- Netherlands

- /

- Banks

- /

- ENXTAM:INGA

Is ING (ENXTAM:INGA) Still Undervalued After Strong Multi-Year Gains?

Reviewed by Kshitija Bhandaru

ING Groep (ENXTAM:INGA) shares have been in focus as investors weigh the bank’s recent performance. Despite a dip over the past month, ING continues to draw attention because of its track record and strong presence in the European financial sector.

See our latest analysis for ING Groep.

After a strong rally this year, ING Groep’s share price has cooled off somewhat in the past month, trimming gains but still leaving the stock up 37.4% year-to-date. That momentum is supported by a robust three-year total shareholder return of 179%, as well as an impressive five-year total return of 369%. These figures reflect both price appreciation and dividends over time. Recent price swings suggest the market is recalibrating its outlook amid broader moves in European finance, though ING’s long-term track record demonstrates why it remains on investors’ radar.

If ING’s performance has you rethinking what’s possible in today’s market, consider broadening your search and discover fast growing stocks with high insider ownership

But with ING’s shares already posting such impressive gains, investors are left wondering if the current price is still below fair value or if the market has already anticipated future growth, leaving little room for upside.

Most Popular Narrative: 25.3% Undervalued

The latest narrative from PittTheYounger sets ING Groep’s fair value above its recent close, suggesting the market could be overlooking key drivers. With this view, the gulf between sentiment and numbers is hard to ignore.

Additionally, ING is among the sector leaders in its efforts to pivot away from NII as the predominant factor of profits. Instead, the industry in general and the Dutch bankers in particular aim to reap a higher share of income from fees for various services, such as client wealth management, M&A activities, and debt underwriting. The past quarter demonstrates that ING has made ground in this effort at exactly the right time, while still standing to profit from the aforementioned EU investment initiative.

Think the market is just pricing in another bank story? The real surprise is the bold expectations behind this valuation. Could a strategic shift in revenue mix and upgraded profit margins be the secret drivers? Want a peek at what’s fueling that price target? The numbers PittTheYounger uses may headline the next leg up.

Result: Fair Value of €27.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, downside risks remain. Further interest rate cuts or unexpected global economic disruptions could potentially challenge ING’s growth trajectory and valuation story.

Find out about the key risks to this ING Groep narrative.

Another View: Market Ratios Tell a Different Story

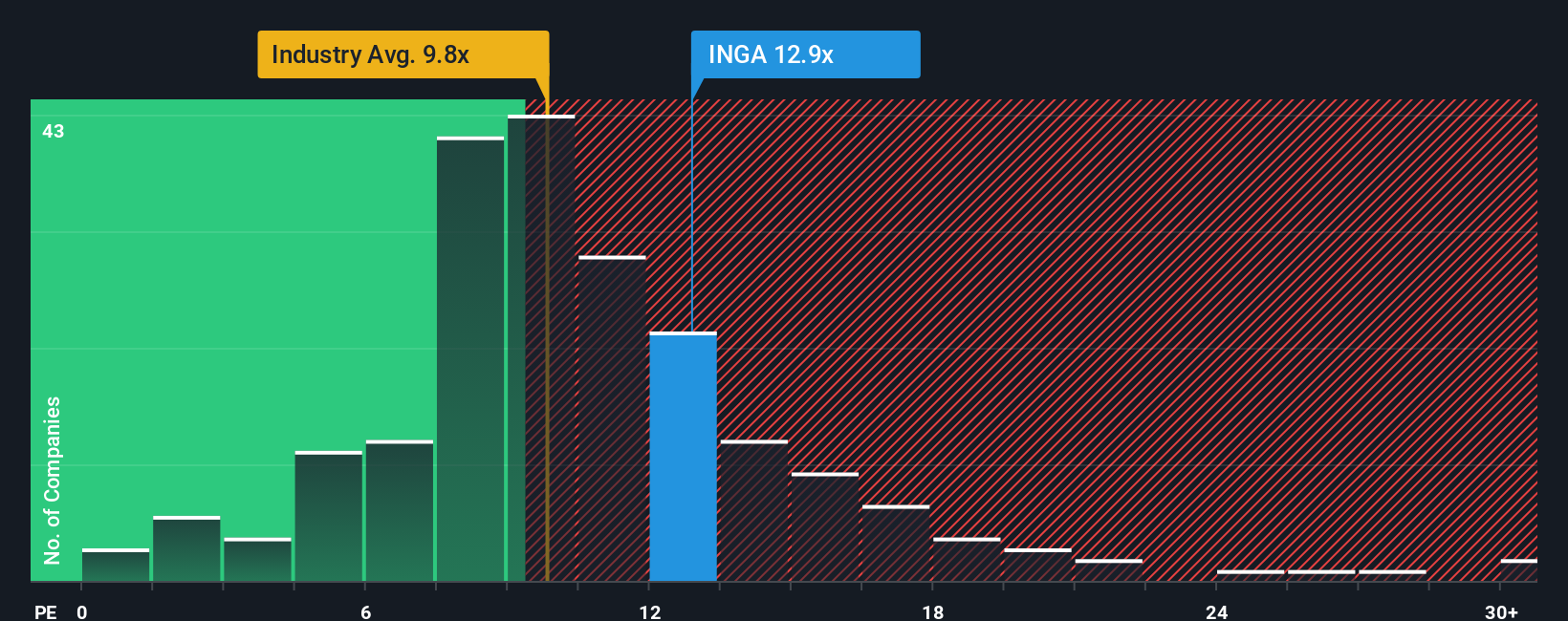

While one valuation highlights ING’s upside, looking at market ratios offers a more sobering perspective. ING’s price-to-earnings ratio is 12.2 times, which is higher than both its peer average of 10 times and the European Banks industry average of 9.8 times. The market could be signaling caution, as ING’s current ratio runs above what is typical in its space. Even though the estimated fair ratio sits at 13 times, there is little room for the shares to re-rate higher without a stronger case for growth. Does this suggest more risk than reward ahead, or is it just pricing in quality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ING Groep Narrative

If you want to approach ING Groep from your own perspective or question these conclusions, know that you can craft your own narrative in under three minutes: Do it your way

A great starting point for your ING Groep research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your opportunity to just one story. Step up your strategy and uncover other stocks that could fit your portfolio using the Simply Wall Street Screener.

- Boost your income potential by checking out these 19 dividend stocks with yields > 3%, which consistently deliver attractive yields and strong financials.

- Tap into future-defining technology by reviewing these 26 quantum computing stocks, innovating at the cutting edge of quantum computing and AI.

- Supercharge your watchlist with these 892 undervalued stocks based on cash flows, which sophisticated models suggest are trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:INGA

ING Groep

Provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives