- Netherlands

- /

- Beverage

- /

- ENXTAM:CCEP

The Return Trends At Coca-Cola Europacific Partners (AMS:CCEP) Look Promising

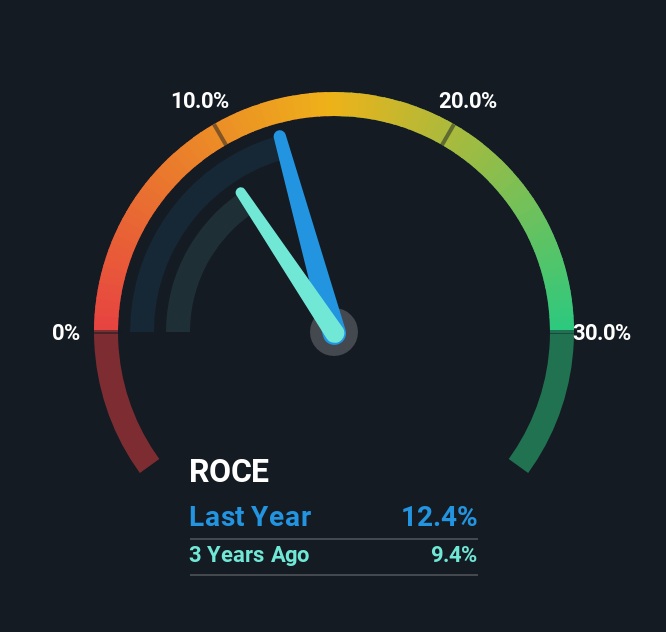

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So when we looked at Coca-Cola Europacific Partners (AMS:CCEP) and its trend of ROCE, we really liked what we saw.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Coca-Cola Europacific Partners, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = €2.7b ÷ (€32b - €9.7b) (Based on the trailing twelve months to June 2025).

So, Coca-Cola Europacific Partners has an ROCE of 12%. In absolute terms, that's a pretty normal return, and it's somewhat close to the Beverage industry average of 11%.

Check out our latest analysis for Coca-Cola Europacific Partners

In the above chart we have measured Coca-Cola Europacific Partners' prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Coca-Cola Europacific Partners .

What Does the ROCE Trend For Coca-Cola Europacific Partners Tell Us?

The trends we've noticed at Coca-Cola Europacific Partners are quite reassuring. Over the last five years, returns on capital employed have risen substantially to 12%. Basically the business is earning more per dollar of capital invested and in addition to that, 47% more capital is being employed now too. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

The Key Takeaway

To sum it up, Coca-Cola Europacific Partners has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. Since the stock has returned a staggering 136% to shareholders over the last five years, it looks like investors are recognizing these changes. Therefore, we think it would be worth your time to check if these trends are going to continue.

One more thing to note, we've identified 1 warning sign with Coca-Cola Europacific Partners and understanding it should be part of your investment process.

While Coca-Cola Europacific Partners isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:CCEP

Coca-Cola Europacific Partners

Produces, distributes, and sells a range of non-alcoholic ready to drink beverages.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026