Here's Why SpareBank 1 Sør-Norge (OB:SB1NO) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like SpareBank 1 Sør-Norge (OB:SB1NO), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for SpareBank 1 Sør-Norge

How Fast Is SpareBank 1 Sør-Norge Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that SpareBank 1 Sør-Norge's EPS has grown 20% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

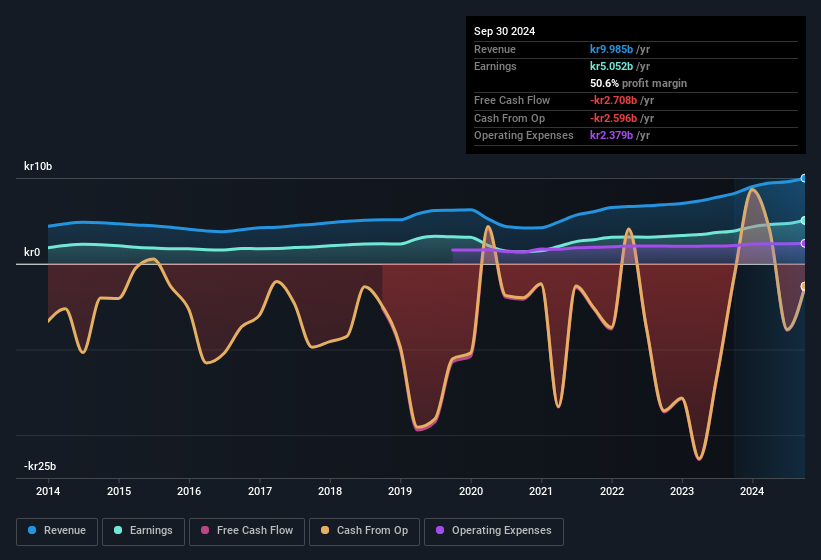

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of SpareBank 1 Sør-Norge's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for SpareBank 1 Sør-Norge remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 22% to kr10.0b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of SpareBank 1 Sør-Norge's forecast profits?

Are SpareBank 1 Sør-Norge Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did SpareBank 1 Sør-Norge insiders refrain from selling stock during the year, but they also spent kr2.1m buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. It is also worth noting that it was Chief Executive Officer Inge Reinertsen who made the biggest single purchase, worth kr1.3m, paying kr134 per share.

Does SpareBank 1 Sør-Norge Deserve A Spot On Your Watchlist?

For growth investors, SpareBank 1 Sør-Norge's raw rate of earnings growth is a beacon in the night. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. To put it succinctly; SpareBank 1 Sør-Norge is a strong candidate for your watchlist. What about risks? Every company has them, and we've spotted 1 warning sign for SpareBank 1 Sør-Norge you should know about.

The good news is that SpareBank 1 Sør-Norge is not the only stock with insider buying. Here's a list of small cap, undervalued companies in NO with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SB1NO

SpareBank 1 Sør-Norge

Provides various financial products and services for personal and corporate customers in Norway.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives