Stock Analysis

- Netherlands

- /

- Electrical

- /

- ENXTAM:ALFEN

Exploring Undervalued Stocks On Euronext Amsterdam With Intrinsic Discounts Ranging From 19.4% To 47%

Reviewed by Simply Wall St

Amidst a backdrop of mixed performances across global markets, the Euronext Amsterdam presents intriguing opportunities as investors increasingly turn their focus towards value stocks. This shift is particularly relevant in today's market environment, where discerning investors look for stocks that appear undervalued relative to their intrinsic worth—a strategy that could be prudent given the current economic landscape.

Top 5 Undervalued Stocks Based On Cash Flows In The Netherlands

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Majorel Group Luxembourg (ENXTAM:MAJ) | €29.45 | €55.97 | 47.4% |

| Alfen (ENXTAM:ALFEN) | €16.695 | €24.93 | 33% |

| Ctac (ENXTAM:CTAC) | €3.08 | €3.85 | 20% |

| Arcadis (ENXTAM:ARCAD) | €63.25 | €119.42 | 47% |

| Ordina (ENXTAM:ORDI) | €5.70 | €10.64 | 46.4% |

| Envipco Holding (ENXTAM:ENVI) | €5.50 | €6.83 | 19.4% |

We're going to check out a few of the best picks from our screener tool.

Alfen (ENXTAM:ALFEN)

Overview: Alfen N.V. specializes in smart grids, energy storage systems, and electric vehicle charging equipment, with a market capitalization of approximately €0.36 billion.

Operations: Alfen N.V. generates revenue from three primary segments: Smart Grid Solutions (€188.38 million), Electric Vehicle Charging Equipment (€153.12 million), and Energy Storage Systems (€162.98 million).

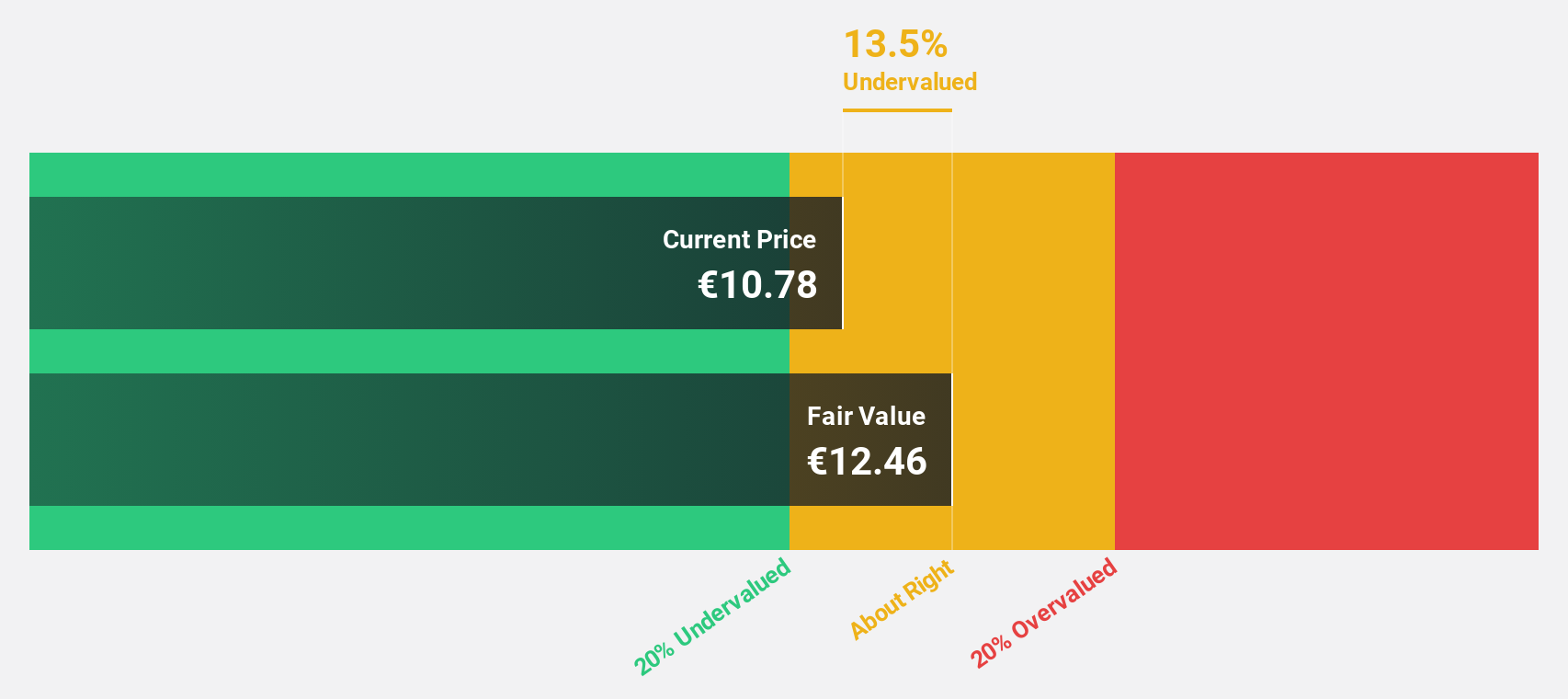

Estimated Discount To Fair Value: 33%

Alfen, priced at €16.7, is trading 33% below its estimated fair value of €24.93, highlighting its potential as an undervalued stock based on cash flows in the Netherlands. Despite recent downward revisions in revenue guidance for 2024 from a range of €590 million to €660 million down to €485 million to €500 million, Alfen's earnings are forecasted to grow by 20.09% annually. However, it faces challenges with highly volatile share prices and lower profit margins compared to the previous year.

- Insights from our recent growth report point to a promising forecast for Alfen's business outlook.

- Click to explore a detailed breakdown of our findings in Alfen's balance sheet health report.

Arcadis (ENXTAM:ARCAD)

Overview: Arcadis NV, operating in The Americas, Europe, the Middle East, and Asia Pacific, provides design, engineering, and consultancy solutions for natural and built assets with a market capitalization of approximately €5.69 billion.

Operations: The company generates revenue through four key segments: Places (€1.94 billion), Mobility (€0.98 billion), Resilience (€1.96 billion), and Intelligence (€0.12 billion).

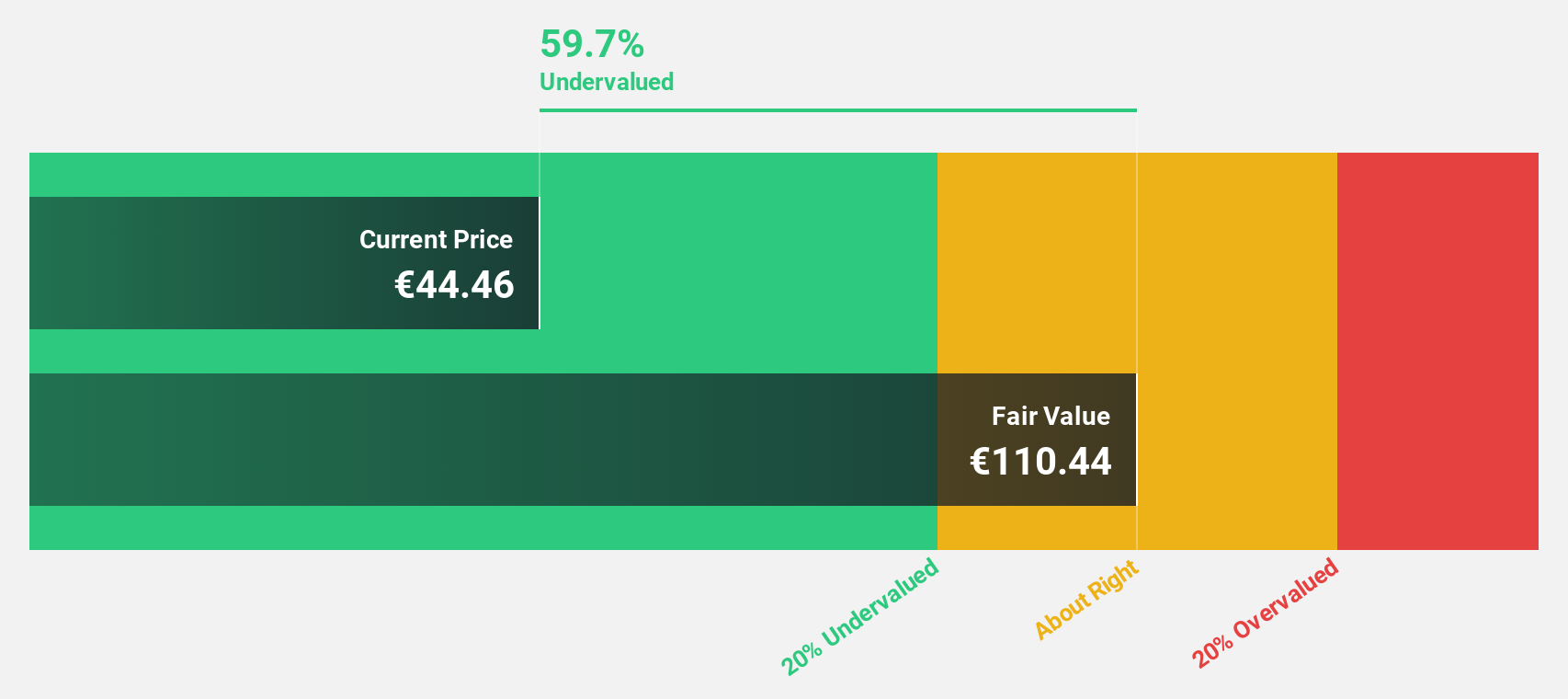

Estimated Discount To Fair Value: 47%

Arcadis, valued at €63.25, is significantly undervalued with a fair value estimate of €119.42, reflecting more than 20% underpricing based on cash flows. Recent earnings show robust growth with net income rising to €112 million from €69 million year-over-year and an EPS increase from €0.77 to €1.24, indicating strong operational performance. Despite this, revenue growth projections are modest at 1.3% annually, lagging behind the Dutch market forecast of 10%. Arcadis also carries a high level of debt which may concern investors looking for financial stability.

- Our comprehensive growth report raises the possibility that Arcadis is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Arcadis.

Envipco Holding (ENXTAM:ENVI)

Overview: Envipco Holding N.V. specializes in designing, developing, manufacturing, and servicing reverse vending machines for recycling used beverage containers, primarily operating in the Netherlands, North America, and other parts of Europe with a market capitalization of approximately €317.30 million.

Operations: Envipco Holding N.V. generates its revenue by designing, developing, manufacturing, and servicing reverse vending machines for recycling used beverage containers across the Netherlands, North America, and other parts of Europe.

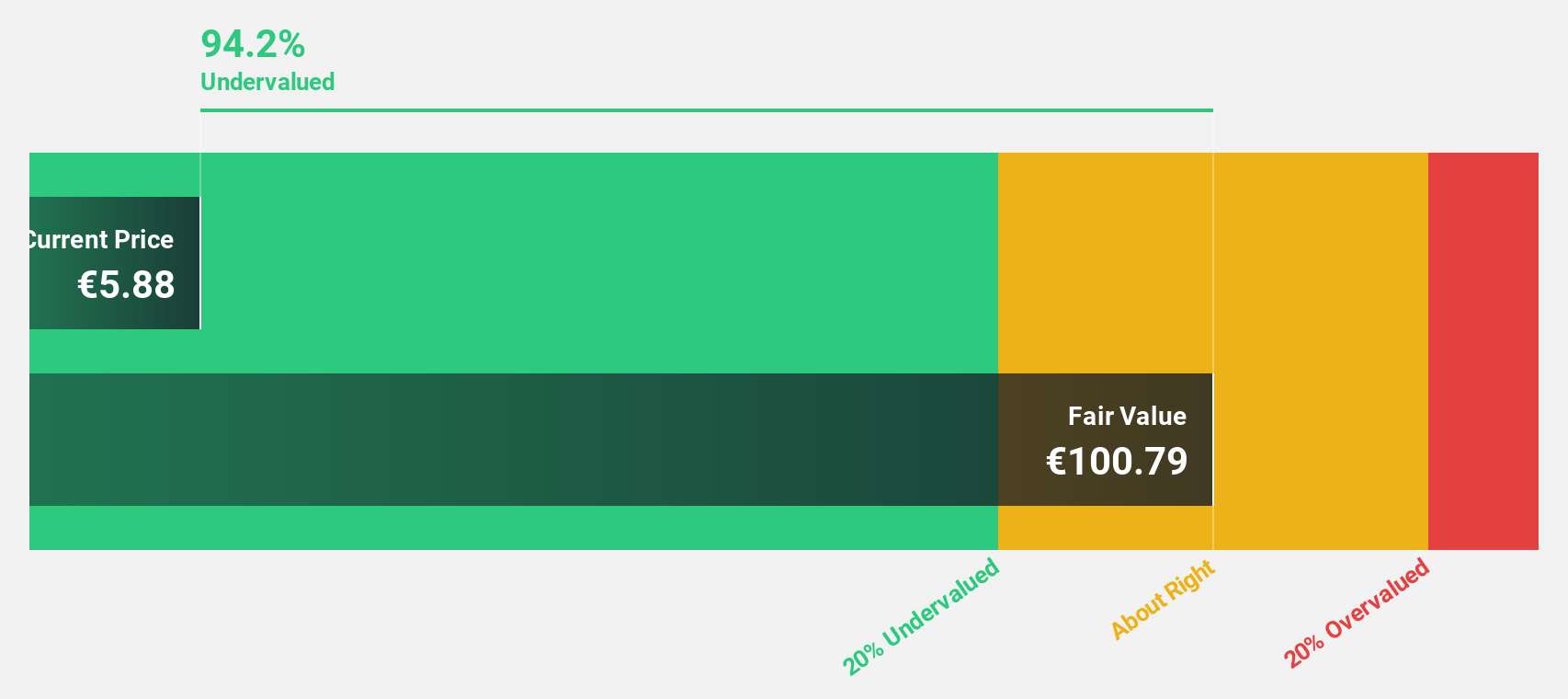

Estimated Discount To Fair Value: 19.4%

Envipco Holding N.V. has shown a notable financial turnaround, reporting a shift from a net loss of €2.57 million to a net income of €0.147 million in Q1 2024, with sales jumping from €10.41 million to €27.44 million year-over-year. Currently trading at €5.5, below the estimated fair value of €6.83, Envipco is positioned as undervalued based on cash flows despite its high share price volatility and recent shareholder dilution. Revenue and earnings are expected to grow significantly above the market average.

- In light of our recent growth report, it seems possible that Envipco Holding's financial performance will exceed current levels.

- Get an in-depth perspective on Envipco Holding's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Access the full spectrum of 6 Undervalued Euronext Amsterdam Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ALFEN

Alfen

Through its subsidiaries, engages in the design, engineering, development, production, and service of smart grids, energy storage systems, and electric vehicle charging equipment.

Undervalued with excellent balance sheet.