Shareholders May Be A Bit More Conservative With LPI Capital Bhd's (KLSE:LPI) CEO Compensation For Now

As many shareholders of LPI Capital Bhd (KLSE:LPI) will be aware, they have not made a gain on their investment in the past three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 31 March 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for LPI Capital Bhd

How Does Total Compensation For Kok Tan Compare With Other Companies In The Industry?

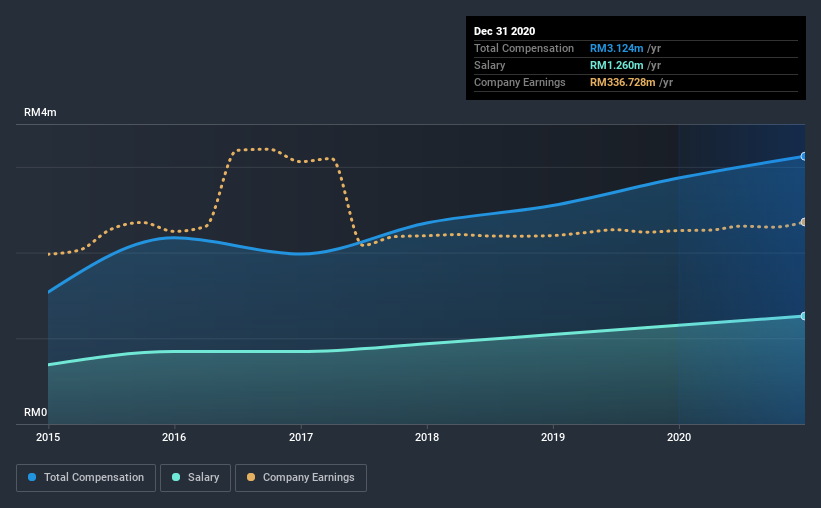

According to our data, LPI Capital Bhd has a market capitalization of RM5.4b, and paid its CEO total annual compensation worth RM3.1m over the year to December 2020. That's a notable increase of 8.9% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at RM1.3m.

For comparison, other companies in the same industry with market capitalizations ranging between RM4.1b and RM13b had a median total CEO compensation of RM3.7m. This suggests that LPI Capital Bhd remunerates its CEO largely in line with the industry average. Moreover, Kok Tan also holds RM8.6m worth of LPI Capital Bhd stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM1.3m | RM1.2m | 40% |

| Other | RM1.9m | RM1.7m | 60% |

| Total Compensation | RM3.1m | RM2.9m | 100% |

On an industry level, roughly 68% of total compensation represents salary and 32% is other remuneration. In LPI Capital Bhd's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at LPI Capital Bhd's Growth Numbers

LPI Capital Bhd's earnings per share (EPS) grew 2.4% per year over the last three years. Revenue was pretty flat on last year.

We would argue that the lack of revenue growth in the last year is less than ideal, but it is good to see a modest EPS growth at least. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has LPI Capital Bhd Been A Good Investment?

With a three year total loss of 5.5% for the shareholders, LPI Capital Bhd would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for LPI Capital Bhd that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading LPI Capital Bhd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:LPI

LPI Capital Bhd

An investment holding company, engages in the underwriting of general insurance products for personal and business needs in Malaysia, Singapore, and Cambodia.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026