3 Stocks Estimated To Be Up To 48.8% Below Fair Value Offering Potential Opportunities

Reviewed by Simply Wall St

In a week marked by mixed performances across major global indices, growth stocks outperformed their value counterparts significantly, highlighting the ongoing divergence within the markets. Amidst this backdrop of record highs for some indices and declines for others, investors are keenly observing undervalued stocks that present potential opportunities due to their current pricing below estimated fair value. Identifying such stocks often involves assessing intrinsic value against market price, especially in sectors experiencing varied performance like consumer discretionary and technology.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SKS Technologies Group (ASX:SKS) | A$1.945 | A$3.85 | 49.5% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.00 | CLP576.34 | 49.9% |

| Befesa (XTRA:BFSA) | €22.32 | €44.53 | 49.9% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.10 | HK$54.03 | 49.8% |

| Visional (TSE:4194) | ¥8535.00 | ¥17012.42 | 49.8% |

| Ingenia Communities Group (ASX:INA) | A$4.62 | A$9.15 | 49.5% |

| First Advantage (NasdaqGS:FA) | US$19.81 | US$39.49 | 49.8% |

| DoubleVerify Holdings (NYSE:DV) | US$20.77 | US$41.28 | 49.7% |

| Nyab (OM:NYAB) | SEK5.20 | SEK10.29 | 49.5% |

| Carter Bankshares (NasdaqGS:CARE) | US$19.30 | US$38.28 | 49.6% |

We're going to check out a few of the best picks from our screener tool.

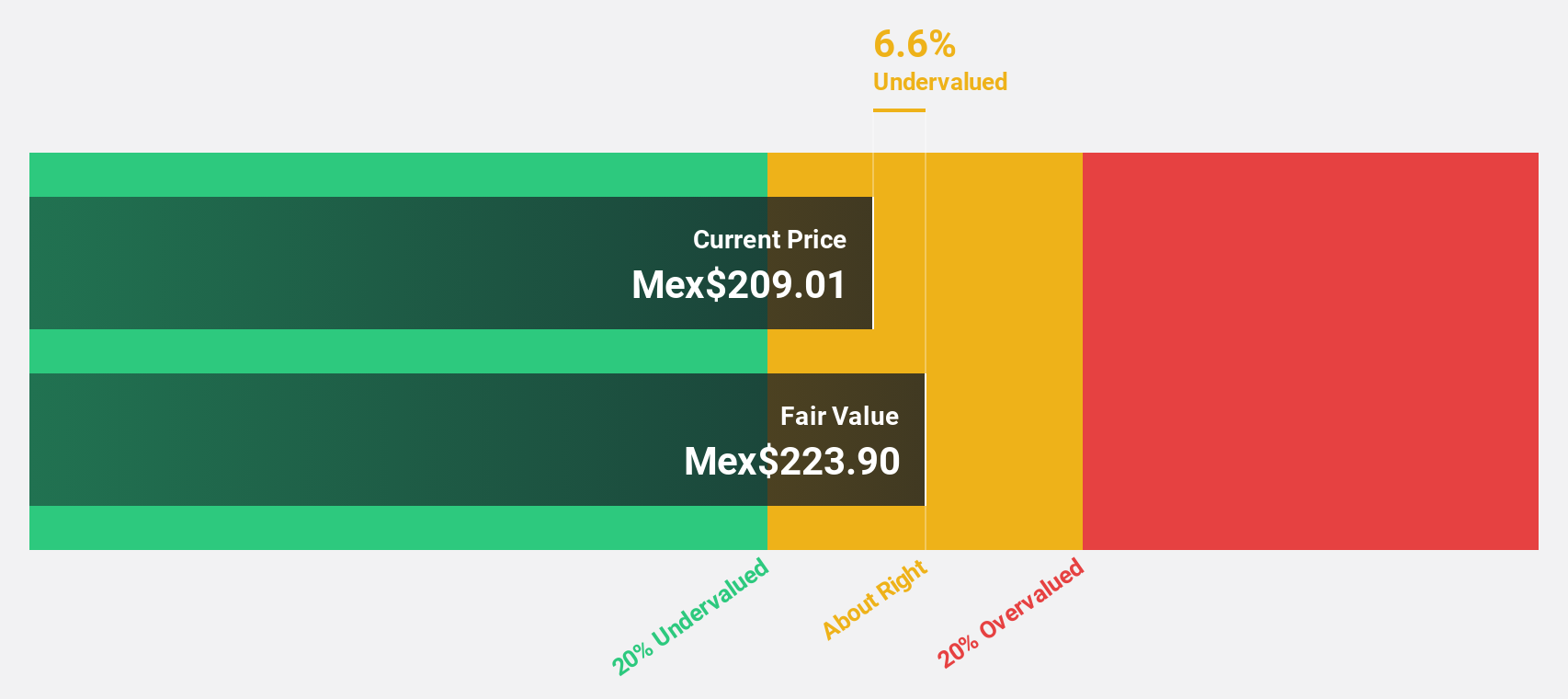

Quálitas Controladora. de (BMV:Q *)

Overview: Quálitas Controladora, S.A.B. de C.V. operates through its subsidiaries to provide insurance, coinsurance, and reinsurance services in the automobile sector across Mexico, El Salvador, Costa Rica, Peru, and the United States with a market cap of MX$68.37 billion.

Operations: Quálitas Controladora generates revenue through its subsidiaries by offering insurance, coinsurance, and reinsurance services focused on the automobile sector in Mexico, El Salvador, Costa Rica, Peru, and the United States.

Estimated Discount To Fair Value: 16.9%

Quálitas Controladora is trading at MX$172.42, below its estimated fair value of MX$207.39, indicating it may be undervalued based on discounted cash flows. Despite high earnings volatility and a dividend not well covered by free cash flows, the company's earnings grew significantly over the past year and are forecast to grow 13.1% annually, surpassing market expectations. Recent reports show net income increased to MXN 3.76 billion from MXN 2.66 billion year-over-year.

- In light of our recent growth report, it seems possible that Quálitas Controladora. de's financial performance will exceed current levels.

- Take a closer look at Quálitas Controladora. de's balance sheet health here in our report.

Turkiye Garanti Bankasi (IBSE:GARAN)

Overview: Turkiye Garanti Bankasi A.S. offers a range of banking products and services in Turkey, with a market cap of TRY529.20 billion.

Operations: The company's revenue segments include Retail Banking at TRY114.16 billion, Investment Banking at -TRY138.48 billion, and Corporate and Commercial Banking at TRY125.29 billion.

Estimated Discount To Fair Value: 10.6%

Turkiye Garanti Bankasi is trading at TRY 126, below its estimated fair value of TRY 140.95. Despite a high level of bad loans (2.1%) and an unstable dividend track record, the bank's earnings grew by 24% last year and are forecast to grow significantly over the next three years. Recent earnings reports show net income for nine months increased to TRY 66.27 billion from TRY 57.22 billion year-over-year, with strategic alliances enhancing its crypto asset platform security.

- Our growth report here indicates Turkiye Garanti Bankasi may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Turkiye Garanti Bankasi.

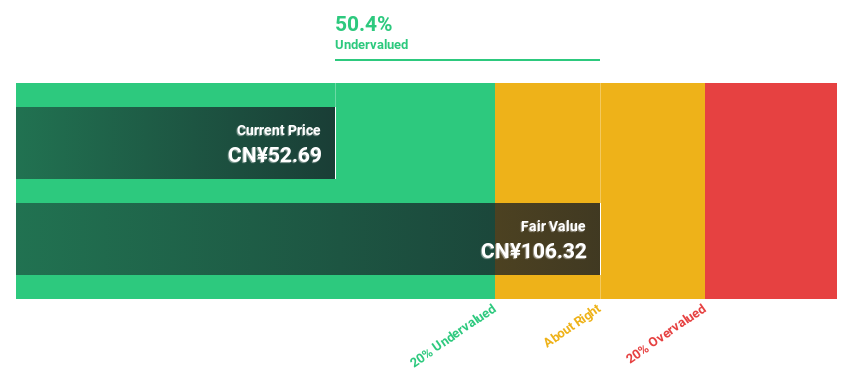

iFLYTEKLTD (SZSE:002230)

Overview: iFLYTEK CO., LTD. specializes in artificial intelligence (AI) technology services in China and has a market cap of CN¥122.02 billion.

Operations: The company's revenue segments include AI education products and services at CN¥4.56 billion, consumer products at CN¥3.24 billion, smart city applications at CN¥2.78 billion, and healthcare solutions generating CN¥1.89 billion.

Estimated Discount To Fair Value: 48.8%

iFLYTEK is trading at CN¥53.21, significantly below its estimated fair value of CN¥103.95, representing a 48.8% discount. Despite reporting a net loss of CN¥343.7 million for the first nine months of 2024, revenue increased to CNY 14.85 billion from CNY 12.61 billion year-on-year. The company's earnings are forecasted to grow at an impressive rate of over 62% annually, outpacing the Chinese market's growth projections and indicating potential undervaluation based on cash flows.

- Upon reviewing our latest growth report, iFLYTEKLTD's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of iFLYTEKLTD stock in this financial health report.

Next Steps

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 901 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turkiye Garanti Bankasi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:GARAN

Turkiye Garanti Bankasi

Provides various banking products and services in Turkey.

High growth potential with excellent balance sheet and pays a dividend.