- Netherlands

- /

- Construction

- /

- ENXTAM:FUR

We Ran A Stock Scan For Earnings Growth And Fugro (AMS:FUR) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Fugro (AMS:FUR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Fugro with the means to add long-term value to shareholders.

Check out our latest analysis for Fugro

How Fast Is Fugro Growing Its Earnings Per Share?

In the last three years Fugro's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Fugro's EPS shot up from €0.80 to €1.02; a result that's bound to keep shareholders happy. That's a fantastic gain of 27%.

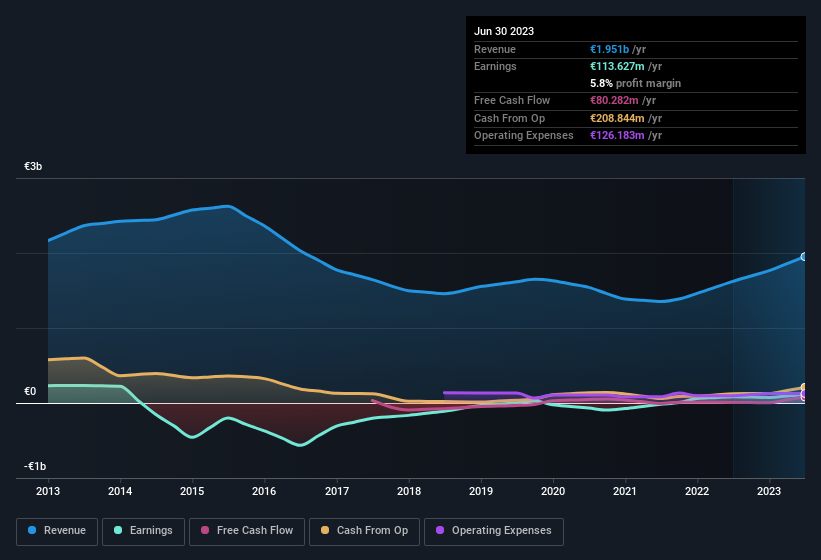

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Fugro shareholders is that EBIT margins have grown from 4.8% to 7.8% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Fugro.

Are Fugro Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Even though some insiders sold down their holdings, their actions speak louder than words with €413k more invested than sold by people who know they company best. You could argue that level of buying implies genuine confidence in the business. Zooming in, we can see that the biggest insider purchase was by Chairman of Management Board & CEO Mark Rembold Heine for €123k worth of shares, at about €12.28 per share.

Along with the insider buying, another encouraging sign for Fugro is that insiders, as a group, have a considerable shareholding. Indeed, they hold €37m worth of its stock. This considerable investment should help drive long-term value in the business. Even though that's only about 1.9% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Fugro To Your Watchlist?

For growth investors, Fugro's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. Astute investors will want to keep this stock on watch. Of course, just because Fugro is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Fugro, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:FUR

Fugro

Provides geo-data services for the infrastructure, energy, and water industries in Europe, Africa, the Americas, the Asia Pacific, the Middle East, and India.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives