- Malaysia

- /

- Wireless Telecom

- /

- KLSE:CDB

Does Celcomdigi Berhad's (KLSE:CDB) Weak Fundamentals Mean A Downturn In Its Stock Should Be Expected?

Most readers would already know that Celcomdigi Berhad's (KLSE:CDB) stock increased by 3.6% over the past month. Given that the markets usually pay for the long-term financial health of a company, we wonder if the current momentum in the share price will keep up, given that the company's financials don't look very promising. Particularly, we will be paying attention to Celcomdigi Berhad's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Celcomdigi Berhad

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Celcomdigi Berhad is:

10% = RM1.7b ÷ RM16b (Based on the trailing twelve months to September 2024).

The 'return' is the profit over the last twelve months. That means that for every MYR1 worth of shareholders' equity, the company generated MYR0.10 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Celcomdigi Berhad's Earnings Growth And 10% ROE

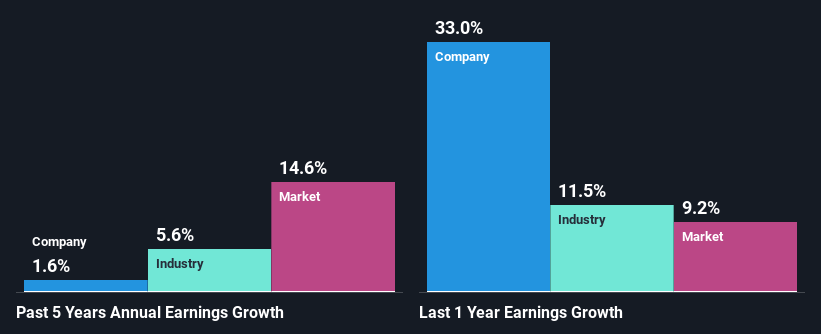

When you first look at it, Celcomdigi Berhad's ROE doesn't look that attractive. However, given that the company's ROE is similar to the average industry ROE of 12%, we may spare it some thought. Still, Celcomdigi Berhad has seen a flat net income growth over the past five years. Bear in mind, the company's ROE is not very high. Hence, this provides some context to the flat earnings growth seen by the company.

As a next step, we compared Celcomdigi Berhad's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 5.6% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for CDB? You can find out in our latest intrinsic value infographic research report.

Is Celcomdigi Berhad Making Efficient Use Of Its Profits?

The high three-year median payout ratio of 100% (meaning, the company retains only 0.2% of profits) for Celcomdigi Berhad suggests that the company's earnings growth was miniscule as a result of paying out a majority of its earnings.

Moreover, Celcomdigi Berhad has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 80%. Regardless, the future ROE for Celcomdigi Berhad is predicted to rise to 17% despite there being not much change expected in its payout ratio.

Summary

Overall, we would be extremely cautious before making any decision on Celcomdigi Berhad. The low ROE, combined with the fact that the company is paying out almost if not all, of its profits as dividends, has resulted in the lack or absence of growth in its earnings. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CDB

Celcomdigi Berhad

An investment holding company, provides mobile communication services and related products in Malaysia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)