- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

We Ran A Stock Scan For Earnings Growth And ABN AMRO Bank (AMS:ABN) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in ABN AMRO Bank (AMS:ABN). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for ABN AMRO Bank

ABN AMRO Bank's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Impressively, ABN AMRO Bank has grown EPS by 25% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that ABN AMRO Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. ABN AMRO Bank maintained stable EBIT margins over the last year, all while growing revenue 6.2% to €8.1b. That's a real positive.

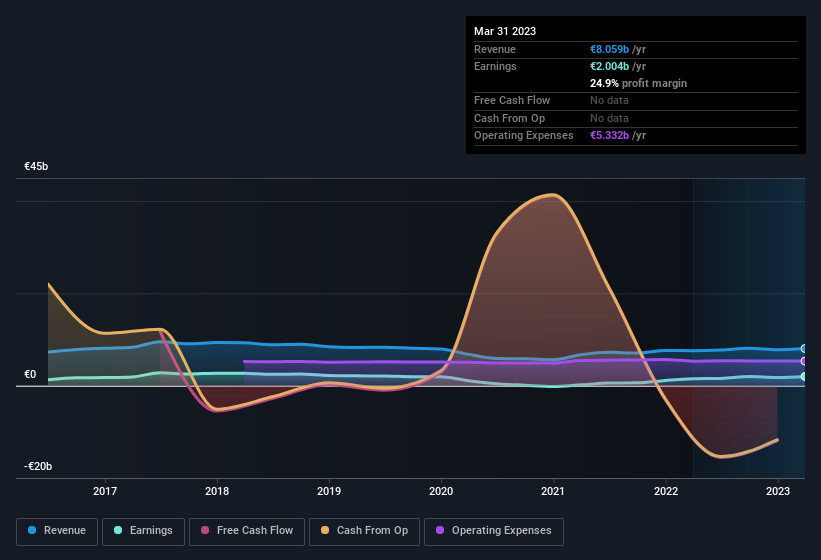

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of ABN AMRO Bank's forecast profits?

Are ABN AMRO Bank Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, ABN AMRO Bank insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Chief Commercial Officer of Personal & Business Banking and Member of Executive Board, Annerie Vreugdenhil, paid €112k to buy shares at an average price of €11.21. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

It's commendable to see that insiders have been buying shares in ABN AMRO Bank, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like ABN AMRO Bank, with market caps over €7.4b, is about €3.2m.

The CEO of ABN AMRO Bank only received €1.0m in total compensation for the year ending December 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add ABN AMRO Bank To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into ABN AMRO Bank's strong EPS growth. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. All in all, this stock is worth the time to delve deeper into the details. You still need to take note of risks, for example - ABN AMRO Bank has 1 warning sign we think you should be aware of.

Keen growth investors love to see insider buying. Thankfully, ABN AMRO Bank isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands, rest of Europe, the United States, Asia, and internationally.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives