Stock Analysis

- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

3 High Yield Dividend Stocks From Euronext Amsterdam Offering Up To 9.9%

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets and heightened trade tensions, the Netherlands' stock market remains a point of interest for investors seeking stable returns. Dividend stocks, particularly those offering high yields, stand out as attractive options in the current economic environment where value seems to be gaining an edge over growth.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| ABN AMRO Bank (ENXTAM:ABN) | 9.14% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.43% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.11% | ★★★★☆☆ |

| Van Lanschot Kempen (ENXTAM:VLK) | 9.94% | ★★★★☆☆ |

| Koninklijke KPN (ENXTAM:KPN) | 4.12% | ★★★★☆☆ |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.78% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.61% | ★★★★☆☆ |

We'll examine a selection from our screener results.

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and globally, with a market capitalization of €13.77 billion.

Operations: ABN AMRO Bank N.V. generates its revenue primarily through three segments: Corporate Banking (€3.50 billion), Wealth Management (€1.59 billion), and Personal & Business Banking (€4.07 billion).

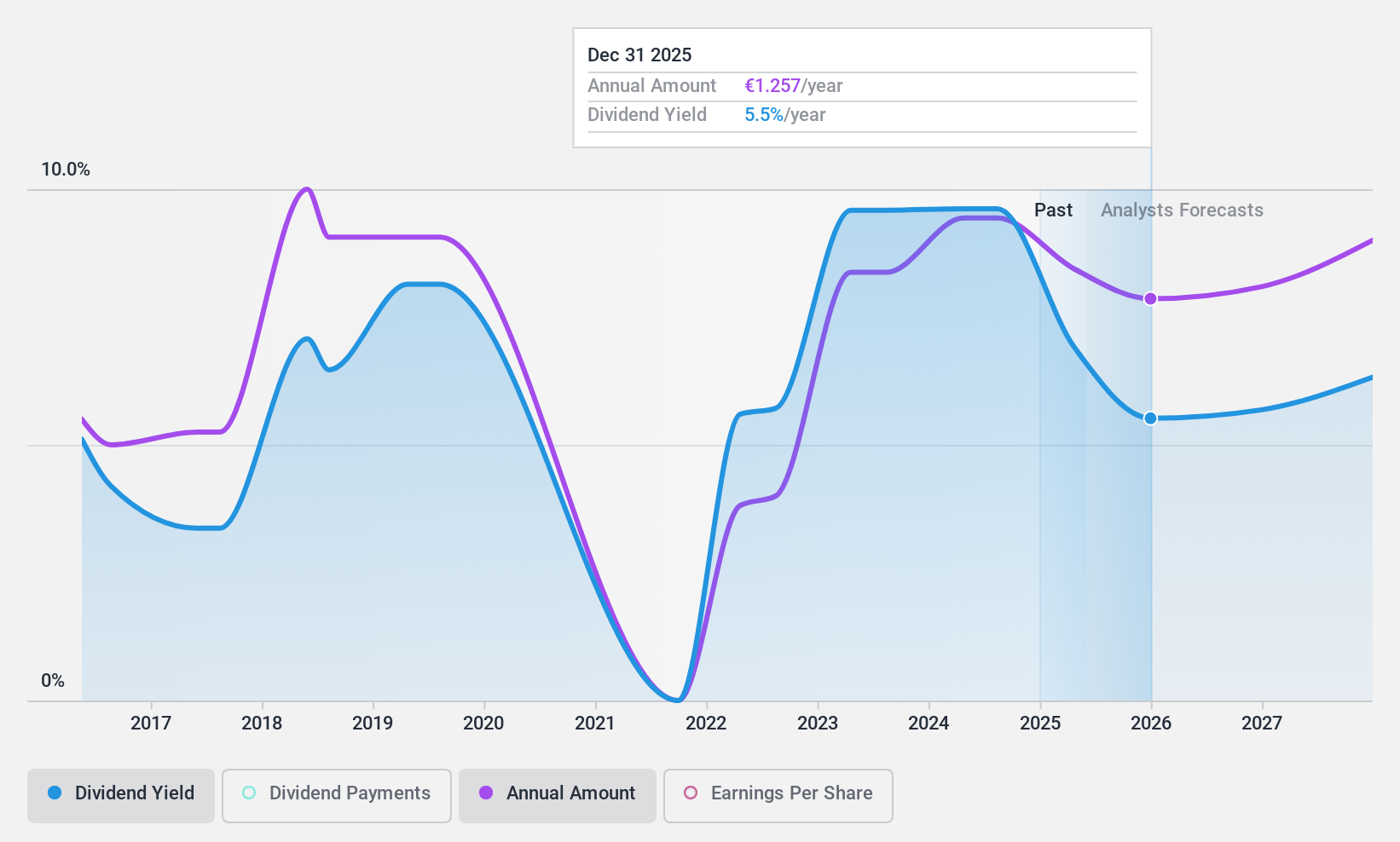

Dividend Yield: 9.1%

ABN AMRO Bank's dividend profile is nuanced, with a relatively low payout ratio of 47.9%, suggesting that dividends are well-covered by earnings despite a history of volatility in payments. Recent strategic expansions into Germany's wealth management sector could influence future financial stability and asset management growth, potentially impacting dividend sustainability. However, the bank's dividends are considered unstable due to historical fluctuations and a short track record of less than 10 years in consistent dividend payments. Additionally, while the stock trades below estimated fair value, earnings are expected to decline over the next three years, posing risks to ongoing dividend reliability and growth.

- Click to explore a detailed breakdown of our findings in ABN AMRO Bank's dividend report.

- Our valuation report unveils the possibility ABN AMRO Bank's shares may be trading at a discount.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. is a company based in the Netherlands that operates in property development, construction, and infrastructure sectors, with a market capitalization of approximately €631.75 million.

Operations: Koninklijke Heijmans N.V. generates revenue through its Real Estate segment (€411.79 million), Van Wanrooij division (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology sector (€1.08 billion).

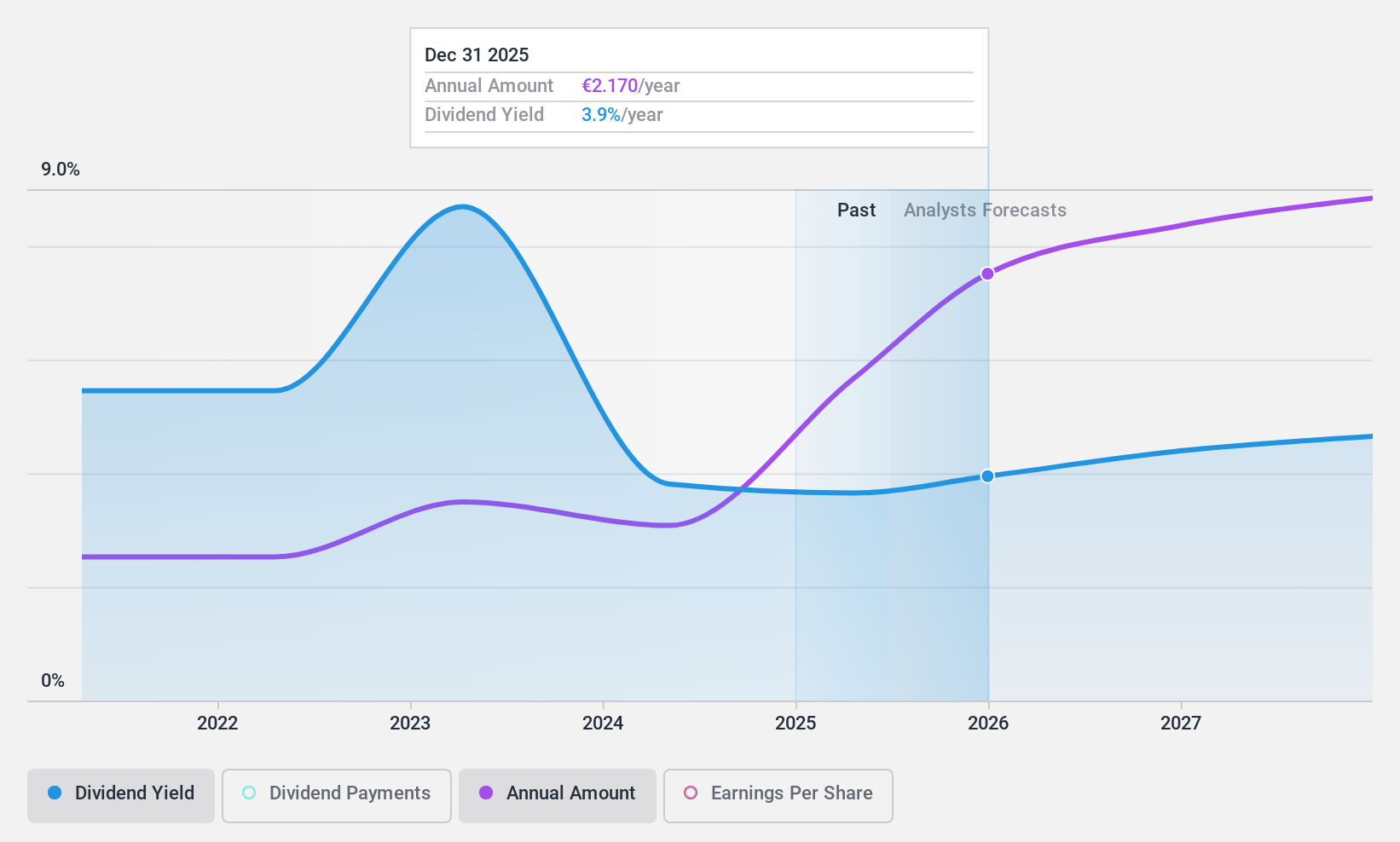

Dividend Yield: 3.8%

Koninklijke Heijmans exhibits a mixed dividend profile. Its 3.78% yield is lower than the top Dutch dividend payers, and its history of dividend payments has been volatile, with no consistent growth over the past decade. However, the dividends are well-supported by earnings and cash flows, with payout ratios of 37.1% and 59% respectively. The company's share price has shown high volatility recently, despite earnings growing at an annual rate of 19.4% over the past five years.

- Get an in-depth perspective on Koninklijke Heijmans' performance by reading our dividend report here.

- Our valuation report here indicates Koninklijke Heijmans may be overvalued.

Van Lanschot Kempen (ENXTAM:VLK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Van Lanschot Kempen NV is a financial services provider operating both in the Netherlands and internationally, with a market capitalization of approximately €1.70 billion.

Operations: Van Lanschot Kempen NV generates revenue primarily through its Investment Banking Clients and Wholesale & Institutional Clients segments, contributing €41 million and €83.10 million respectively.

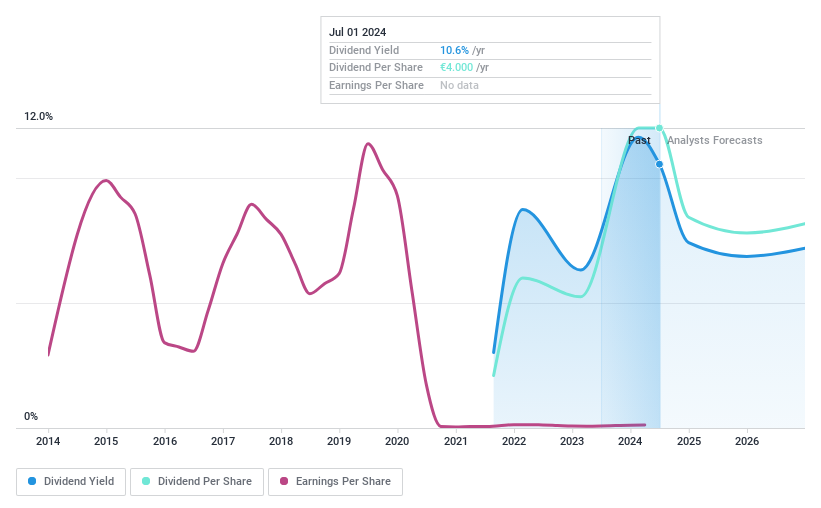

Dividend Yield: 9.9%

Van Lanschot Kempen, with a dividend yield of 9.94%, stands out in the top 25% of Dutch dividend payers. The company's dividends are well-covered by earnings, with a payout ratio of 70.9%. Despite only initiating dividends three years ago, payments show promising growth and stability. Recent share buybacks totaling €22.66 million underscore confidence in financial health, although its short dividend history suggests potential uncertainty in long-term sustainability. Trading at a P/E ratio of 13x, it offers value relative to peers.

- Click here and access our complete dividend analysis report to understand the dynamics of Van Lanschot Kempen.

- Our comprehensive valuation report raises the possibility that Van Lanschot Kempen is priced lower than what may be justified by its financials.

Key Takeaways

- Embark on your investment journey to our 7 Top Euronext Amsterdam Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands and internationally.

Undervalued with solid track record and pays a dividend.