We didn't see UCrest Berhad's (KLSE:UCREST) stock surge when it reported robust earnings recently. We looked deeper into the numbers and found that shareholders might be concerned with some underlying weaknesses.

See our latest analysis for UCrest Berhad

A Closer Look At UCrest Berhad's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

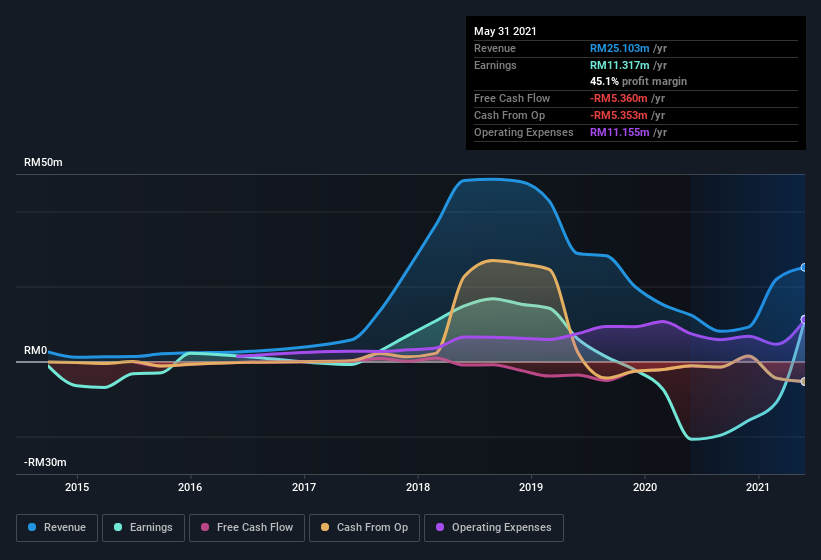

For the year to May 2021, UCrest Berhad had an accrual ratio of 0.57. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of RM11.3m, a look at free cash flow indicates it actually burnt through RM5.4m in the last year. We also note that UCrest Berhad's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of RM5.4m. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings. One positive for UCrest Berhad shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of UCrest Berhad.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, UCrest Berhad increased the number of shares on issue by 32% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of UCrest Berhad's EPS by clicking here.

A Look At The Impact Of UCrest Berhad's Dilution on Its Earnings Per Share (EPS).

We don't have any data on the company's profits from three years ago. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). So you can see that the dilution has had a fairly significant impact on shareholders.

If UCrest Berhad's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On UCrest Berhad's Profit Performance

In conclusion, UCrest Berhad has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). Considering all this we'd argue UCrest Berhad's profits probably give an overly generous impression of its sustainable level of profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Be aware that UCrest Berhad is showing 5 warning signs in our investment analysis and 2 of those are concerning...

Our examination of UCrest Berhad has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:UCREST

UCrest Berhad

An investment holding company, engages in the design, development, and marketing of information technology related products and services in Malaysia and Singapore.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)