December 2024's Noteworthy Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

As global markets continue to reach record highs, with indices like the Dow Jones and S&P 500 soaring, investors are navigating a landscape shaped by geopolitical developments and economic reports. Amidst this robust market performance, identifying stocks that remain undervalued presents a unique opportunity for those looking to capitalize on potential growth. In such an environment, a good stock is often characterized by solid fundamentals and resilience against broader market volatility, offering value beyond its current price point.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.01 | US$99.93 | 50% |

| HangzhouS MedTech (SHSE:688581) | CN¥62.38 | CN¥124.04 | 49.7% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1118.85 | ₹2224.27 | 49.7% |

| Bank BTPN Syariah (IDX:BTPS) | IDR900.00 | IDR1786.71 | 49.6% |

| Iguatemi (BOVESPA:IGTI3) | R$2.26 | R$4.49 | 49.7% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| AirBoss of America (TSX:BOS) | CA$4.05 | CA$8.05 | 49.7% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.25 | HK$54.11 | 49.6% |

| Genesis Minerals (ASX:GMD) | A$2.41 | A$4.82 | 50% |

| Akeso (SEHK:9926) | HK$66.50 | HK$132.38 | 49.8% |

Let's dive into some prime choices out of the screener.

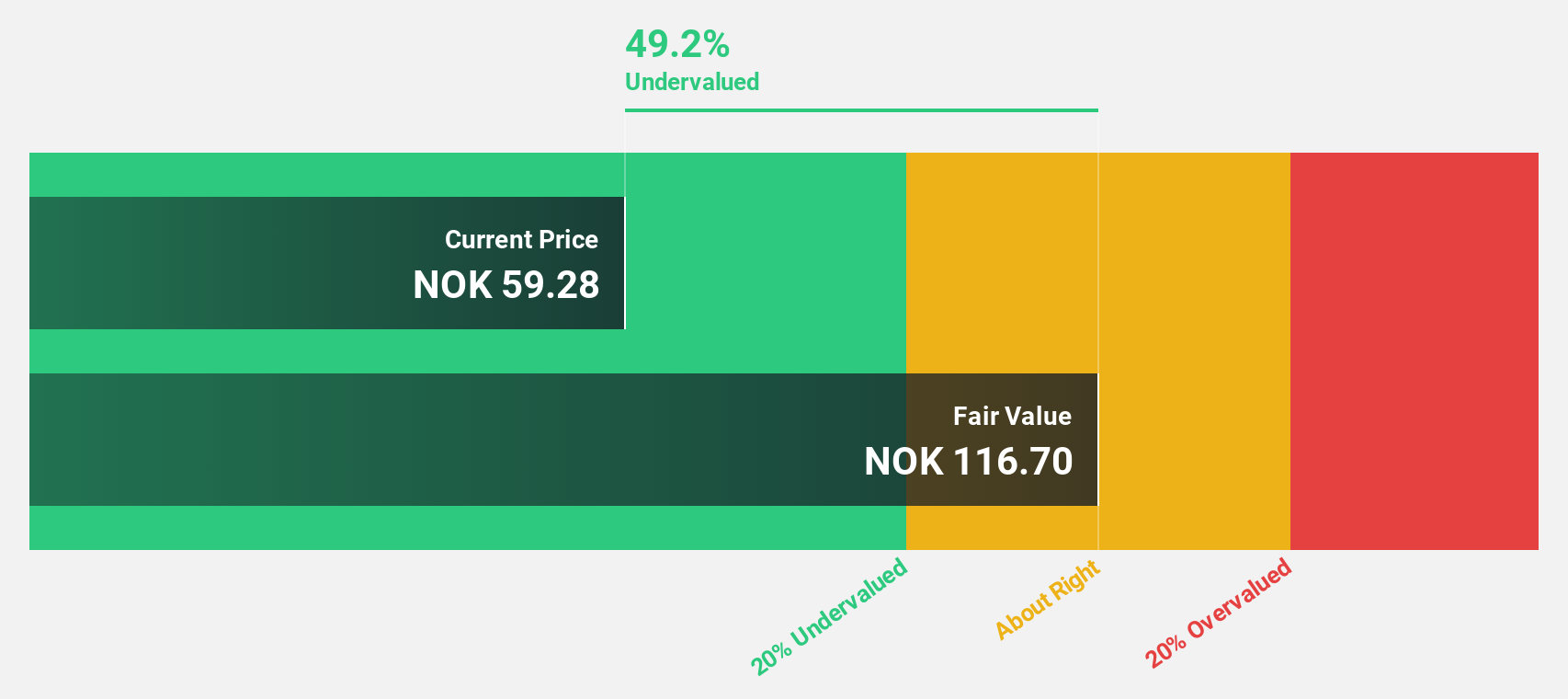

Norsk Hydro (OB:NHY)

Overview: Norsk Hydro ASA operates in power production, bauxite extraction, alumina refining, aluminium smelting, and recycling activities while providing extruded solutions globally, with a market cap of NOK138.39 billion.

Operations: The company's revenue segments include Hydro Energy (NOK10.46 billion), Hydro Extrusions (NOK75.70 billion), Hydro Metal Markets (NOK79.03 billion), Hydro Aluminium Metal (NOK54.21 billion), and Hydro Bauxite & Alumina (NOK46.36 billion).

Estimated Discount To Fair Value: 42.1%

Norsk Hydro appears undervalued, trading 42.1% below estimated fair value at NOK69.68 compared to a fair value of NOK120.42. Despite recent earnings challenges, with net profit margins decreasing from 3.3% to 0.7%, the company is forecasted for significant earnings growth of 48.7% annually over the next three years, outpacing the Norwegian market's growth rate of 9.2%. Recent share buybacks totaling NOK170.83 million may enhance shareholder value further.

- In light of our recent growth report, it seems possible that Norsk Hydro's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Norsk Hydro.

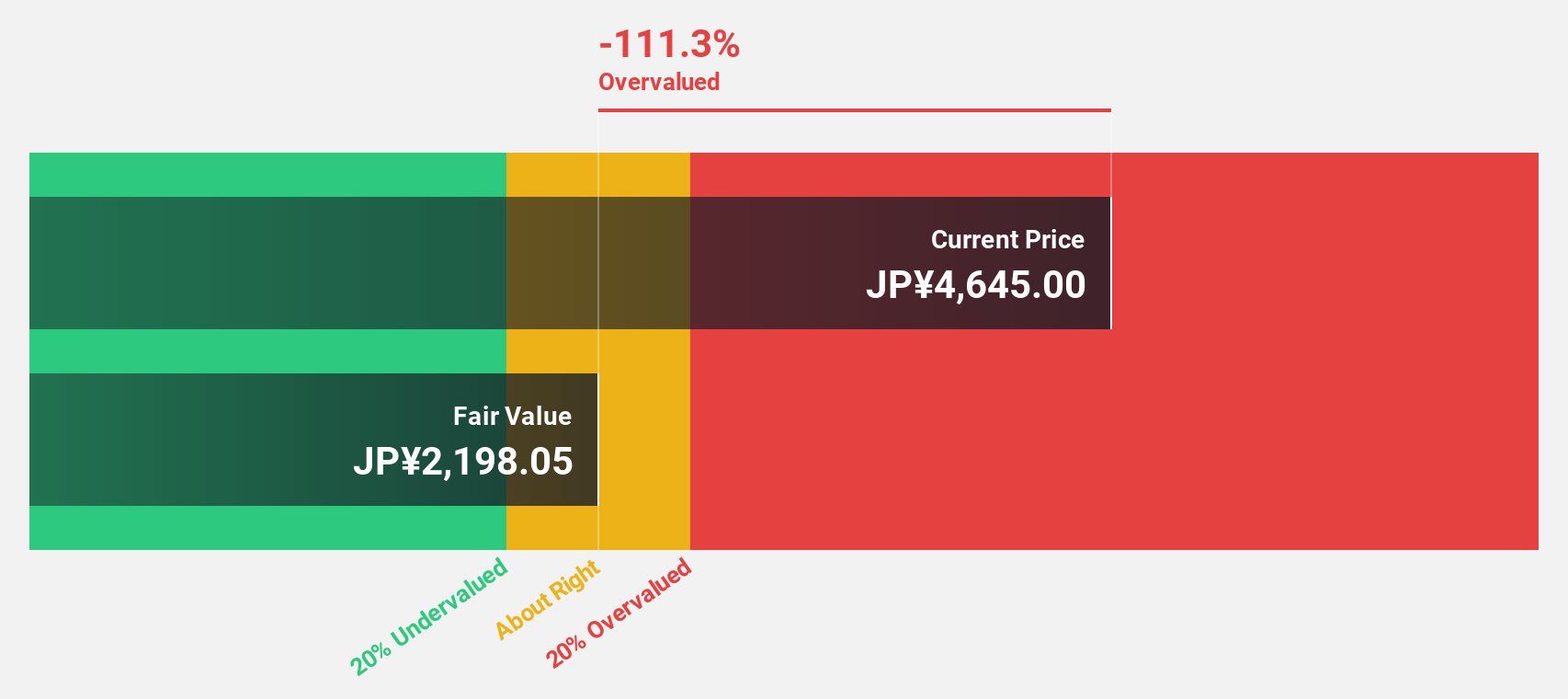

Money Forward (TSE:3994)

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan with a market cap of approximately ¥273.96 billion.

Operations: Revenue segments include Platform Services Business, generating ¥38.47 billion.

Estimated Discount To Fair Value: 42.8%

Money Forward is trading significantly below its estimated fair value of ¥8,763.49 at ¥5,017, suggesting it may be undervalued based on cash flows. Despite a volatile share price and current operating losses projected between ¥1.9 billion to ¥3.9 billion for the fiscal year ending November 2024, revenue growth is expected at 19.7% annually—outpacing the JP market's 4.2%. The company anticipates profitability within three years amidst strategic shifts like subsidiary consolidation.

- Insights from our recent growth report point to a promising forecast for Money Forward's business outlook.

- Dive into the specifics of Money Forward here with our thorough financial health report.

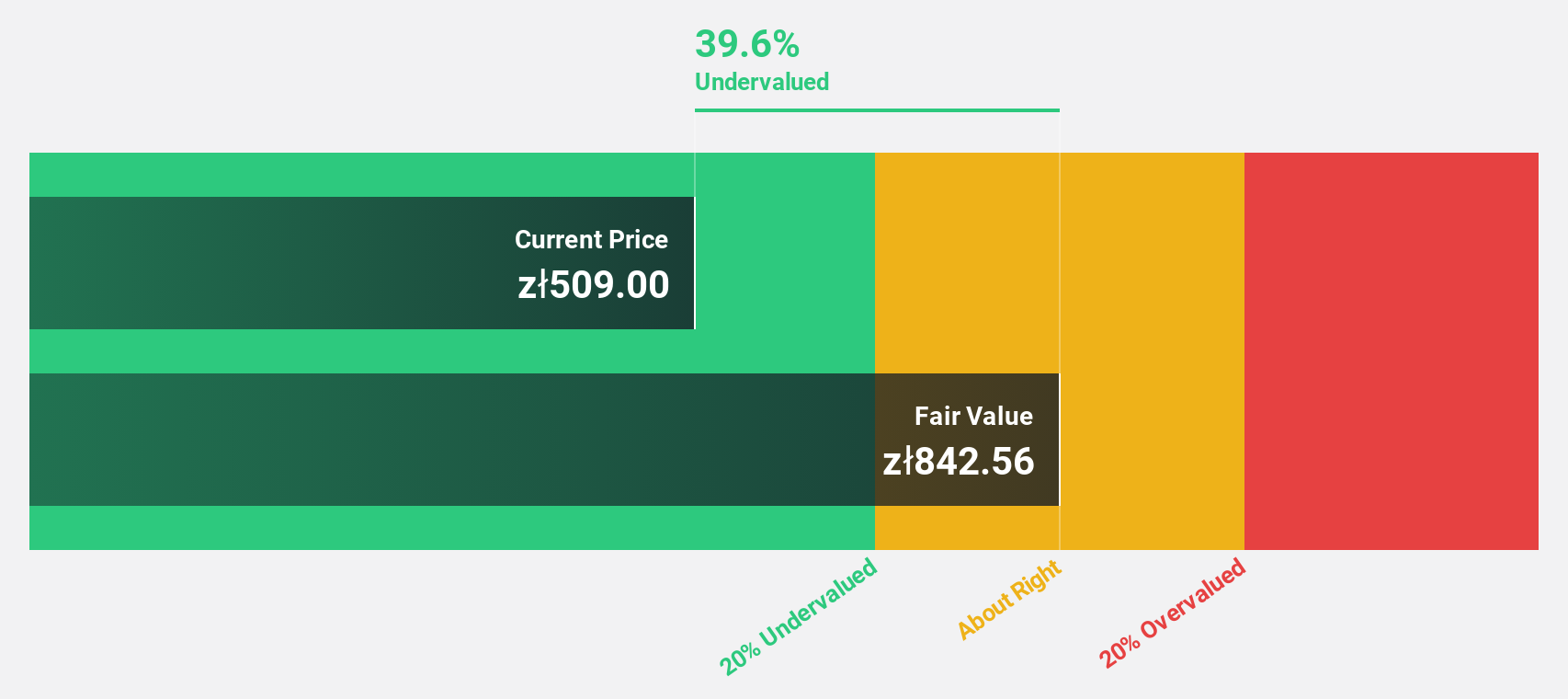

Dino Polska (WSE:DNP)

Overview: Dino Polska S.A. operates a network of mid-sized grocery supermarkets under the Dino brand in Poland and has a market cap of PLN39.10 billion.

Operations: Dino Polska generates its revenue through a network of mid-sized grocery supermarkets across Poland.

Estimated Discount To Fair Value: 39.8%

Dino Polska, trading at PLN 398.8, is below its estimated fair value of PLN 662.99, highlighting potential undervaluation based on cash flows. The company reported Q3 sales of PLN 7.61 billion and net income of PLN 438.21 million, showing solid growth from the previous year. With revenue forecasted to grow faster than the Polish market at 14.6% annually and earnings expected to rise by 18.2%, Dino Polska presents a compelling investment case amidst robust financial performance.

- According our earnings growth report, there's an indication that Dino Polska might be ready to expand.

- Click to explore a detailed breakdown of our findings in Dino Polska's balance sheet health report.

Seize The Opportunity

- Click this link to deep-dive into the 893 companies within our Undervalued Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3994

Money Forward

Provides financial solutions for individuals, financial institutions, and corporations primarily in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives