- Malaysia

- /

- Specialty Stores

- /

- KLSE:CARLORINO

Carlo Rino Group Berhad (KLSE:CRG) Ticks All The Boxes When It Comes To Earnings Growth

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Carlo Rino Group Berhad (KLSE:CRG), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Carlo Rino Group Berhad

How Fast Is Carlo Rino Group Berhad Growing Its Earnings Per Share?

Over the last three years, Carlo Rino Group Berhad has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Carlo Rino Group Berhad has grown its trailing twelve month EPS from RM0.028 to RM0.03, in the last year. That's a modest gain of 7.3%.

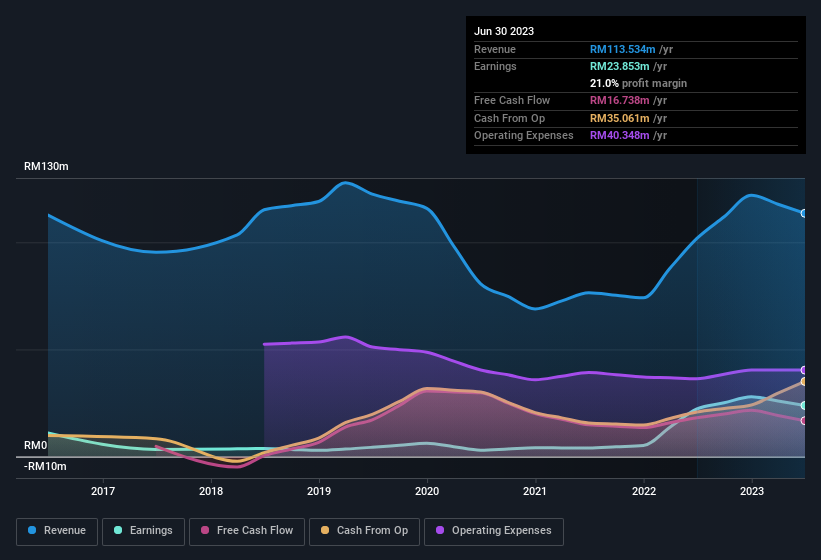

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Carlo Rino Group Berhad achieved similar EBIT margins to last year, revenue grew by a solid 12% to RM114m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since Carlo Rino Group Berhad is no giant, with a market capitalisation of RM173m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Carlo Rino Group Berhad Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Carlo Rino Group Berhad insiders own a significant number of shares certainly is appealing. Actually, with 42% of the company to their names, insiders are profoundly invested in the business. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. To give you an idea, the value of insiders' holdings in the business are valued at RM72m at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Carlo Rino Group Berhad To Your Watchlist?

As previously touched on, Carlo Rino Group Berhad is a growing business, which is encouraging. If that's not enough on its own, there is also the rather notable levels of insider ownership. These two factors are a huge highlight for the company which should be a strong contender your watchlists. You should always think about risks though. Case in point, we've spotted 3 warning signs for Carlo Rino Group Berhad you should be aware of, and 1 of them doesn't sit too well with us.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CARLORINO

Carlo Rino Group Berhad

An investment holding company, designs, promotes, markets, distributes, and retails women's footwear, handbags, and accessories under the Carlo Rino brand in Malaysia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)