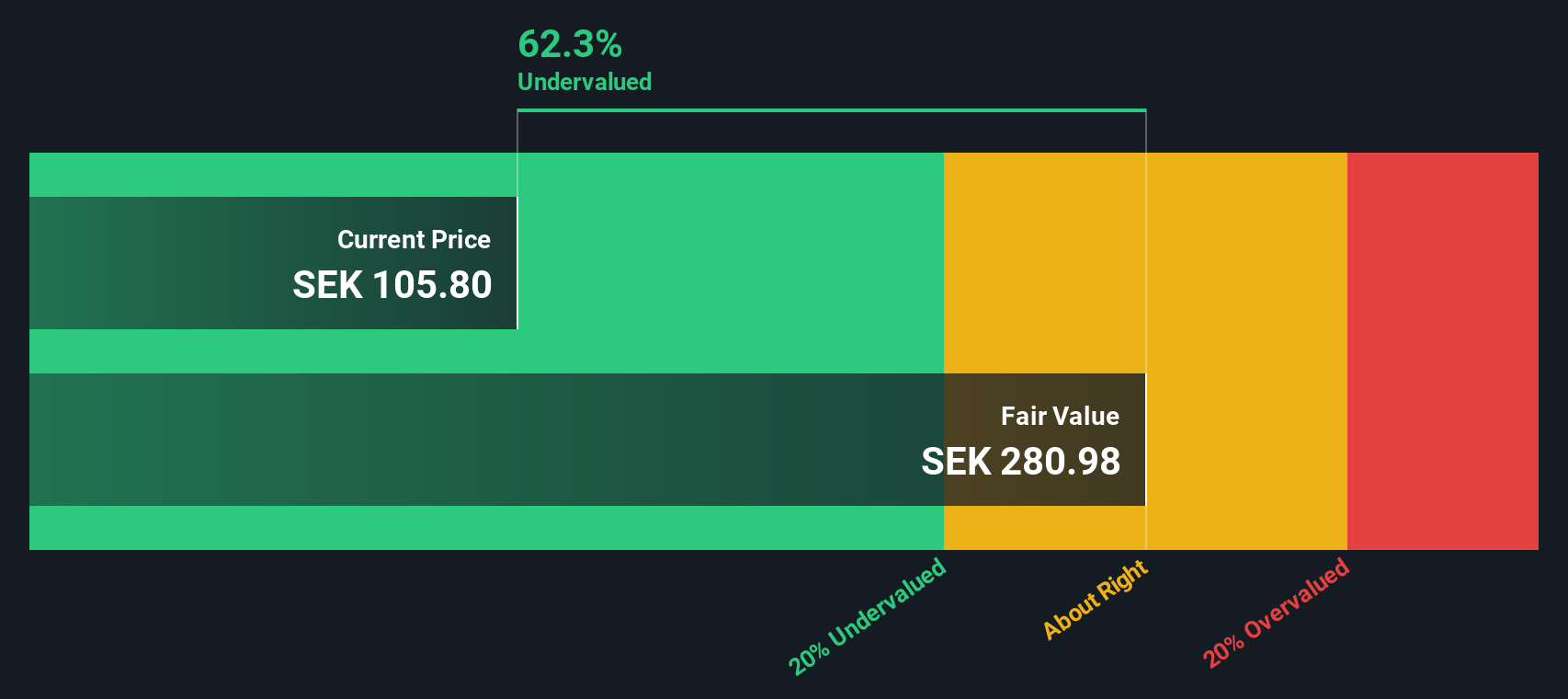

Proact IT Group (OM:PACT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Proact IT Group is a leading independent integrator in data center and cloud services, operating across regions including the Nordics & Baltics, UK, West (Belgium and Netherlands), and Central (Czech Republic and Germany), with a market capitalization of SEK 3.21 billion.

Operations: The company generates revenue primarily from its operations in the Nordics & Baltics, UK, West (Belgium and Netherlands), and Central (Czech Republic and Germany) regions. The gross profit margin has shown a notable trend, reaching 24.84% by the end of 2024. Operating expenses include significant allocations to sales & marketing and general & administrative functions.

PE: 15.8x

Proact IT Group, a smaller company in the tech sector, recently reported Q4 2024 earnings with revenue at SEK 1,268.5 million and net income of SEK 50.3 million, both down from last year. Despite this dip, insider confidence is evident through share purchases over the past year. The board proposed a dividend increase to SEK 2.40 per share for May 2025. CEO Jonas Hasselberg announced his resignation after significantly growing Proact's revenue and profits during his tenure.

- Navigate through the intricacies of Proact IT Group with our comprehensive valuation report here.

Gain insights into Proact IT Group's past trends and performance with our Past report.

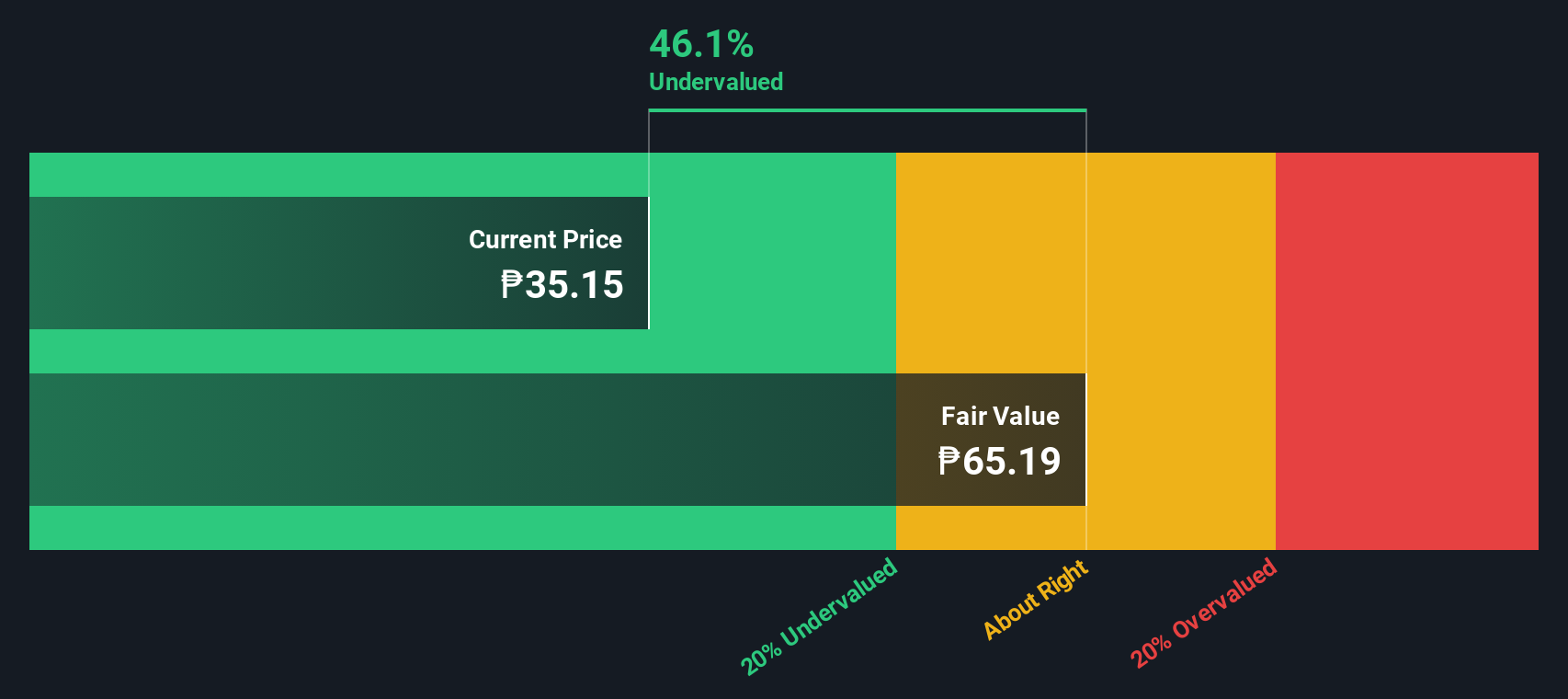

Puregold Price Club (PSE:PGOLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Puregold Price Club operates a retailing business, focusing on supermarket and hypermarket formats, with a market capitalization of ₱92.86 billion.

Operations: The company's primary revenue stream is its retailing business, generating ₱211.71 billion. Cost of goods sold (COGS) significantly impacts profitability, with gross profit margins fluctuating between 16.23% and 18.42% over recent periods. Operating expenses are a substantial component of costs, including general and administrative expenses that have reached ₱17.61 billion in the latest period analyzed.

PE: 8.5x

Puregold Price Club, a prominent player in the retail sector, attracts attention due to its potential for growth with earnings forecasted to rise by 10.8% annually. Despite relying entirely on external borrowing for funding, which poses higher risk compared to customer deposits, insider confidence is evident through recent share purchases. This reflects optimism about future prospects. The company recently appointed a new Vice President for Operations and approved its 2025 management plans and budget during board meetings in early 2025.

Xingda International Holdings (SEHK:1899)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xingda International Holdings is a company that specializes in the production of radial tire cords, bead wires, and other wires, with a market cap of CN¥3.45 billion.

Operations: The company's revenue primarily comes from the sale of radial tire cords, bead wires, and other wires, totaling CN¥12.24 billion. Over recent periods, the gross profit margin has shown fluctuations, with a notable decrease to 19.46% in the latest period from a higher percentage in previous years. Operating expenses have been significant but relatively stable around CN¥1.64 billion recently, impacting net income margins which have also varied over time but currently stand at 3.67%.

PE: 5.3x

Xingda International Holdings, a company with recent insider confidence, saw significant share purchases by insiders over the past six months. The firm approved a special dividend of HK$0.15 per share to be paid on February 21, 2025, reflecting strong retained earnings management. However, its debt is not well covered by operating cash flow and relies entirely on external borrowing for funding. Recent M&A activity includes Liu Jinlan acquiring an additional 26.41% stake for approximately HK$660 million in November 2024.

Make It Happen

- Access the full spectrum of 182 Undervalued Small Caps With Insider Buying by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1899

Xingda International Holdings

An investment holding company, manufactures and trades in radial tire cords, bead wires, and other wires in the People's Republic of China, India, the United States, Thailand, Romania, Slovakia, Brazil, and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)