Analysts Just Made A Major Revision To Their Oceancash Pacific Berhad (KLSE:OCNCASH) Revenue Forecasts

One thing we could say about the analysts on Oceancash Pacific Berhad (KLSE:OCNCASH) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

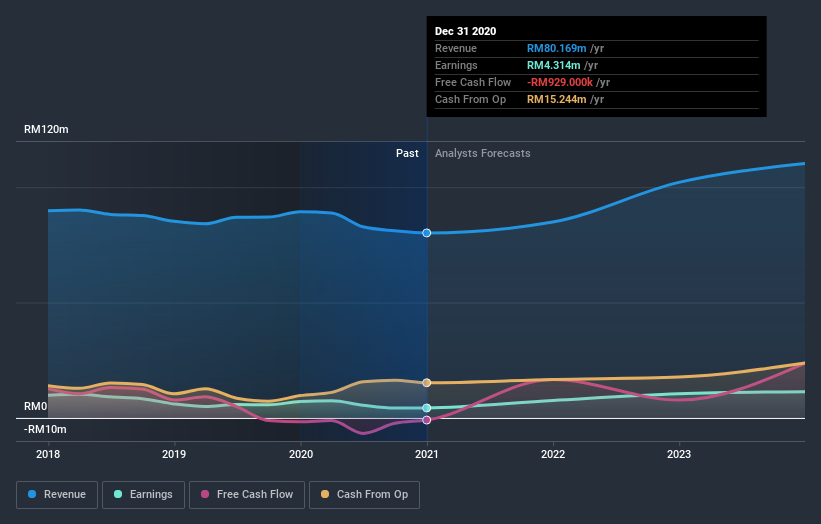

Following the downgrade, the most recent consensus for Oceancash Pacific Berhad from its two analysts is for revenues of RM85m in 2021 which, if met, would be a modest 5.9% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of RM98m in 2021. The consensus view seems to have become more pessimistic on Oceancash Pacific Berhad, noting the measurable cut to revenue estimates in this update.

View our latest analysis for Oceancash Pacific Berhad

Notably, the analysts have cut their price target 14% to RM0.61, suggesting concerns around Oceancash Pacific Berhad's valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Oceancash Pacific Berhad at RM0.67 per share, while the most bearish prices it at RM0.55. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that Oceancash Pacific Berhad's rate of growth is expected to accelerate meaningfully, with the forecast 5.9% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 1.0% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 16% per year. It seems obvious that, while the future growth outlook is brighter than the recent past, Oceancash Pacific Berhad is expected to grow slower than the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Oceancash Pacific Berhad this year. They also expect company revenue to perform worse than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of Oceancash Pacific Berhad's future valuation. Given the stark change in sentiment, we'd understand if investors became more cautious on Oceancash Pacific Berhad after today.

Of course, there's always more to the story. We have estimates for Oceancash Pacific Berhad from its two analysts out until 2023, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Oceancash Pacific Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:OCNCASH

Oceancash Pacific Berhad

An investment holding company, manufactures and trades in non-woven products in Malaysia, Indonesia, Japan, Thailand, and internationally.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)