- Netherlands

- /

- Capital Markets

- /

- ENXTAM:VLK

Top Dividend Stocks On Euronext Amsterdam July 2024

Reviewed by Simply Wall St

As global markets navigate through fluctuating trade tensions and economic indicators, investors are increasingly focusing on stable returns, making dividend stocks a compelling option. In the context of Euronext Amsterdam, selecting top-performing dividend stocks can offer a blend of reliability and potential growth amidst current market dynamics.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Acomo (ENXTAM:ACOMO) | 6.45% | ★★★★★☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.23% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.47% | ★★★★☆☆ |

| Van Lanschot Kempen (ENXTAM:VLK) | 9.82% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.10% | ★★★★☆☆ |

| Koninklijke KPN (ENXTAM:KPN) | 3.99% | ★★★★☆☆ |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.64% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

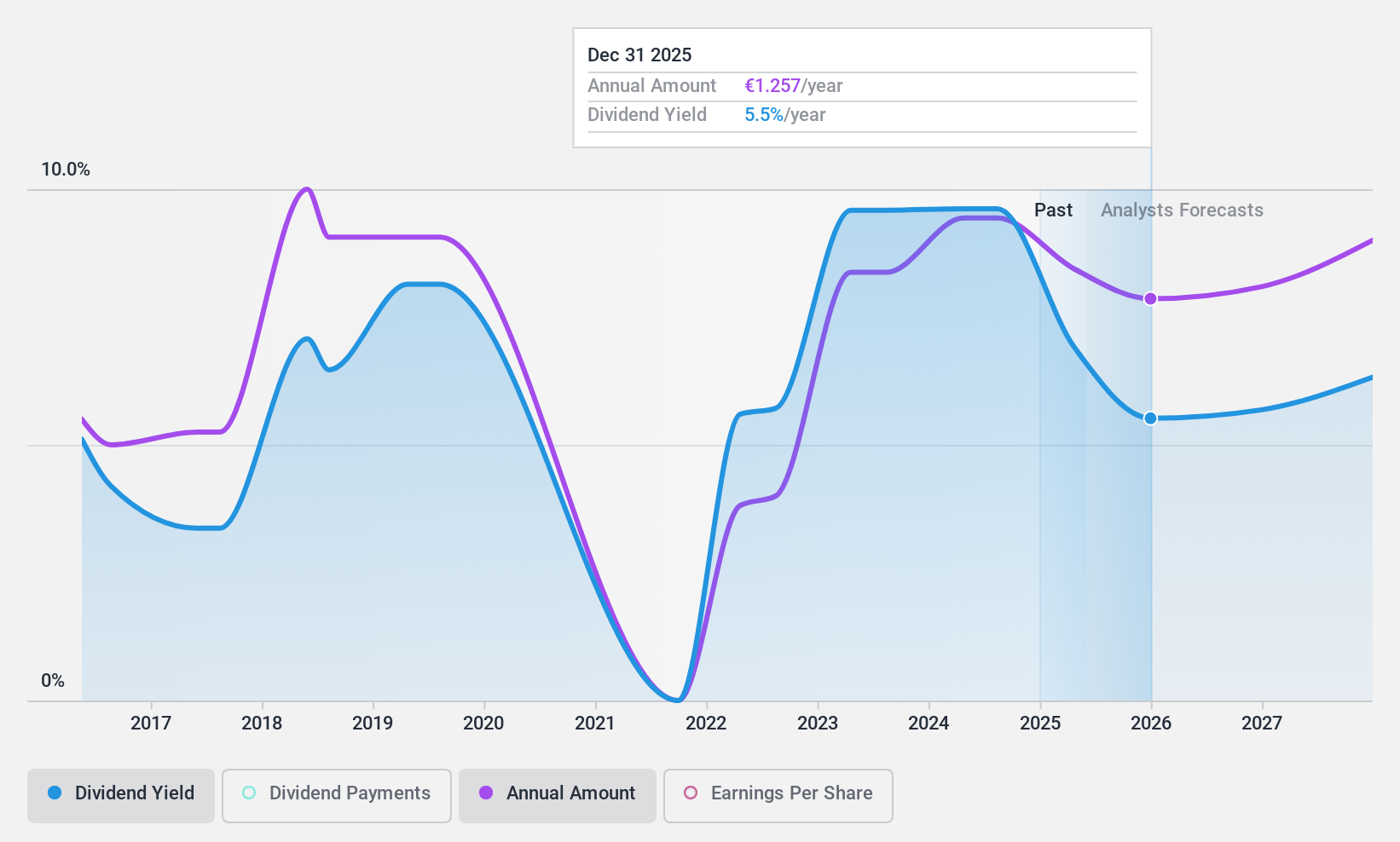

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and globally, with a market capitalization of approximately €13.63 billion.

Operations: ABN AMRO Bank N.V. generates its revenue primarily through three key segments: Corporate Banking at €3.50 billion, Personal & Business Banking at €4.07 billion, and Wealth Management at €1.59 billion.

Dividend Yield: 9.2%

ABN AMRO Bank, despite a top 25% dividend yield in the Dutch market at 9.23%, shows a mixed performance as a dividend stock. Its dividends, only distributed for the past 8 years, have been unstable and unreliable with significant annual fluctuations exceeding 20%. However, its payout ratio remains modest at 47.9%, suggesting earnings adequately cover dividends currently and are projected to remain so over the next three years. Recent strategic moves include expanding into Germany's wealth management sector through acquisitions, potentially influencing future financial stability and dividend capacity.

- Navigate through the intricacies of ABN AMRO Bank with our comprehensive dividend report here.

- Our valuation report here indicates ABN AMRO Bank may be undervalued.

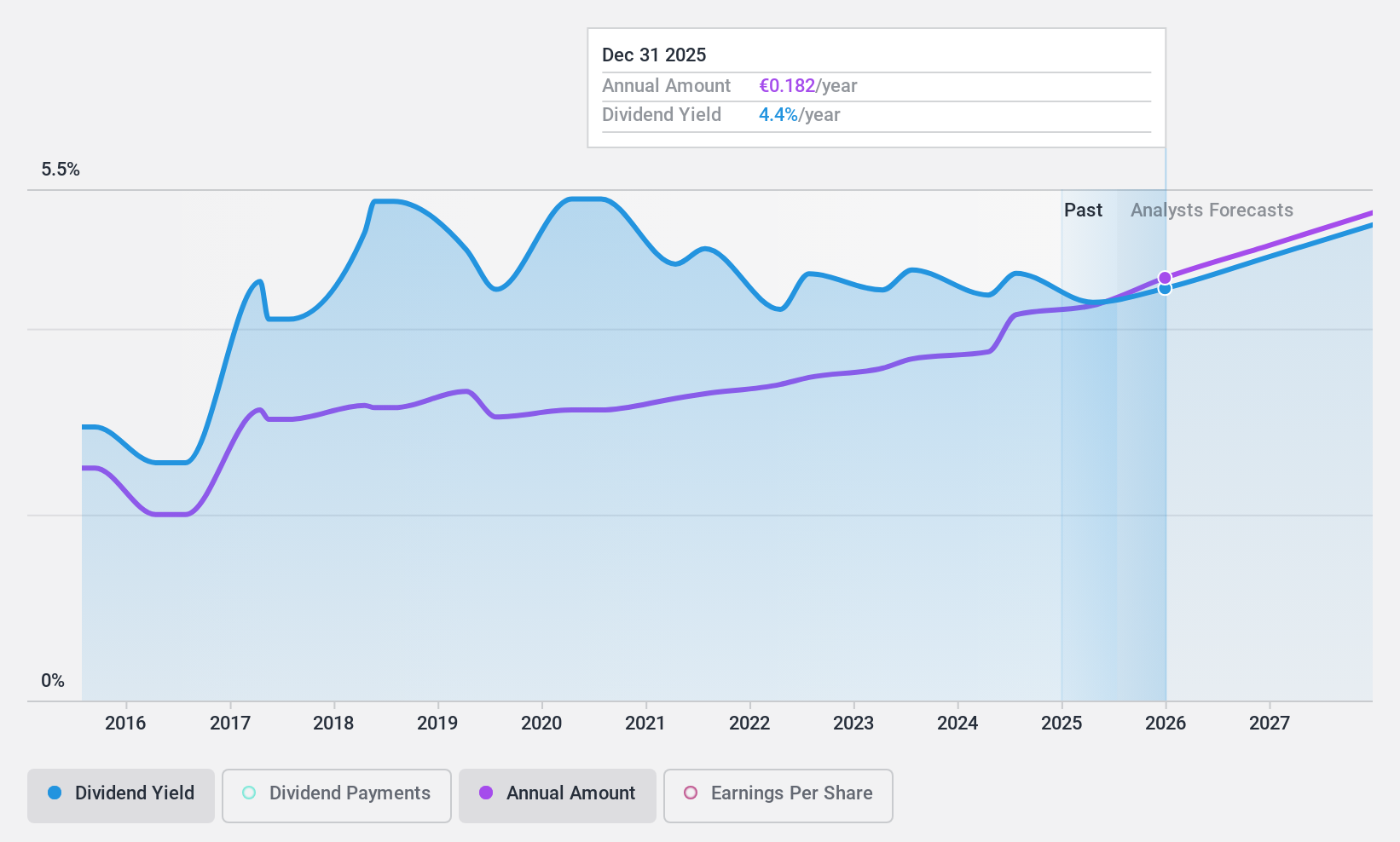

Koninklijke KPN (ENXTAM:KPN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. is a telecommunications and IT service provider in the Netherlands, with a market capitalization of approximately €14.79 billion.

Operations: Koninklijke KPN N.V. generates revenue through three primary segments: Business (€1.84 billion), Consumer (€2.93 billion), and Wholesale (€0.70 billion).

Dividend Yield: 4%

Koninklijke KPN has demonstrated a mix of strategic initiatives and financial transactions that underscore its complex position as a dividend stock. Recently, KPN engaged in significant business expansions, notably acquiring 5G spectrum licenses for €58.4 million and forming TowerCo with ABP, enhancing its infrastructure capabilities. Despite these growth efforts, the company's dividends have shown volatility over the past decade with an unstable track record. Financially, while KPN's dividends are covered by both earnings and cash flows with payout ratios of 78.4% and 59.6% respectively, its overall debt level remains high which could influence future sustainability and reliability of dividend payments.

- Take a closer look at Koninklijke KPN's potential here in our dividend report.

- Our valuation report unveils the possibility Koninklijke KPN's shares may be trading at a discount.

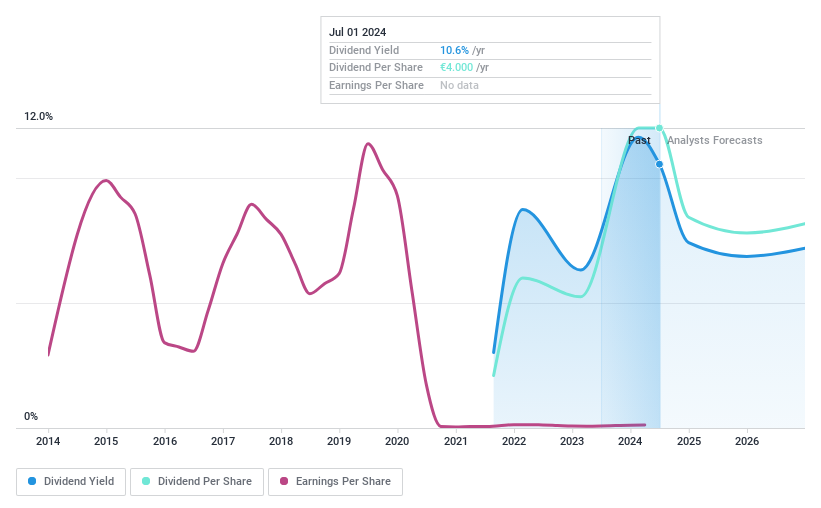

Van Lanschot Kempen (ENXTAM:VLK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Van Lanschot Kempen NV is a financial services provider operating both in the Netherlands and internationally, with a market capitalization of approximately €1.72 billion.

Operations: Van Lanschot Kempen NV generates revenue through its Investment Banking Clients and Wholesale & Institutional Clients segments, contributing €41 million and €83.10 million respectively.

Dividend Yield: 9.8%

Van Lanschot Kempen, with a dividend yield of 9.82%, ranks in the top 25% of Dutch dividend payers. Despite its attractive Price-To-Earnings ratio of 13.1x, below the market average, VLK's history as a dividend payer is short at only three years, casting some uncertainty on the sustainability of its dividends. However, earnings have grown by 81.8% over the past year and dividends are well-covered by earnings with a payout ratio of 70.9%. Recently, VLK completed a share buyback program for €22.66 million which may reflect positively on shareholder value but does not directly impact dividend payments.

- Dive into the specifics of Van Lanschot Kempen here with our thorough dividend report.

- According our valuation report, there's an indication that Van Lanschot Kempen's share price might be on the cheaper side.

Summing It All Up

- Click this link to deep-dive into the 7 companies within our Top Euronext Amsterdam Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:VLK

Van Lanschot Kempen

Provides various financial services in the Netherlands and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives