It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Orkla (OB:ORK). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Orkla

Orkla's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Orkla managed to grow EPS by 9.0% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

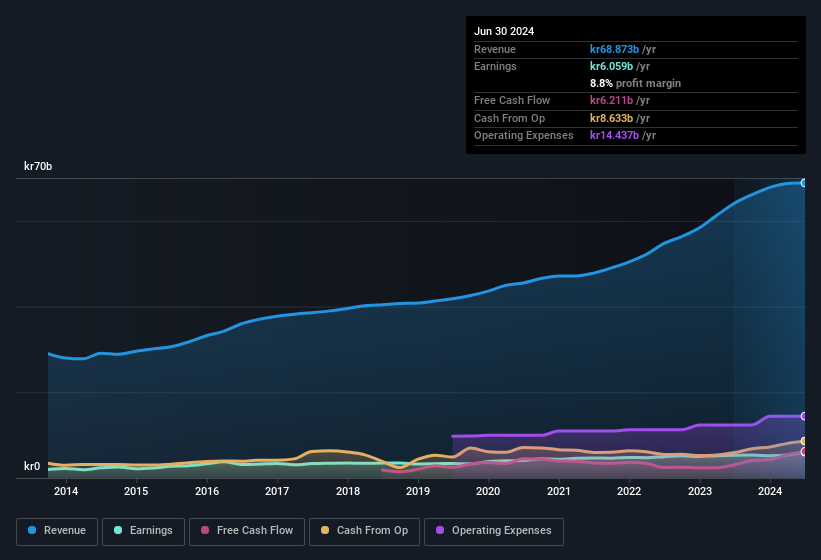

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Orkla maintained stable EBIT margins over the last year, all while growing revenue 7.4% to kr69b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Orkla's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Orkla Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Orkla insiders walking the walk, by spending kr4.0m on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the Group Director of Finance & CFO, Arve Regland, who made the biggest single acquisition, paying kr1.6m for shares at about kr82.42 each.

Does Orkla Deserve A Spot On Your Watchlist?

As previously touched on, Orkla is a growing business, which is encouraging. It's not easy for business to grow EPS, but Orkla has shown the strengths to do just that. The eye-catcher here is the reecnt insider share acquisitions which are undoubtedly enough to entice some investors to keep watch for the future. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Orkla.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Orkla, you'll probably love this curated collection of companies in NO that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ORK

Orkla

Operates as an industrial investment company within brands and consumer-oriented businesses in Norway, Sweden, Denmark, Finland, Iceland, the Baltics, rest of Europe, and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives