- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

Top 3 Dividend Stocks On Euronext Amsterdam In October 2024

Reviewed by Simply Wall St

As the European Central Bank continues to cut rates, stimulating expectations for further monetary easing, the Dutch market has been experiencing a rise in major stock indexes. In this environment, dividend stocks on Euronext Amsterdam present an appealing option for investors seeking steady income streams amidst evolving economic conditions.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.44% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.16% | ★★★★☆☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.85% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.96% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.36% | ★★★★☆☆ |

| ING Groep (ENXTAM:INGA) | 7.05% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.71% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of €12.77 billion.

Operations: ABN AMRO Bank's revenue is primarily derived from Personal & Business Banking (€4.02 billion), Corporate Banking (€3.46 billion), and Wealth Management (€1.55 billion).

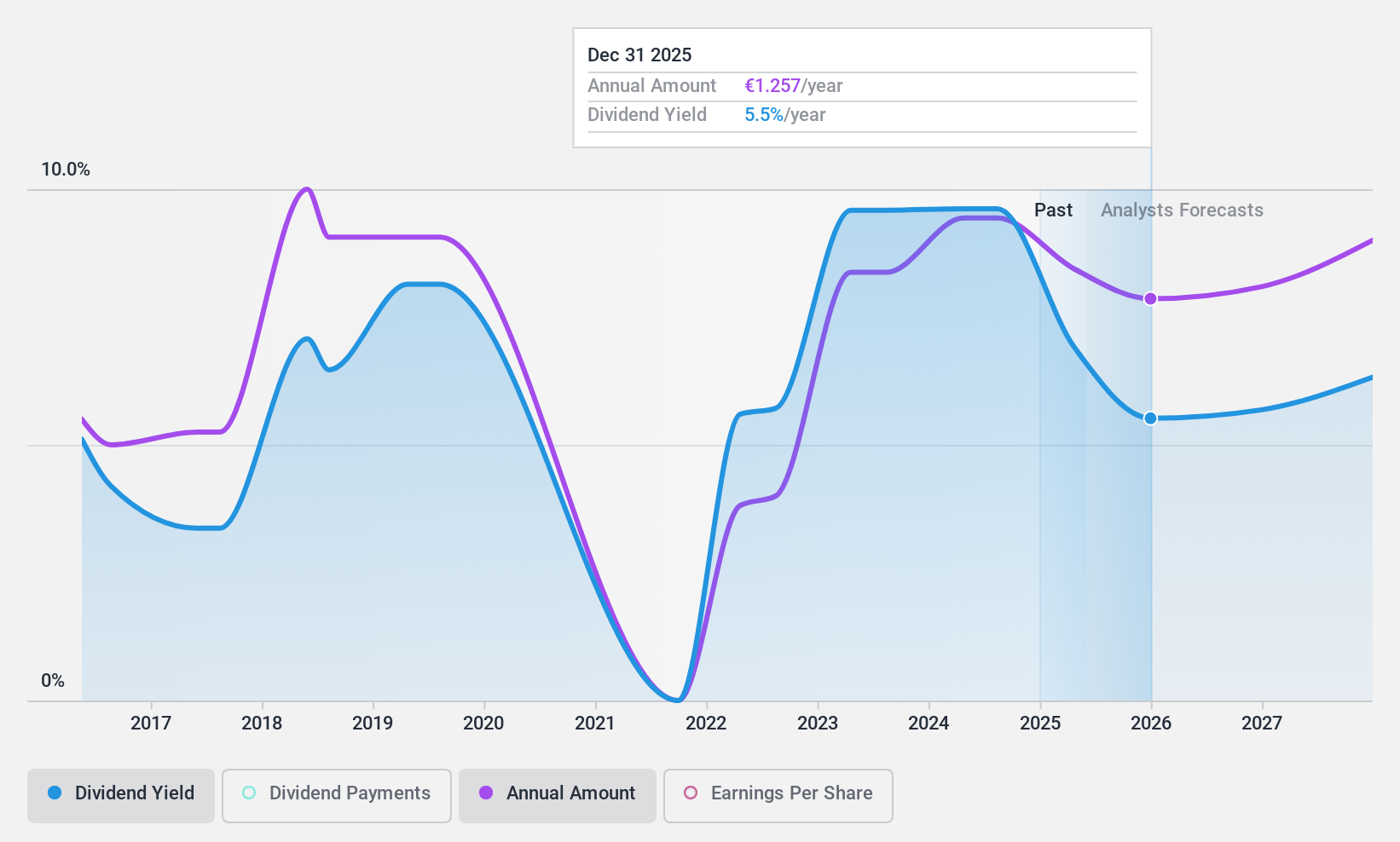

Dividend Yield: 9.8%

ABN AMRO Bank's dividend yield is among the highest in the Dutch market, yet its dividend history has been volatile over the past nine years. Despite recent earnings growth, future earnings are forecasted to decline, which could impact dividend reliability. The bank's payout ratio of 50.5% suggests dividends are currently sustainable and expected to remain covered by earnings in three years at 47.1%. However, a low allowance for bad loans may pose risks to financial stability.

- Navigate through the intricacies of ABN AMRO Bank with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that ABN AMRO Bank is trading behind its estimated value.

Signify (ENXTAM:LIGHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. is a company that offers lighting products, systems, and services across Europe, the Americas, and globally with a market cap of €2.81 billion.

Operations: Signify N.V.'s revenue segments include Conventional lighting, which generated €519 million.

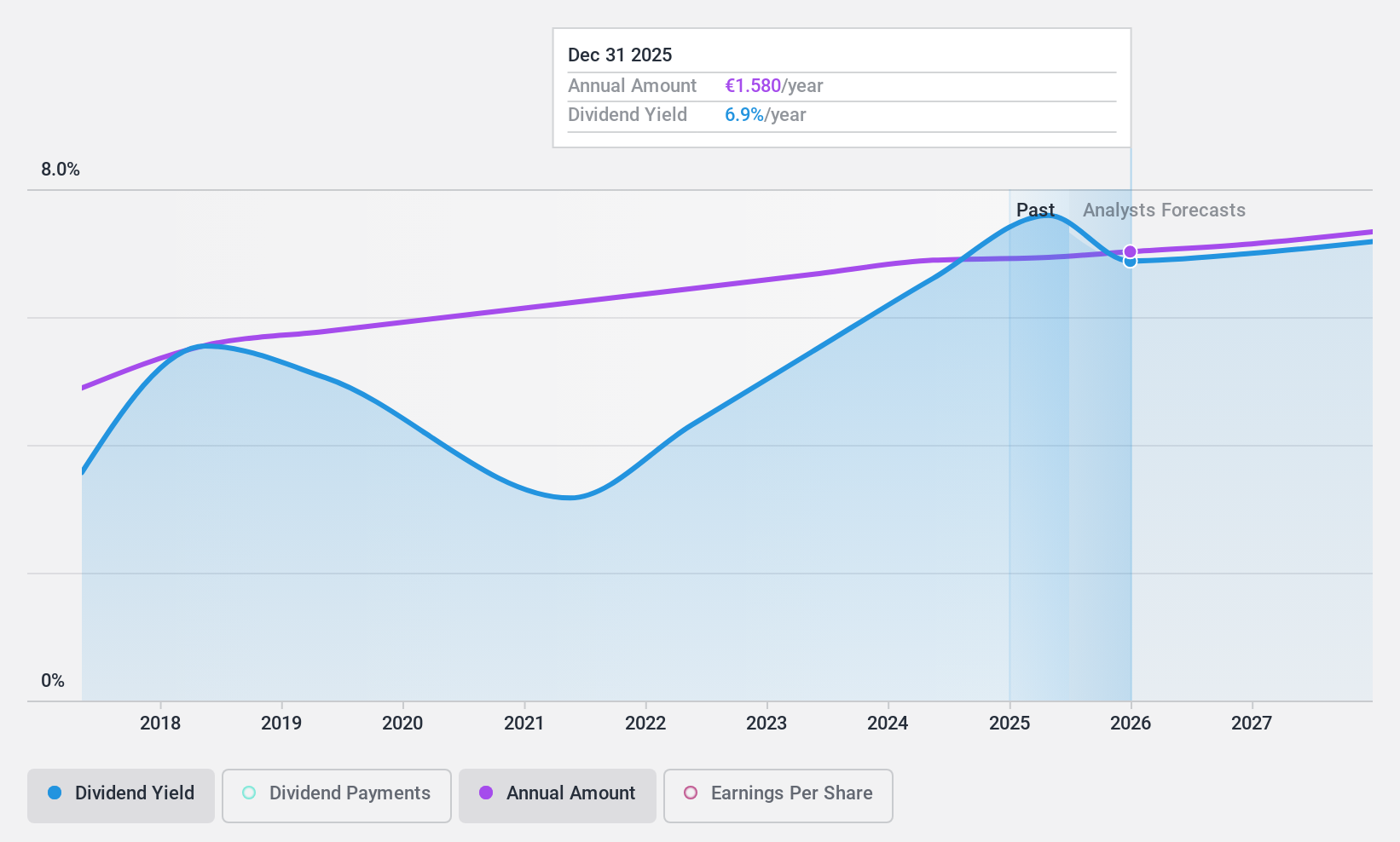

Dividend Yield: 7.0%

Signify's dividend yield ranks in the top quartile of Dutch payers, yet its eight-year history reveals volatility and unreliability. Despite a high payout ratio of 80.4%, dividends are supported by earnings and cash flows, with a low cash payout ratio of 34.2%. Recent earnings growth is notable; however, its removal from the FTSE All-World Index may affect investor perception. Trading significantly below estimated fair value could indicate potential undervaluation despite unstable dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Signify.

- Our valuation report here indicates Signify may be undervalued.

Randstad (ENXTAM:RAND)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. offers solutions in work and human resources services, with a market cap of €7.75 billion.

Operations: Randstad N.V.'s revenue is derived from its offerings in the work and human resources services sector.

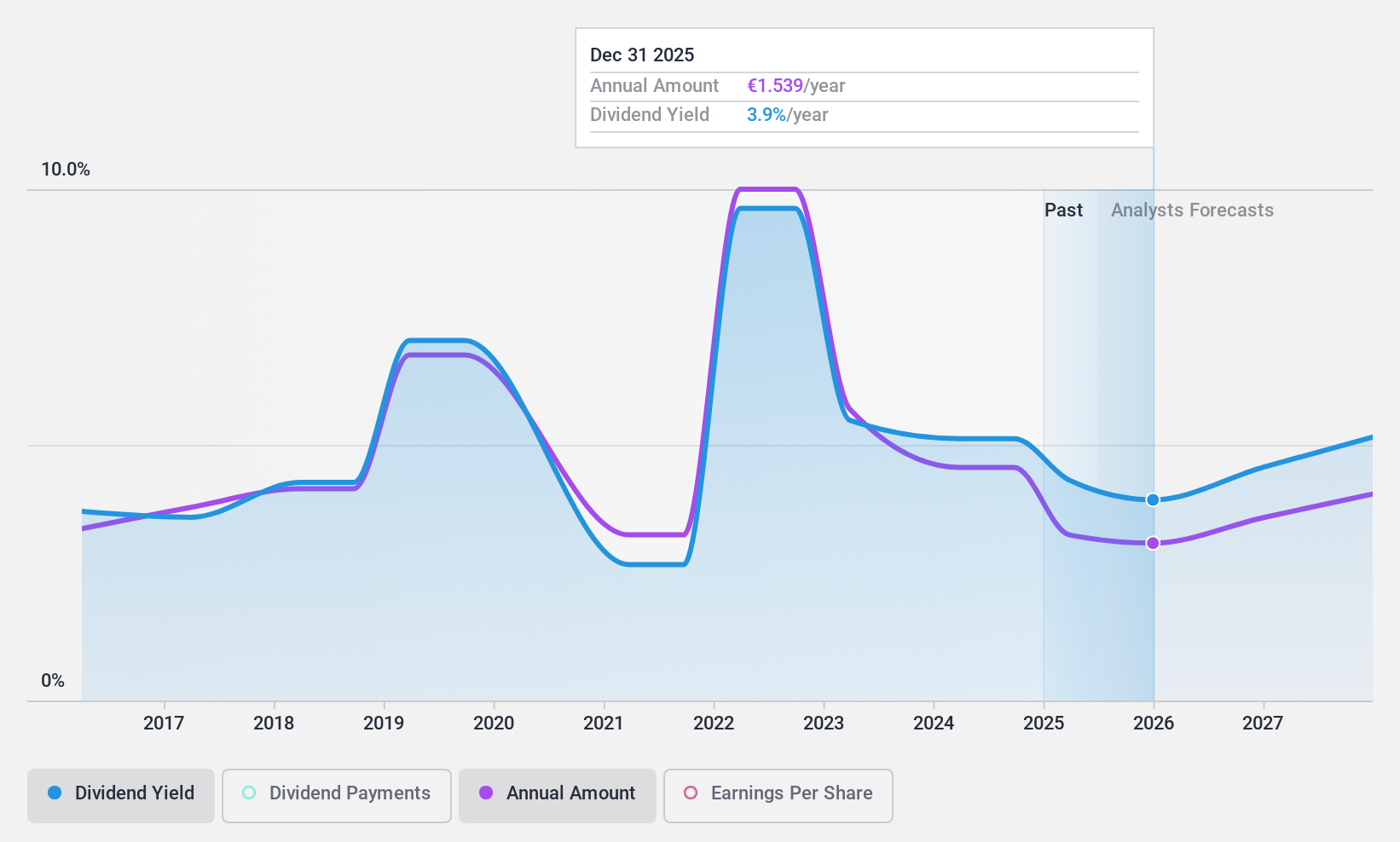

Dividend Yield: 5.2%

Randstad's dividend yield is below the top 25% of Dutch payers, and its track record over the past decade shows volatility and unreliability. Despite a high payout ratio of 81.3%, dividends are covered by earnings and cash flows, with a reasonable cash payout ratio of 51.5%. Recent earnings reports show declining net income and sales compared to last year, potentially impacting future payouts. Randstad's shares trade significantly below estimated fair value, suggesting potential undervaluation amidst these challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of Randstad.

- The valuation report we've compiled suggests that Randstad's current price could be quite moderate.

Next Steps

- Unlock our comprehensive list of 7 Top Euronext Amsterdam Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ABN AMRO Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands, rest of Europe, the United States, Asia, and internationally.

Good value with adequate balance sheet and pays a dividend.