- Netherlands

- /

- Banks

- /

- ENXTAM:INGA

Is ING a Good Value After Delivering a 41.7% Gain Over the Past Year?

Reviewed by Bailey Pemberton

If you’re weighing your next move on ING Groep stock, you’re definitely not alone. Whether you’re holding, buying, or just watching from the sidelines, ING’s recent price action has given all of us something to think about. After an impressive multi-year run—up nearly 370.6% over five years and more than 176% in three—the stock has delivered a robust 41.7% gain over the last year alone. Sure, there has been a bit of a pause recently, with a slight dip of 3.0% this past week and a modest 2.4% slide in the last month, but it’s hard to ignore the long-term momentum behind this Dutch banking giant.

What’s driving all of this? Part of the answer lies in the shifting risk appetite across European banks, as investors increasingly seek stable, dividend-paying financials amid greater global uncertainty. At the same time, the recent cooling-off periods likely reflect short-term market jitters more than fundamental weakness. That’s why many are now zooming in on ING Groep’s valuation, wondering if there’s more upside ahead, or if the price already reflects all the good news.

If you crunch the numbers across six common valuation checks, ING comes up as undervalued in half of them, landing a solid value score of 3 out of 6. But raw numbers only tell part of the story. Next, let’s break down those key valuation methods, and later, I’ll share an even smarter way to size up whether ING Groep offers true value in today’s market.

Why ING Groep is lagging behind its peers

Approach 1: ING Groep Excess Returns Analysis

The Excess Returns valuation model focuses on how efficiently a company uses its equity to generate profits above its cost of capital. It examines the difference between what ING Groep earns on its equity and the cost shareholders expect, giving investors a clear view of the company’s ability to create real economic value over time.

For ING Groep, the numbers indicate a strong performance. With a Book Value of €17.36 per share and a Stable EPS (Earnings Per Share) of €2.33, analysts see a steady income stream moving forward. The bank’s Cost of Equity is €1.12 per share, while impressive performance gives ING an Excess Return of €1.21 per share. This means the business is generating value above what its investors demand. ING’s average Return on Equity stands at 13.09%, and future stability is supported by a Stable Book Value projection of €17.80 per share.

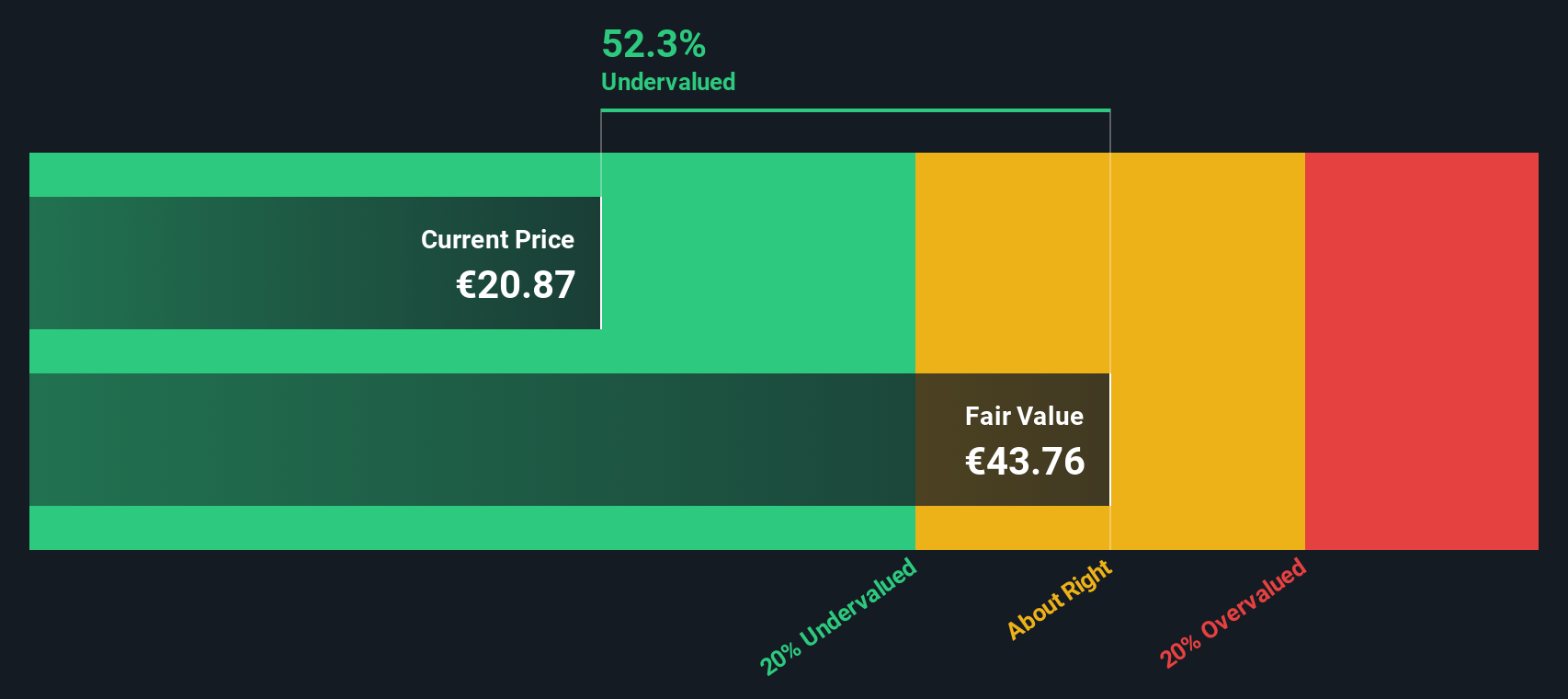

Based on these fundamentals, the Excess Returns model estimates ING Groep’s fair value at €43.69 per share. With the current price at a significant 51.8% discount, the stock currently appears notably undervalued according to this approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests ING Groep is undervalued by 51.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: ING Groep Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to valuation tool for profitable companies like ING Groep, as it directly connects a company’s market value to its earnings power. For investors, the PE ratio offers a quick sense of how much they are paying for each euro of profit, helping benchmark whether a stock is cheap or expensive relative to its earnings.

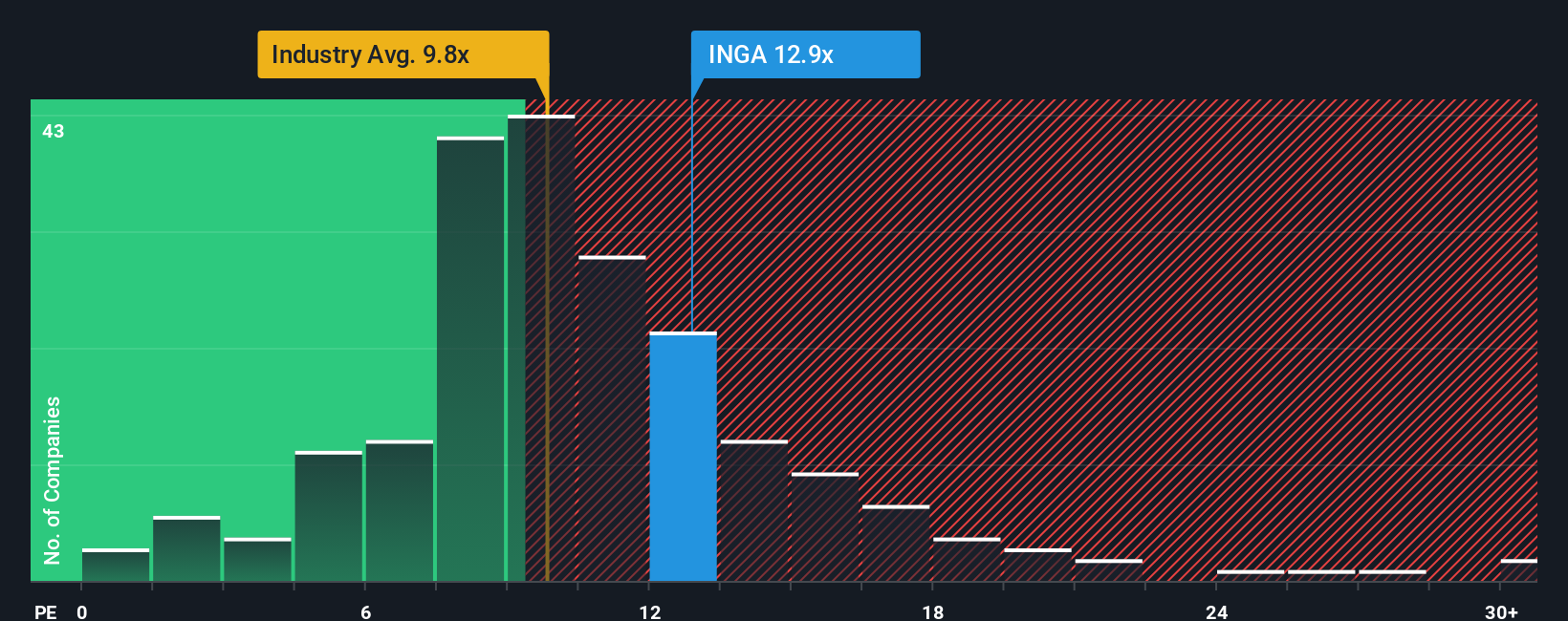

The “right” PE ratio for a bank like ING Groep depends largely on growth expectations and perceived risk. Higher growth prospects or lower risk can justify a higher PE, while slower growth or heightened market risk could warrant a discount. ING is currently trading at a PE of 12.3x, compared to an industry average of 10.3x and a peer average of 10.1x. At first glance, this premium may suggest ING is priced a bit higher than its closest competitors.

However, Simply Wall St's proprietary Fair Ratio model goes one step further. Unlike basic peer or industry comparisons, the Fair Ratio factors in ING Groep’s expected earnings growth, profitability, risk profile, industry group, and market capitalization. This approach offers a more tailored benchmark for what a fair multiple should be in today’s market. For ING, the Fair Ratio is 13.0x, slightly above the company's actual PE. Since ING’s current PE is only 0.7x below this fair value, the stock’s valuation appears to sit right in line with fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ING Groep Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce Narratives, an innovative and approachable tool that lets you describe your perspective on ING Groep, connecting the company's story with your own financial forecasts and expected fair value.

A Narrative is much more than just numbers; it's your personalized explanation for why ING Groep is worth what it is, based on your predictions for future revenue, earnings, margins, and broader business trends. Narratives link your unique view of ING’s potential to your valuation, allowing you to see clearly whether your story aligns with the current market price.

This feature, easily accessible on the Simply Wall St Community page, empowers millions of investors to compare their Narratives and decide when to act by contrasting their estimated Fair Value with today’s share price. As soon as important news or earnings drop, Narratives update in real time, keeping your decisions relevant and reflective of the latest insights.

For ING Groep, for example, some bullish Narratives estimate a Fair Value as high as €27.92, pointing to non-lending income growth and EU stimulus, while more cautious perspectives land around €17.50, citing regulatory risks and margin pressure. This proves there is never a single story behind the share price.

Do you think there's more to the story for ING Groep? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:INGA

ING Groep

Provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives