- Norway

- /

- Oil and Gas

- /

- OB:OKEA

Need To Know: Analysts Just Made A Substantial Cut To Their OKEA ASA (OB:OKEA) Estimates

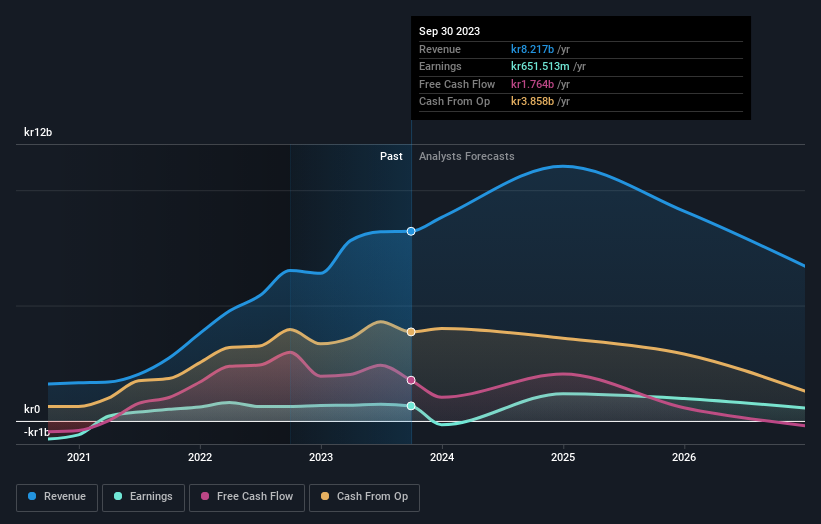

One thing we could say about the analysts on OKEA ASA (OB:OKEA) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

After the downgrade, the five analysts covering OKEA are now predicting revenues of kr11b in 2024. If met, this would reflect a huge 34% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to bounce 81% to kr11.37. Previously, the analysts had been modelling revenues of kr13b and earnings per share (EPS) of kr14.07 in 2024. Indeed, we can see that the analysts are a lot more bearish about OKEA's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for OKEA

The consensus price target fell 18% to kr38.00, with the weaker earnings outlook clearly leading analyst valuation estimates.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that OKEA's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 27% growth on an annualised basis. This is compared to a historical growth rate of 43% over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue shrink 5.5% per year. So it's clear that despite the slowdown in growth, OKEA is still expected to grow meaningfully faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Sadly they also cut their revenue estimates, although at least the company is expected to perform a bit better than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of OKEA.

Uncomfortably, our automated valuation tool also suggests that OKEA stock could be overvalued following the downgrade. Shareholders could be left disappointed if these estimates play out. Learn why, and examine the assumptions that underpin our valuation by visiting our free platform here to learn more about our valuation approach.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:OKEA

OKEA

An oil and gas company, engages in the development and production of oil and gas in the Norwegian Continental Shelf.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)