- New Zealand

- /

- Logistics

- /

- NZSE:MFT

With EPS Growth And More, Mainfreight (NZSE:MFT) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Mainfreight (NZSE:MFT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Mainfreight with the means to add long-term value to shareholders.

Check out our latest analysis for Mainfreight

Mainfreight's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Mainfreight's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 39%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

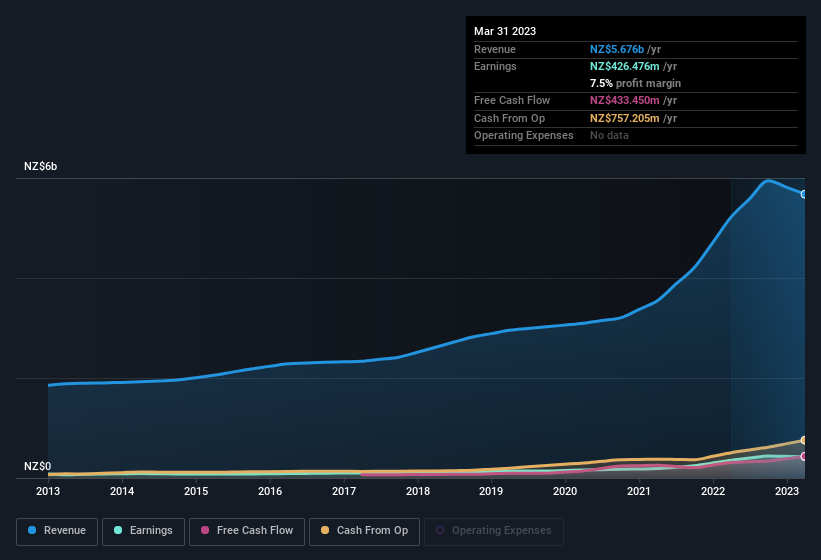

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Mainfreight shareholders can take confidence from the fact that EBIT margins are up from 15% to 17%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Mainfreight's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Mainfreight Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold NZ$799k worth of shares. But that's far less than the NZ$7.2m insiders spent purchasing stock. This bodes well for Mainfreight as it highlights the fact that those who are important to the company having a lot of faith in its future. It is also worth noting that it was Founding Owner & Executive Chairman Bruce Plested who made the biggest single purchase, worth NZ$3.5m, paying NZ$69.49 per share.

Along with the insider buying, another encouraging sign for Mainfreight is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth NZ$1.1b. This totals to 18% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Should You Add Mainfreight To Your Watchlist?

Mainfreight's earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Mainfreight belongs near the top of your watchlist. Now, you could try to make up your mind on Mainfreight by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that Mainfreight is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:MFT

Mainfreight

Provides supply chain logistics services in New Zealand, Australia, the Americas, Europe, and Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives